By Elara Caps

Zee Entertainment (Z IN) reported revenue of INR 18,457mn, up 4 percent YoY, on low base, and down 20.5 percent QoQ, down 8 percent vs pre-COVID levels to INR 18.5bn, in line with our estimates, affected by FTA withdrawal (Zee Anmol) and lower ad spend by brands due to weak macroeconomic conditions.

The company reported an EBITDA of INR 2,358mn, down 31 percent YoY, and an EBITDA margin of 12.8 percent, down 660bp YoY and 820bp QoQ, primarily due to weak revenue growth and continued investment in the digital business. Reported PAT stood at INR 1,066mn, down 48.9 percent YoY, on the back of lower revenue growth during the quarter.

Z is estimated to report an ad revenue CAGR of 7.5 percent over FY23-25E, negatively affected by H1FY23,which has seen a sharp negative impact on ad spend.

This was due to:

1) RM inflation pressure on various business verticals (FMCG & auto)

2) the shift of Zee Anmol from FTA to pay; we estimate ad revenue for Z to revert to pre-COVID levels by FY24 (105 percent recovery rate vs FY20). In terms of subscription revenue too, concerns persist as there is still uncertainty over implementation of NTO 2.0; ARPU remains flat and there are concerns over the shift of viewership toward digital (early chord-cutting trends). Further, challenges persist on profitability too as EBITDA margin is estimated to be in the band of 16-23 percent over FY23-25, due to investments in digital offerings and lower subscriber revenue growth; growth momentum on digital (Zee5) is estimated to be 20 percent over FY23-25; however, losses may magnify YoY due to heavy investments in technology and content (current annual loss of INR 9.4bn basis Q1FY23). Merger with Sony remains to be a key monitorable, which will drive synergy and valuation multiple upgrade; we await NCLT approval for the merger.

Valuation: Z is currently trading at an inexpensive valuation of 23.5x FY23E earnings and 17.6x FY24E earnings. The stock has moved up a mere 4 percent over the past three months, as approvals on merger have taken time and the same has been an overhang. We pare down our revenue estimates by 2.1 percent for FY23 and 2.4 percent for FY24 after factoring in the negative implications of ad spend in H1FY23 and lower subscriber revenue; our earnings estimates cut was due to lower revenue on subscription and investment in the digital businesses. We reiterate Buy with a lower TP of INR 415 from INR 450 based on a SOTP method. We assign 19x (from 20x) one-year forward P/E for the broadcasting business, backed by synergies post-merger and 4.5x (from 5x) EV/sales for the digital business, as the digital OTT market in India is estimated to grow in the healthy double-digits.

Vaz, Mani, Gupta to head 3 verticals of RIL-Disney India merged entity

Vaz, Mani, Gupta to head 3 verticals of RIL-Disney India merged entity  Govt & industry to prime gaming space for global dominance: MIB Secy Jaju

Govt & industry to prime gaming space for global dominance: MIB Secy Jaju  Netflix ad-supported tier touches 70mn MAUs globally

Netflix ad-supported tier touches 70mn MAUs globally  Minister Murugan likens IFFI to Cannes fest; ‘Better Man’ opening film

Minister Murugan likens IFFI to Cannes fest; ‘Better Man’ opening film  Nickelodeon extends #HappyKidding campaign

Nickelodeon extends #HappyKidding campaign  WBD celebrates kids with enchanting lineup

WBD celebrates kids with enchanting lineup  Nikkhil Advani: SonyLIV’s ‘Freedom at Midnight’ chronicles Indian history

Nikkhil Advani: SonyLIV’s ‘Freedom at Midnight’ chronicles Indian history  TRAI deadline for submission on ground-based b’casters extended

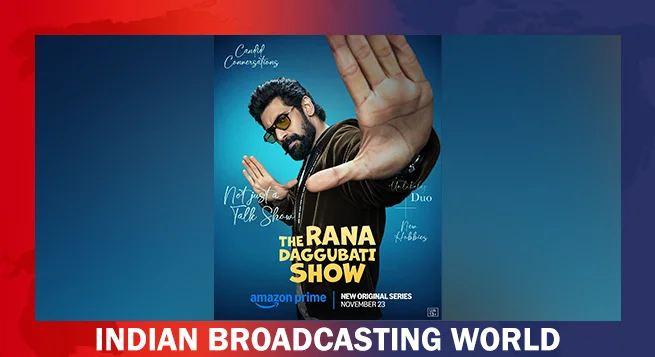

TRAI deadline for submission on ground-based b’casters extended  Prime Video to premiere ‘Rana Daggubati Show’ Nov 23

Prime Video to premiere ‘Rana Daggubati Show’ Nov 23