Karan Taurani @Elara Capital

Most large broadcasters, except Disney and TV18, have submitted their RIO and bouquet package prices. As per our checks, the prices of bouquets been revised upwards by 10 percent on an average (slightly ahead of our estimates of 8 percent price hike).

This hike is bound to have a positive impact of 4-5 percent on revenue estimates for FY24 for broadcasters

Further, the broadcasters have also rolled back a la carte pricing towards Rs. 19 for their marquee channels (from Rs.12 earlier due to uncertainty over NTO 2.0). However, this rollback won’t have any impact on ARPUs, as the shift from Rs. 19 to Rs.12 was only notional in nature as per RIOs (Reference Interconnect Offers) submitted last year post NTO 2.0 norms.

NTO 3.0, does not have any material difference vs NTO 1.0, except the fact that discount percentage for sum of a la carte vs same channels in the bouquet should be capped at 45 percent.

We maintain our view that price hikes are a positive for broadcasters and may drive upgrades in the range of 3-5 percent, in case of no cord cutting/shaving trends due to price hikes.

Meanwhile, TV industry subscription revenues dipped at 2.2 percent CAGR in FY19-22, on NTO 2.0 overhang. NTO 2.0 implementation will pave the way for at least inflation-led price hikes in TV broadcasting, in our view.

But expect price hike to be in the lower end of the high single-digit range. Thus, core TV subscription revenue (excluding OTT) may grow at least 6-7 percent (price hike) over the medium term, on clarity emerging over NTO 2.0.

We do not foresee a sizeable growth (double-digit price hike) in TV subscription ARPUs given: 1) lack of growth in HD penetration [digital, a key winner for HD content] 2) OTT offering convenience led viewing 3) continued dip in TV consumption by the youth 4) increased penetration of smart TV [bundled OTT offerings] and 5) very little or no growth for TV households (net adds).

Cable ARPUs in India are still very low at INR 350 versus OTT ARPU in INR 600-700 range, if one were to subscribe to the top OTT platforms in India (excluding data charges). This, in turn, shows the potential for marginal growth in TV ARPUs of India.

We believe a larger chunk of the above growth will come from sports /mainstream GEC genres, which appeal to the urban audience on a very large subscriber scale.

AniMela partners AMS for India’s global AVGC XR fest

AniMela partners AMS for India’s global AVGC XR fest  Filmmaker Shekhar Kapur feels AI ‘yet to match human imagination’

Filmmaker Shekhar Kapur feels AI ‘yet to match human imagination’  Punit Goenka makes himself unavailable for Zee MD post ahead of AGM

Punit Goenka makes himself unavailable for Zee MD post ahead of AGM  ‘Kicking Balls’ premieres on Prasar Bharati’s WAVES

‘Kicking Balls’ premieres on Prasar Bharati’s WAVES  Streambox unveils subscription-based TV service Dor

Streambox unveils subscription-based TV service Dor  Vir Das’ maiden hosting stint at 52nd Emmy Awards ‘went well’

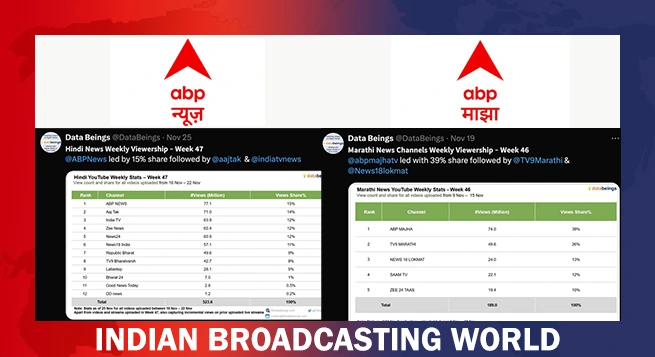

Vir Das’ maiden hosting stint at 52nd Emmy Awards ‘went well’  ABP News overtakes Aaj Tak, ABP Majha leads Marathi news market

ABP News overtakes Aaj Tak, ABP Majha leads Marathi news market