Fifty-nine percent sports fan-respondents from eight major global markets reveal they currently have trouble finding or affording sports content they want to watch, while 56 percent would watch more sports video content if it were available, according to Altman Solon’s 2023 Global Sports Media Survey.

Once the province of TV networks and pay TV providers, streaming services have become big sports players, including through big broadcasting rights deals like Amazon’s with the NFL and Apple TV+’s with Major League Baseball. US fans also have more options to watch international sports leagues like the English Premier League and domestic women’s leagues like the WNBA through cable channels and streaming services.

The current industry structure in media distribution is not making life easier for fans wanting to discover and access the content they are passionate about.

Of the sports fans who say they have trouble accessing live sports content, 35 percent say it’s too expensive to access all the content they want, 30 percent don’t know which channels to watch, and 28 percent don’t know which platforms to watch, a media statement from Altman Solon on the sports survey stated.

In developing this report, Altman Solon surveyed 2,500 adults across eight countries, including the US, the UK, Germany, France, Italy, Spain, Mexico and China, between July-August this year. Respondents represent the country’s population, weighted by age, gender, and income.

Altman Solon revealed it will release more results from the survey in the coming months. The survey also polled 150 top sports executives to paint picture of the fragmented sports media landscape

“It seems counterintuitive that the answer to the glut of sports content is more sports content, but sports fans are hungry for more,” said Altman Solon Director David Dellea.

“It turns out fans actually want more content, but often can’t afford the costs of additional subscriptions or get lost in the web of channels and streaming platforms providing content. Some form of industry consolidation seems likely, either through audience aggregation or content democratization, which should be beneficial for both the industry and sports fans,” Dellea added.

This year’s survey for the first time included a poll of global sports media executives to understand the priorities and solutions for a changing industry. The executives identify facilitating content aggregation (65 percent), improving content promotion (64 percent) and fostering flexible pricing (58 percent) as the top ways to make sports content more accessible globally, the researchers explained.

The executives also pointed to a transformation in the way consumers view fandom, with more than half (56 percent) expecting a continued transition towards a more fluid and athlete-driven fandom, as opposed to loyally following the same teams.

“It is important to recognize that the way fans consume sports is much different from a generation ago or even at the end of the past decade,” said Altman Solon Director Matt Del Percio in a statement.

Other key findings of the consumer portion of the survey include the following:

# Global fans of all ages are multitasking on other digital media, while watching sports: 57 percent browse the internet, 50 percent use social media, 43 percent use messaging.

# Younger fans average 1.5x more hours online compared to older fans, underscoring the need for sports media to provide multi-platform content experiences.

# Average TV hours watched per week is expected to drop 16 percent by 2040.

Altman Solon, according to the press release, is the world’s largest strategy consulting firm focused exclusively on the Telecommunications, Media, and Technology (TMT) industries. It has offices spread across the globe including in Boston, London, Los Angeles, Mexico City, Milan, Munich, New York, Paris, Singapore, Sydney, Warsaw and Zurich.

Telecom subs base up marginally; Trai withholds updated b’band data

Telecom subs base up marginally; Trai withholds updated b’band data  WAVES driven by industry; govt just a catalyst: Vaishnaw

WAVES driven by industry; govt just a catalyst: Vaishnaw  In officials’ reshuffle, Shankar moves out of MIB; Prabhat comes in

In officials’ reshuffle, Shankar moves out of MIB; Prabhat comes in  Balaji Tele elevates Viren Trivedi to finance controller

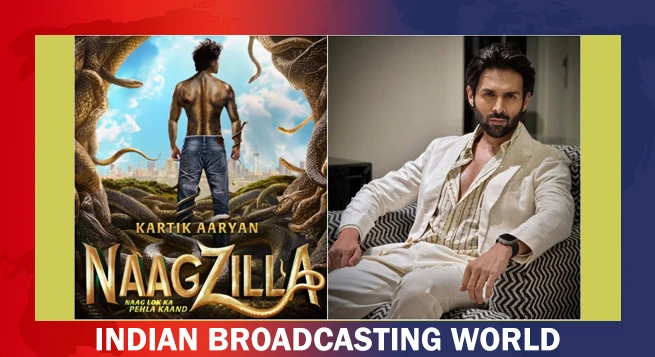

Balaji Tele elevates Viren Trivedi to finance controller  Kartik Aaryan turns shape-shifting serpent for ‘Naagzilla’

Kartik Aaryan turns shape-shifting serpent for ‘Naagzilla’  Mohit Suri’s ‘Saiyaara’ set for July 18 release

Mohit Suri’s ‘Saiyaara’ set for July 18 release  ApplaToon launches ‘Kiya & Kayaan’

ApplaToon launches ‘Kiya & Kayaan’  Jio captures a massive 85% share of India’s 5G fixed wireless market

Jio captures a massive 85% share of India’s 5G fixed wireless market  WAVES offers big opportunity to all media: Murugan

WAVES offers big opportunity to all media: Murugan