A panel of Indian state finance ministers has yet to submit its report on taxation of the booming online gaming sector that is crucial to a final decision on how the levies should be imposed, a senior government official said on Monday.

The panel has for weeks been deliberating how it should tax online gaming companies — and whether federal tax should be imposed on only the profits of firms or on the value of the entire pool of money collected from participants.

The panel is unlikely to reach a consensus this month, the official told reporters in New Delhi, according to a Reuters news dispatch.

Real-money online games have become hugely popular in India, prompting foreign investors like Tiger Global and Sequoia Capital to back local gaming start-ups Dream11 and Mobile Premier League, popular for their fantasy cricket games.

Any decision on this in the upcoming meeting of India’s goods and services tax (GST) council on December 17 will be contingent on availability of the report which has yet to be finalized, the official said.

India is also separately working on federal regulations for the gaming sector that research firm Redseeer estimates will be worth $7 billion by 2026, dominated by real-money games.

Those planned regulations will apply to all real-money games after the Prime Minister’s Office overruled a proposal to only regulate games of skill and leave out games of chance.

Akashvani bags 6 honours at India Audio Summit & Awards

Akashvani bags 6 honours at India Audio Summit & Awards  Govt tells media to desist from live coverage of defence ops

Govt tells media to desist from live coverage of defence ops  Jio Platforms net profit up 25.7% in Jan-Mar quarter

Jio Platforms net profit up 25.7% in Jan-Mar quarter  SRK, Aamir, Big B, Ted Sarandos, WPP CEO, MPA chief, other stars, to headline WAVES

SRK, Aamir, Big B, Ted Sarandos, WPP CEO, MPA chief, other stars, to headline WAVES  TIPS Music ends FY25 on high note with 29% revenue growth

TIPS Music ends FY25 on high note with 29% revenue growth  Gaurav Sawant to anchor ‘India First’ on India Today TV

Gaurav Sawant to anchor ‘India First’ on India Today TV  ‘Bohurupi’ set for digital premiere on ZEE5

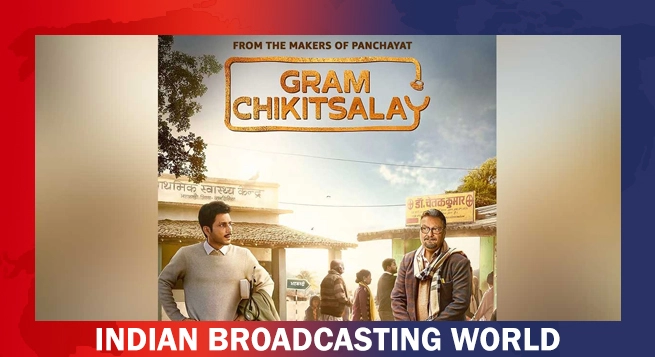

‘Bohurupi’ set for digital premiere on ZEE5  Amol Parashar’s ‘Gram Chikitsalay’ to premiere on May 9

Amol Parashar’s ‘Gram Chikitsalay’ to premiere on May 9  Sony YAY! set to host special Shin chan celebration in Noida

Sony YAY! set to host special Shin chan celebration in Noida  SC seeks Centre’s response on explicit content on OTT, SM

SC seeks Centre’s response on explicit content on OTT, SM