Despite slower growth in the first quarter of 2022, global streaming grew 10 percent, led mostly by Africa, Oceania, South America, and Asia, according to Conviva’s State of Streaming Q1 2022 report. On the other hand, Europe and North America showed much slower growth.

What’s more, a majority of the viewing took place on bigger screen devices (compared to a mobile phone screen), mostly on smart TVs.

So while more saturated markets like North America and Europe are starting to stabilize, there are still plenty of growth opportunities throughout the world. And, any growth after such massive expansion over the past two years is good news for both streaming providers and streaming viewers, the report stated.

Though smaller in global share of streamed minutes, Africa and Oceania grew by about 50 percent and South America by 34 percent. Europe and North America were more closely aligned with global growth, with 9 percent and 5 percent increases, respectively.

Big Screens Reign As TikTok Remains Hot: Seventy-seven percent of all streamed minutes globally were on a big screen device, particularly smart TVs, which were up 34 percent year over year.

Most regions followed this pattern, with the exception of Asia and Africa, where only about half of all streaming was on a big screen.

Globally, minutes per play remained flat from year to year, but picture quality, buffering, and video start failures all improved significantly.

Globally, most people streamed on big screens, followed way behind by mobile phones with 11 percent, desktops with 7 percent, and tablets with 5 percent.

TikTok is increasingly becoming an important channel for many brands. It was the only platform that had an increase in audience share for every sports league measured.

For example, amongst the American Super Bowl teams, the two teams in the big game gained over 100K followers on TikTok in 24 hours, while the Rams gained the most followers on a single platform, with a 139.9K increase on Instagram.

Due to global geopolitical conditions, streaming data pertaining to China has been removed from this report, Conviva said in its report.

Last quarter was the first quarter to show that the streaming growth accelerated by the pandemic started to stabilize, and this quarter continued the trend.

Overall, viewing minutes grew by 10 percent in Q1 2022 over Q1 2021. Growth in North America and Europe was on par. Africa, Oceania, and South America had strong double-digit growth, led by Africa up 55 percent.

But it was Asia — excluding China, so a smaller base compared to the rest of the regions — that showed explosive growth, up 172 percent.

While streaming growth is stabilizing in the more saturated markets like North America and Europe, there are still plenty of growth opportunities throughout the world.

Quality Metrics: Quality throughout the world followed a similar pattern to last quarter—video start failures were up across the board, while buffering and bitrate improved. As big screens, especially smart TVs, continue to grow in share, it follows that there might be longer wait times, but much better quality overall.

On the positive side, all regions enjoyed improved picture quality, with Asia leading the pack at nearly a 90 percent improvement despite having the lowest bitrate among regions.

On the negative side, video start time increased in every region, up 30 percent globally and especially in Asia, which was up 56 percent year over year. Europeans waited the least for their videos, just 4 seconds, while Africa had the longest wait time at 8 seconds.

The rest of the quality metrics varied by region. Globally, minutes per play is just over 20 minutes. Most regions also watched around 20 minutes, except Africa and Asia, which had a much higher proportion of streamed minutes watched on other devices, such as mobile phones.

Streaming Advertising Bounces Back: After a quarter that saw remarkable advertising delays and increased buffering, streaming advertising bounced back nicely.

Ad impressions were up 18 percent and ad attempts were up 14 percent, thanks mostly to big Q1 sporting events like March Madness, the Super Bowl, and the Winter Olympics. Live events, especially sports, are a massive driver of streaming, and where there are large audiences, increases in advertising follow.

In another bright spot for streaming advertising, there were significant improvements in ad quality, as well, the Conviva report stated.

(Main image courtesy rev.com)

TRAI revamps website to connect with wider audience

TRAI revamps website to connect with wider audience  Prime Video to limit in India number of TV sets having access per subscription

Prime Video to limit in India number of TV sets having access per subscription  Delhi HC orders meta to remove deepfake videos of Rajat Sharma

Delhi HC orders meta to remove deepfake videos of Rajat Sharma  Govt. blocked 18 OTT platforms for obscene content in 2024

Govt. blocked 18 OTT platforms for obscene content in 2024  Broadcasting industry resists inclusion under Telecom Act

Broadcasting industry resists inclusion under Telecom Act  ‘Cobra Kai Season 6 Part 3’ set for February 2025 release on Netflix

‘Cobra Kai Season 6 Part 3’ set for February 2025 release on Netflix  Radio City unveils ‘WOKA Santa’ to spread Christmas cheer across 10 cities

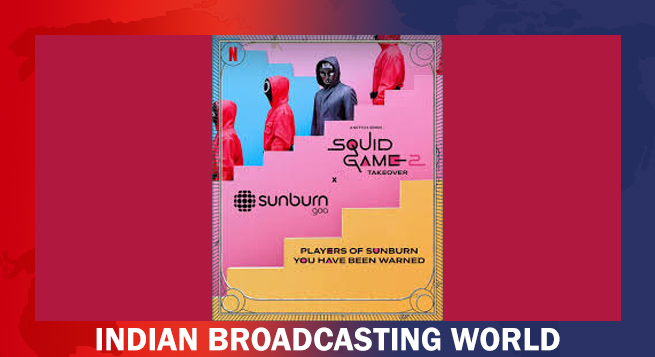

Radio City unveils ‘WOKA Santa’ to spread Christmas cheer across 10 cities  ‘Squid Game 2’ comes to Sunburn Goa 2024

‘Squid Game 2’ comes to Sunburn Goa 2024  Zee Telugu to premiere ‘Saripodhaa Sanivaaram’ on Dec 29

Zee Telugu to premiere ‘Saripodhaa Sanivaaram’ on Dec 29  &pictures announces ‘Khichdi 2’ premieres December 29

&pictures announces ‘Khichdi 2’ premieres December 29