Streamers in India may have started negotiating better for theatrical releases, trying to keep acquisition costs down, but Netflix and Prime Video control 75+ percent share of major films released in Hindi, Telugu and Tamil languages since 2022, edging out other players, according to a new analysis by Ormax.

In ‘The Ormax SVOD Audience Report: 2024’, theatrical films outscored original content formats such as web-series and direct-to-OTT films on audience appeal. Similarly, insights from ‘Ormax Stream Track’ reports reveal that theatrical films consistently outscore originals on , a metric that captures the ability of a piece of content to attract new subscribers.

The new Ormax analysis examines the implications of this duopolistic landscape on the Indian theatrical industry.

For pay (SVOD) streaming platforms, theatrical films continue to be a key driver of customer acquisition. Acquiring theatrical film rights can be costly, and platforms often prefer to deploy their content budgets in creating IPs they own. However, the undeniable audience pull of theatrical films makes this content category difficult to overlook.

So, which streaming platforms have a stronger presence in the theatrical films category, and how does the platform distribution mix of theatrical films on streaming impact both the streaming and theatrical industries?

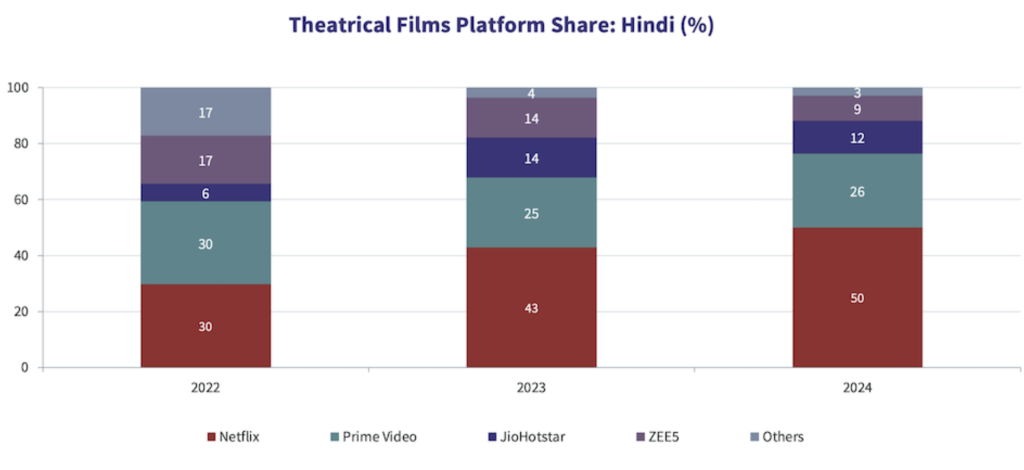

In the category of Hindi theatrical films released over the past three years, Netflix’s dominance has grown significantly during this period, with its share rising from 30 percent to 50 percent.

Netflix has licensed some of the biggest Hindi blockbusters in recent years, including ‘Jawan’ and ‘Animal’, as well as the Hindi streaming rights for ‘Pushpa 2: The Rule’ and ‘Kalki 2898 AD’, solidifying its strong presence in this category.

Consequently, the combined share of Netflix and Prime Video now stands at 76 percent, indicating marginalisation of other platforms on this metric.

