There are 384 operational private FM radio stations in India as of mid July 2021, according to government data, which does not include the stations operated by pubcaster All India Radio.

Both Delhi and Mumbai have nine private sector FM radio stations each — a number that seems to be on the lower side considering smaller cities like Hong Kong and Singapore with comparatively lesser population, for example, have higher number of stations with more variety on offer.

Radio Mirchi, owned and operated by Entertainment Network India Ltd., part of the Times of India group, is present in over 140 cities (not exceeding 150), the Ministry of Information & Broadcasting (MIB) stated.

There are approximately 56 BigFM stations in the country. Reliance Broadcast Network Ltd. operates the BigFM stations and its former CEO Tarun Katial is credited for charting out a roadmap for this popular network.

Music Broadcast Ltd. — which was once upon a time supplied content software by Rupert Murdoch-controlled Star TV India before the company got out of the radio business — operates 39 stations presently.

FM radio spectrums are auctioned from time to time by the government and in the early 2000s, when the private FM radio took wings in India, the government raked in huge amounts of revenues as big media houses, and even non-media companies, bid outrageously for city-specific terrestrial spectrum.

However, a FICCI-E&Y media entertainment report, released earlier 2021, stated that radio revenues, which had fallen 7.5 percent in 2019, fell by over 50 percent again on account of both ad rate and volume drops as key advertiser segments (regional and retail) were unable to run their businesses at their usual scale owing to the pandemic and slowing economy.

As live event revenues faltered due to the pandemic, FM radio companies increased their focus on creating online IPs and content production, the report highlighted.

It also said that radio revenues’ fall was highest (81 percent) in the April to June 2020 quarter, but recovered to 54 percent of 2019 levels by the October to December 2020 quarter.

Pointing out that radio would continue to stay the “lowest cost entertainment medium”, the E&Y report added it would serve large portions of India through smart phone FM receivers, playing a vital role in retail advertising.

Radio will build-out and monetize communities through its RJs and influencer networks, apart from re-defining itself into a marketing specialist for brands with a D2C focus, the E&Y projected.

WAVES 2025 to set sail in Mumbai today, promises to transform India’s creative economy

WAVES 2025 to set sail in Mumbai today, promises to transform India’s creative economy  Sony MAX 1 set to launch on May 1

Sony MAX 1 set to launch on May 1  Avijit Dhar appointed VP-Marketing for Star Plus

Avijit Dhar appointed VP-Marketing for Star Plus  Akashvani bags 6 honours at India Audio Summit & Awards

Akashvani bags 6 honours at India Audio Summit & Awards  Govt tells media to desist from live coverage of defence ops

Govt tells media to desist from live coverage of defence ops  India at dawn of Orange Economy, says PM Modi at WAVES

India at dawn of Orange Economy, says PM Modi at WAVES  Meta launches standalone Meta AI app to expand chatbot reach

Meta launches standalone Meta AI app to expand chatbot reach  ‘Right Time for Create in India, Create for the World,’ says PM Modi at WAVES

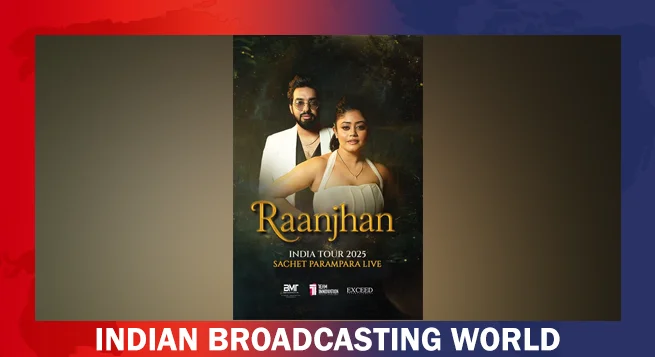

‘Right Time for Create in India, Create for the World,’ says PM Modi at WAVES  Sachet-Parampara gear up for first-ever India Tour this summer

Sachet-Parampara gear up for first-ever India Tour this summer  Rashmika Mandanna joins Crocs as global brand ambassador

Rashmika Mandanna joins Crocs as global brand ambassador