India’s antitrust body Competition Commission of India (CCI) is conducting a market study on film distribution in the country, with the larger intention of exploring the possibility of a self-regulatory mechanism within the industry to ensure a competitive landscape.

Separately, the antitrust watchdog has completed a study to understand the scenario where large institutional shareholders hold minority stakes in a number of companies that are active in the same industry and compete with each other.

A market study on film distribution has been commissioned to gain insights into various aspects of the state of competition and concerns over anti-competitive practices in the film distribution chain, CCI Chairperson Ashok Kumar Gupta told the Press Trust of India (PTI) in an interview.

The study also comes against the backdrop of digitisation and OTT platforms becoming key factors in the film space.

The watchdog, which keeps a tab on unfair business practices in the marketplace, has received cases related to the film industry from time to time.

To have a better understanding of the “market construct and dynamics”, the CCI has commissioned the study and the “intention is also to explore whether there can be a self-regulatory mechanism within the industry for ensuring a competitive landscape,” Gupta said.

In the film industry, there are basically three key players — producers, distributors and exhibitors.

“The study is an attempt to understand the role of various federations and associations in the industry in India, and the horizontal and vertical arrangements that exist between the market players,” the CCI chief said.

According to him, new issues have arisen with the digitisation of cinema and the use of technology.

“OTTs and other platforms are becoming important channels for the distribution of content. The study seeks to bring out the impact of these developments on the ecosystem in India,” he said, adding that the “the study is complete and CCI will now examine the report and decide appropriately”.

He noted that the aim was to gain visibility in markets with substantial institutional investors, gauge the trends and patterns in common ownership across various sectors in India, and institutional investors’ underlying incentives and motivations behind such investments.

“Since a substantial portion of combination filings is by institutional investors, the idea was also to see whether, in the spirit of ease of doing business, competition assessment can be fast-tracked. This required understanding the rights conferred to institutional investors and their impact on strategic and operational aspects of business across firms in the same industry. The investor community engaged with us and also brought forth their viewpoints on the issue of control and notifiability, especially when institutional investment by an investor is in competing firms,” Gupta said.

In recent times, the CCI has come out with market studies on the e-commerce, pharma and telecom sectors.

Such studies are carried out for the purpose of enforcement and advocacy, and also help uncover new parameters of competition.

Kevin Vaz, Kiran Mani, Sanjog Gupta to head 3 verticals of JioStar

Kevin Vaz, Kiran Mani, Sanjog Gupta to head 3 verticals of JioStar  Govt & industry to prime gaming space for global dominance: MIB Secy Jaju

Govt & industry to prime gaming space for global dominance: MIB Secy Jaju  Netflix ad-supported tier touches 70mn MAUs globally

Netflix ad-supported tier touches 70mn MAUs globally  Minister Murugan likens IFFI to Cannes fest; ‘Better Man’ opening film

Minister Murugan likens IFFI to Cannes fest; ‘Better Man’ opening film  Nickelodeon extends #HappyKidding campaign

Nickelodeon extends #HappyKidding campaign  WBD celebrates kids with enchanting lineup

WBD celebrates kids with enchanting lineup  Nikkhil Advani: SonyLIV’s ‘Freedom at Midnight’ chronicles Indian history

Nikkhil Advani: SonyLIV’s ‘Freedom at Midnight’ chronicles Indian history  TRAI deadline for submission on ground-based b’casters extended

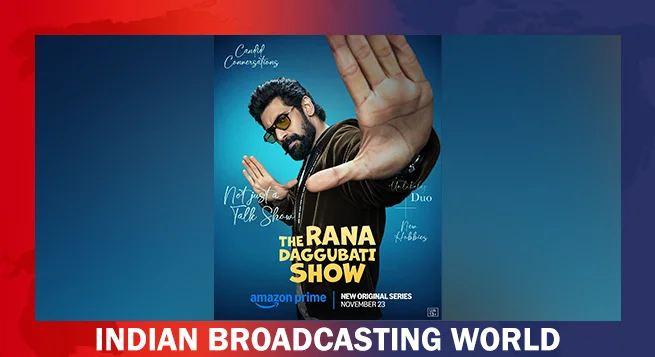

TRAI deadline for submission on ground-based b’casters extended  Prime Video to premiere ‘Rana Daggubati Show’ Nov 23

Prime Video to premiere ‘Rana Daggubati Show’ Nov 23