Even as the latest FICCI-EY report has revealed that TV has been dethroned as the numero uno in the Indian media and entertainment realm by digital, also feeling the pain are the local cable operators or LCOs.

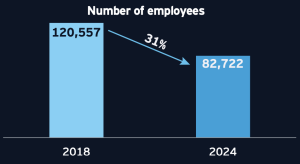

As per a survey of LCOs, which was undertaken as part of the FICCI-EY report titled ‘Shape the Future: Indian Media & Entertainment is Scripting a New Story’, it was revealed that there was 31 percent loss of employment since 2018.

A majority of the LCO respondents — 93 percent — reported that their monthly take-home income had reduced since 2018.

The survey was carried out amongst 28,181 LCOs across 31 Indian States and Union Territories with support from the industry body All India Digital Cable Federation (AIDCF), the FICCI-EY report said.

The ‘Shape the Future: Indian Media & Entertainment is Scripting a New Story’ report revealed the sector reached a total value of INR2.5 trillion (US$29.4 billion), representing a growth of INR 81 billion from the previous year, marking a 3.3 percent increase. But it also added that TV was no more #1 and the segment’s ad revenues too were 23 percent in 2024, down from 36 percent in 2019.

While the M&E sector was 30 percent above its pre-pandemic 2019 levels, television, print and radio still lagged their 2019 revenue levels.

The reasons listed by LCOs for their dipping fortunes, probably, reflect the industry-wide trends as the reasons include movement of subscribers from legacy pay TV platforms to digital and free-to-air services.

The top reason for shifting return on investments of LCOs was inability to increase collections/rates from customers when TV channels’ prices increased. However, the survey didn’t detail what impeded this collection process.

Other reasons listed by LCOs was movement of subscribers from pay TV to OTT, Doordarshan FreeDish and CTVs apart from pay TV content quality not being at par with OTT platforms — a reason that both TV executives and producers of shows need to tackle as it’s very evident to others also.

The survey highlighted that such trends led to approximately 10k of the respondents losing more than 40 percent of their subscriber base.

The various trends that came out in the LCO survey, probably, was summed up best by Vysnley Fernandes, who sits on the board of Hinduja Global Solutions as the MD and CEO of NXTDigital Ltd, an integrated delivery platform.

Making a general observation about the Indian M&E industry, Fernandes was quoted in the FICCI-EY report as saying, “The future of the M&E industry in India will be premised on its ability to integrate innovation with legacy. Evolution through IPTV exemplifies this — providing a seamless transition from traditional cable and offering a dynamic and personalised alternative to standalone OTT services.

“This would effectively combine ‘live’ TV, video-on-demand and access to streaming apps on a single platform, creating a unified entertainment experience.”

According to Mihir Shah of Media Partners Asia, the television distribution landscape is polarizing into three segments: a shrinking legacy pay-TV base, a saturated free-to-air segment and a rapidly expanding CTV segment, driven by rising home broadband adoption.

Probably the LCO survey highlights all of these.

WAVES ‘Create in India Challenge’ crosses 85k registrations

WAVES ‘Create in India Challenge’ crosses 85k registrations  DD FreeDish subs base 49mn homes; likely to reach 53mn: FICCI-EY report

DD FreeDish subs base 49mn homes; likely to reach 53mn: FICCI-EY report  Akashvani’s Aradhana channel to air special Navratri shows

Akashvani’s Aradhana channel to air special Navratri shows  News18 India dominates YouTube viewership, races 43% ahead of Aaj Tak

News18 India dominates YouTube viewership, races 43% ahead of Aaj Tak  Asianet to Premiere ‘Teacheramma’

Asianet to Premiere ‘Teacheramma’  ‘Shin Chan: Our Dinosaur Diary’ set for India release

‘Shin Chan: Our Dinosaur Diary’ set for India release  ‘Saunkan Saunkne 2’ set for May release

‘Saunkan Saunkne 2’ set for May release  Dolby Laboratories to launch Dolby Cinema in India

Dolby Laboratories to launch Dolby Cinema in India