Stock markets in India may be booming and so are investments in mutual funds. But do you know how many Indian families invest in the stock market and mutual funds? Only 3 percent of Indian families invest in stock markets and just about 6 percent in mutual funds. The largest share of investment goes into real estate at 18 percent.

These are some of the findings of India’s First and Biggest independent personal finance survey conducted by Money9, a digital offering of TV9 Network, India’s No.1 television news network.

Despite robust growth in financial inclusion and the burgeoning financial services industry, almost 69 percent of Indian households struggle due to financial insecurity and vulnerability. The survey, released on Saturday, for the first time, maps Indian households’ income, savings, investment, and spending. It comes up with crucial insights into how India earns, spends, and saves. The survey has also unveiled India’s first-ever state ranking of citizen financial security, i.e., the Money9 Financial Security Index.

The Money9 Personal Finance Survey is a nationally representative household survey with a mega sample size of 31,510 households across 1,154 urban wards and villages in 100 districts and 20 states or state groups. The Survey was conducted between May and September 2022.

The Money9 Survey has been executed in collaboration with Research Triangle Institute (RTI) Global India, a subsidiary of RTI International (US).

The scale of the Money9 personal finance survey is comparable to RBI and NCAER, in terms of design, and geographical coverage. The survey adopted a holistic, systematic, interlinked approach to focus on the demand side of personal financial services to measure the levels of financial security among Indian Households, across states and districts of India.

Key Survey Findings

The survey finds that the average income of an Indian family of 4.2 persons is Rs 23,000 per month. Over 46 percent of Indian families have an income of less than Rs 15,000 per month i.e. belong to the aspiring or lowest-income cohort.

Only 3 percent of Indian households have a luxury standard of living and most of them belong to higher income cohorts (High- Middle and Rich)

A survey finds that 70 percent of Indian households do some financial savings in the form of Bank deposits, Insurance, Post office savings, and Gold. The incidence of saving is less prevalent among the aspiring class. Also, two-fifths of the Indian households in the same class are unable to do any financial savings. There is a clear need to address this segment by the policy makers/ market players.

The survey finds 22 percent of Indian households invested in stocks, mutual funds, ULIP & physical assets. However, investment in Property/ Land is high (18 percent) followed by Mutual Funds (6 percent), Stock Market (3 percent), and ULIP (3 percent)

The survey finds that only 11 percent of Indian households have active loans with banks or NBFC. Among all retail loans, the consumption of personal loans is highest, followed by home loan

India’s Money9 Financial Security Index ranks states in security across several parameters. This index finds 42 percent half of the Indian households are “insecure” (this includes households having monthly earnings of INR 15,000 or more). The level of financial insecurity further increases to 69 percent after including the lowest income cohorts i.e. households having monthly earnings up to Rs.15,000

Commenting on the importance of the Survey, Barun Das, MD & CEO, of TV9 Network, said, “The survey findings point to the critical gap between demand and supply side in the personal finance space. The data should help diverse stakeholders quickly refurbish the demand side and at the same time, understand the gap in the supply side. And thus, we would be able to complete our journey of achieving financial security through financial wisdom. Money9 is committed to playing a pivotal role in bringing about this paradigm shift”.

Anshuman Tiwari, Editor, of Money9, said, “This survey has thrown up unique and highly valuable insights about the financial security of the masses in India and their income-saving behavior. We will continue to engage with policymakers and financial service providers to further the objective of financial security”.

Filmmaker Shekhar Kapur feels AI ‘yet to match human imagination’

Filmmaker Shekhar Kapur feels AI ‘yet to match human imagination’  Punit Goenka makes himself unavailable for Zee MD post ahead of AGM

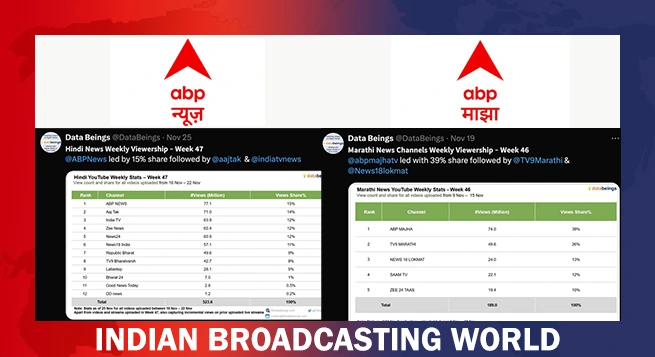

Punit Goenka makes himself unavailable for Zee MD post ahead of AGM  ABP News overtakes Aaj Tak, ABP Majha leads Marathi news market

ABP News overtakes Aaj Tak, ABP Majha leads Marathi news market  Zee Cinema to premiere ‘Auron Mein Kahan Dum Tha’ on Nov 30

Zee Cinema to premiere ‘Auron Mein Kahan Dum Tha’ on Nov 30  Boman Irani’s ‘The Mehta Boys’ shines at its Asia premiere at IFFI

Boman Irani’s ‘The Mehta Boys’ shines at its Asia premiere at IFFI  WBD revolutionizes streaming ads with ‘Shop with Max’ ‘Moments’

WBD revolutionizes streaming ads with ‘Shop with Max’ ‘Moments’  Live Times unveils ‘Daily News Digest for Journalists’

Live Times unveils ‘Daily News Digest for Journalists’