The global OTT market size, valued at $121.61 billion in 2019, is projected to reach $1,039.03 billion by 2027, growing at a CAGR of 29.4 percent from 2020 to 2027, according to a new study by Allied Market Research.

Rise in demand for OTT services in developing regions, increase of SVoD services, availability of a variety of content, the surge in demand for live streaming channels, the emergence of new streaming markets and new developments in digital technology are the factors that majorly boost the growth of the market.

However, lack of data network infrastructure and latency issues are expected to hamper the OTT market growth.

The smartphone segment dominated the overall over-the-top industry share in 2019, and is expected to remain dominant during the forecast period, said the report, titled “Over-the-top Industry by Component, Device Type, Content-Type, Revenue Model, User Type, and End User: Opportunity Analysis and Industry Forecast, 2020-2027,”

Depending on device type, the smartphones segment dominated the overall OTT market share in 2019 and is expected to continue this trend during the forecast period. This is attributed to rising penetration of smartphones to stream OTT services and the growing market for larger screen smartphones in developing economies.

In addition, the segment is expected to witness the highest CAGR during the forecast period due to the ongoing gradual replacement of TVs with smartphones and mobile app streaming via OTT.

The subscription revenue model was the highest contributor to the global OTT market in 2019 and is projected to remain dominant during the forecast period, as the adoption of smartphones and tablets has increased considerably among the target consumers base for vendors that offer SVoD and video-on-demand (VoD) services, the report stated.

In addition, the availability of high-speed internet and smartphone applications have improved access to SVoD services.

However, the advertisement revenue model is expected to witness the highest growth due to the rise in the popularity of VoD ads. Moreover, ad-supported VoD platforms is currently experiencing strong growth in ad revenues, thereby making the advertisement-based revenue model popular amidst the COVID-19 pandemic.

As far as five of the major ad-supported streaming platforms — such as Hulu, Peacock, Roku, Pluto TV and Tubi — are concerned, ad revenue reached 31 percent year-over-year in the second quarter of 2020.

Furthermore, the media & entertainment industry dominated the OTT industry share in 2019 and is expected to remain dominant during the forecast period, due to the rise in the number of digital video consumers, which is expected to increase the demand for OTT services in the media & entertainment industry.

Vaz, Mani, Gupta to head 3 verticals of RIL-Disney India merged entity

Vaz, Mani, Gupta to head 3 verticals of RIL-Disney India merged entity  Govt & industry to prime gaming space for global dominance: MIB Secy Jaju

Govt & industry to prime gaming space for global dominance: MIB Secy Jaju  Netflix ad-supported tier touches 70mn MAUs globally

Netflix ad-supported tier touches 70mn MAUs globally  Minister Murugan likens IFFI to Cannes fest; ‘Better Man’ opening film

Minister Murugan likens IFFI to Cannes fest; ‘Better Man’ opening film  Nickelodeon extends #HappyKidding campaign

Nickelodeon extends #HappyKidding campaign  WBD celebrates kids with enchanting lineup

WBD celebrates kids with enchanting lineup  Nikkhil Advani: SonyLIV’s ‘Freedom at Midnight’ chronicles Indian history

Nikkhil Advani: SonyLIV’s ‘Freedom at Midnight’ chronicles Indian history  TRAI deadline for submission on ground-based b’casters extended

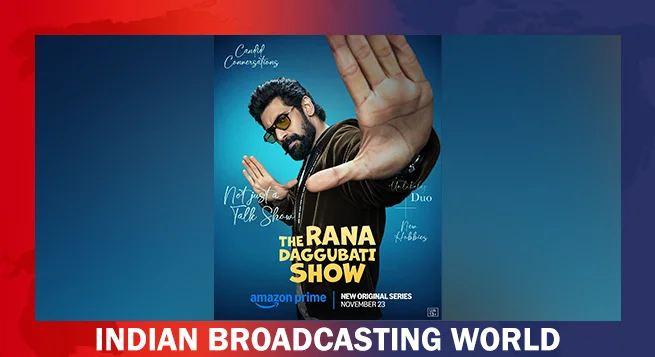

TRAI deadline for submission on ground-based b’casters extended  Prime Video to premiere ‘Rana Daggubati Show’ Nov 23

Prime Video to premiere ‘Rana Daggubati Show’ Nov 23