![]()

Apple Inc. reported quarterly results that sailed past Wall Street estimates, marking a victory against a supply-chain crunch fueled by the pandemic and chip shortages.

Sales climbed 11 percent to a record $123.9 billion in the fiscal first quarter, the company said Thursday. Analysts had predicted $119.1 billion on average. Profit also beat projections, and the company predicted that sales would grow by a double-digit percentage in the March quarter, Bloomberg reported.

The shares were up as much as 5.4 percent as trading opened in New York but gave up some of those gains as the broader market slid on concerns about tighter monetary policy.

The surprisingly strong results from Apple suggest that fears of supply upheaval were overblown. Apple Chief Executive Officer Tim Cook had warned late last year that shortages could cost the company more than $6 billion in sales during the all-important holiday period. But the tech giant navigated the crisis and benefited from a flood of new products, including the iPhone 13, Apple Watch Series 7 and updated Macs.

However, Apple may be an early outlier in resolving supply chain issues, thanks in part to its dominant position in obtaining parts from suppliers. A resurgence of Covid 19, skyrocketing shipping costs and labor shortages continue to strain the global supply chain

STMicroelectronics NV, which counts Apple as a major customer, said Friday it doesn’t see a letup in the chip shortage before 2023. The Biden administration has also stated that the global semiconductor shortage will persist until at least the second half of this year.

Wall Street was broadly happy with Apple’s results and its ability to navigate the supply chain crisis while also introducing a flood of new products.

The earnings report “highlights the strength, and stickiness, of Apple’s ecosystem,” Morgan Stanley’s Katy Huberty wrote in a note to clients. She reiterated Apple as her top pick for 2022.

Investors have been looking to Apple for reassurance after a recent rout battered technology stocks. Concerns about a sales slowdown and looming interest rates hikes have made the sector less appealing in the past month, with Apple itself suffering from the retreat.

After topping a market value of $3 trillion in early January, Apple is now worth $2.6 trillion.

Earnings for the Cupertino, California-based company rose to $2.10 a share in the first quarter, which ended Dec. 25, well above the $1.90 estimated by analysts.

On a conference call, Apple executives said supply-chain constraints would ease further in the March quarter, though its rate of growth would decelerate for both the overall business and the services segment. Apple didn’t give a specific sales target, beyond saying it would be a record for the period. Analysts are predicting that revenue will top $90 billion. Gross margin will be 42.5 percent to 43.5 percent, Apple said.

The company also said there are now 1.8 billion Apple devices currently in use, up 300 million from two years ago. And it has 785 million paid Apple and third-party subscriptions on its platform, up from 745 million reported in the previous quarter.

The company generated $71.6 billion in revenue from its flagship product, the iPhone, beating Wall Street estimates of $67.7 billion. That’s up 9.2 percent from the year-ago quarter.

The sales period represented the first full quarter of iPhone 13 revenue. On the company’s earnings call, Cook said the entire iPhone 13 line contributed to the strong growth and declined to specify if the Pro models were stronger performers than the cheaper versions.

The phone went on sale in September, several weeks earlier than the iPhone 12 did in 2020. Though the iPhone 13 was considered to be a modest update, users looking to upgrade to 5G service still clamoured for the device.

The supply constraints hitting the iPhone 13 line and other new products, including the latest Macs and Apple Watches, resulted in shipment delays of several weeks. In Apple’s previous earnings report, the company said that the problems cost it $6 billion in sales — and warned that the holiday quarter would be even worse.

Against that backdrop, the results were a relief to investors. But not everything was rosy: sales of the iPad were lower than projected. The company had said after its previous quarter that supply problems were hitting that product particularly hard. Japan also was a weak spot last quarter.

The iPad brought in $7.25 billion in the first quarter, compared with an estimate of $8.1 billion. The company launched the most significant iPad mini update in the product’s history and a minor refresh to its cheapest tablet during the quarter, but struggled to get enough supply to market.

Chief Financial Officer Luca Maestri said that iPad shortages in the quarter were “pronounced,” and Cook said some of the constraints were due to Apple reallocating key components to the iPhone.

“This is our eighth quarter reporting results in the shadow of the pandemic,” Cook said, “and while I can’t say it gets any easier, I can say I’m incredibly proud of the way our teams have come together.”

Apple generated $19.5 billion in services revenue in the first quarter, topping Wall Street expectations of $18.6 billion. The category grew 24 percent from a year earlier on strong App Store, Apple Music and iCloud subscription sales.

Apple said earlier this month that developers generated about $60 billion from the App Store during 2021, but it didn’t share specific App Store revenue for the company.

Sony MAX 1 set to launch on May 1

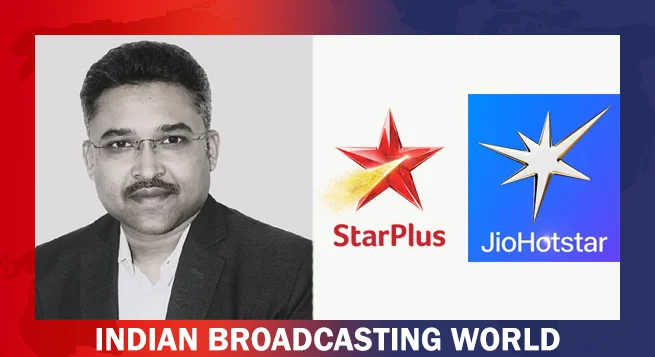

Sony MAX 1 set to launch on May 1  Avijit Dhar appointed VP-Marketing for Star Plus

Avijit Dhar appointed VP-Marketing for Star Plus  Akashvani bags 6 honours at India Audio Summit & Awards

Akashvani bags 6 honours at India Audio Summit & Awards  Govt tells media to desist from live coverage of defence ops

Govt tells media to desist from live coverage of defence ops  Jio Platforms net profit up 25.7% in Jan-Mar quarter

Jio Platforms net profit up 25.7% in Jan-Mar quarter  India M&E sector can unlock $6bn in untapped value by ‘30: Report

India M&E sector can unlock $6bn in untapped value by ‘30: Report  Top creative minds named Jury Chairs for ABBY Awards 2025

Top creative minds named Jury Chairs for ABBY Awards 2025  Pankaj Tripathi returns in ‘Criminal Justice’ S4

Pankaj Tripathi returns in ‘Criminal Justice’ S4  Balaji Digital unveils royal thriller ‘Kull’ on JioHotstar

Balaji Digital unveils royal thriller ‘Kull’ on JioHotstar  Netflix Tudum Live set to stream globally on May 31

Netflix Tudum Live set to stream globally on May 31