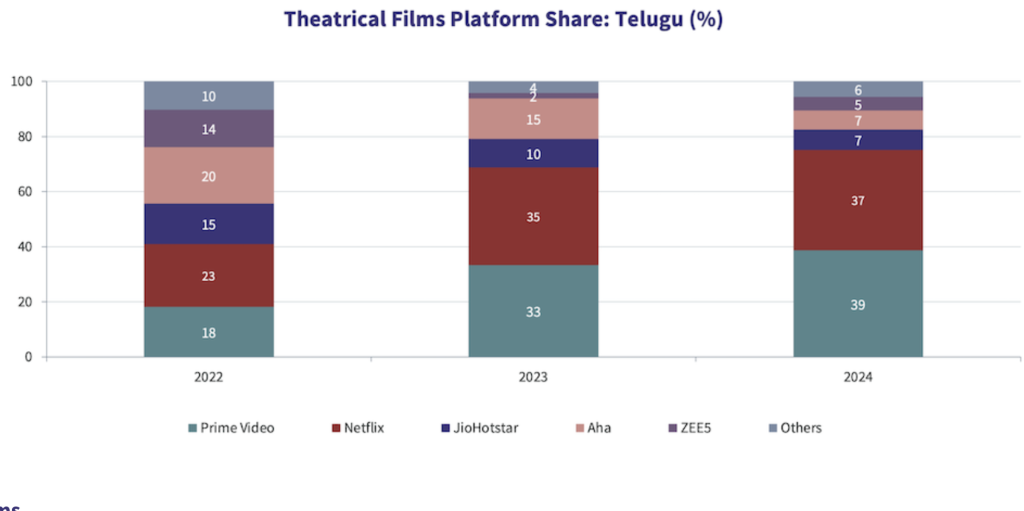

Netflix and Prime Video also dominate the Telugu market, holding a combined share of 76 percent for 2024 releases, a significant increase from just 41 percent for 2022 releases. All other players, both national (JioHotstar and ZEE5) and local (Aha), have slowed down their acquisition of Telugu theatrical rights in 2023 and 2024, allowing Prime Video and Netflix to emerge as the dominant players in this space, the Ormax analysis stated.

The Tamil market mirrors the Telugu trend — with Prime Video and Netflix collectively holding 75 percent share for 2024 releases, up from just 37 percent in 2022. Prime Video has emerged as the dominant player for Tamil theatrical films in 2024, ahead of Netflix.

This duopolistic landscape grants Netflix and Prime Video greater negotiating power, effectively turning the market for streaming rights of theatrical films into a buyer’s market, Ormax observed.

This stands in stark contrast to 2020 and 2021, when multiple streaming platforms, including local players, were competing to acquire theatrical film rights (including those films unable to release in cinemas due to the pandemic), enabling film producers and studios to command high prices.

Ormax said the analysis focuses on theatrical films released in Hindi, Tamil and Telugu languages between 2022 and 2024 with domestic footfalls of one million or more. A total of 323 films across the three languages and the three years were thus identified.

Other languages were not considered, according to Ormax, due to the limited number of films crossing the one million mark annually, making it difficult to identify meaningful trends.

For each of the 323 films, the OTT platform where the film is currently available for streaming in India was identified. Films available on multiple platforms were attributed equally to them — for example, an attribution of 0.5 each if a film is streaming on two platforms.

If the newly-merged platform JioHotstar enters this space with more intent in 2025, it could lead to a more balanced distribution of titles — a scenario the Indian film industry will be eagerly hoping for, the Ormax study concluded.

(Charts courtesy Ormax)

DD FreeDish subs base 49mn homes; likely to reach 53mn: FICCI-EY report

DD FreeDish subs base 49mn homes; likely to reach 53mn: FICCI-EY report  Akashvani’s Aradhana channel to air special Navratri shows

Akashvani’s Aradhana channel to air special Navratri shows  Digital overtakes TV as Indian M&E growth slows down

Digital overtakes TV as Indian M&E growth slows down  Abir Gulaal’ set to release on May 9

Abir Gulaal’ set to release on May 9  Understanding viewer behavior: Key insights from audience engagement research

Understanding viewer behavior: Key insights from audience engagement research  TV9 Marathi joins DD Free Dish

TV9 Marathi joins DD Free Dish  JioHotstar, Big B to bring Ram Navami celebrations live from Ayodhya on April 6

JioHotstar, Big B to bring Ram Navami celebrations live from Ayodhya on April 6  ET Now Swadesh hosts ‘The Gems of Rajasthan’

ET Now Swadesh hosts ‘The Gems of Rajasthan’