ZEE5, India’s largest home-grown video streaming platform and multilingual storyteller for entertainment seekers, launched the fifth edition of its knowledge series ‘ZEE5 Intelligence Monitor’, deep diving into the trends and consumption patterns of digital payments.

The digital payments industry edition sheds light on how its entire ecosystem has evolved in recent years and where it is headed. It highlights how the adoption of digital payments has gathered critical mass in India especially due to the democratisation of affordable smartphones and the proliferation of Internet and connectivity, a media statement from the streamer said yesterday.

The report also calls attention to women feeling empowered with digital payments as it gives them a sense of being independent and tech savvy.

The survey accentuates how digital payments are becoming omnipresent in India, as people are not only using more than one app to pay digitally, but have also found multiple use-cases to pay through their phones.

Some key highlights of the report include the following:

- The survey found that Tier II markets are emerging as the hotbed for digital payments in India and the reasons for the inclination being ease of use (73 percent) and instant transactions (63 percent).

- Digital payments are gaining prominence over traditional financial systems with 63 percentof debit card users preferring mobile wallets and UPI.

- 57 percent of users feel secure using mobile wallets/UPI.

- 54 percent of users use more than three apps to avail offers and discounts.

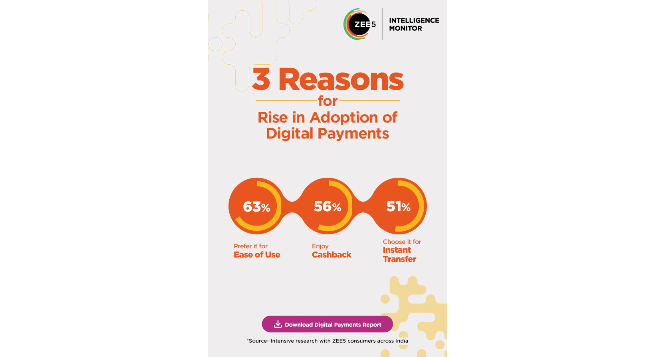

- 63 percent of the people surveyed mentioned that the top reason to avail digital payments is ‘ease of use’, followed by 56 percent saying ‘cashback offers’ and 51 percent of them considering ‘faster transaction’ as a reason to use these apps.

- The top three categories of spending on mobile wallets/UPI apps, according to the report, were mobile bills (50 percent) followed by online shopping (40 percent)and utility bills (42 percent).

- 50 percentof users feel progressive and tech-savvy while using mobile wallet/UPI.

Launching the report, Rajiv Bakshi, Chief Operations Officer – Revenue, ZEE Entertainment Enterprises Limited, said, “The ZEE5 Intelligence Monitor – Digital Payments Report unravels the key trends of the digital payments sector which has become ubiquitous across regions with increase in adoption of a digital-first lifestyle. ZEE5, with its strong presence in both metros and non-metro cities, has a significant access to monitor, map and access data in determining consumption habits, purchase behaviour and consumption patterns.

“As a consumer-first brand, we invest in identifying audience’s preferences to cater to them more efficiently, alongside empowering the marketers to tap into the audience base to better connect and expand their products’ reach. We discovered interesting insights which brand marketers can use at their advantage; some findings that also challenge conventional notions of digital behaviour with respect to personal finance.”

A first of its kind, ‘ZEE5 Intelligence Monitor’ seeks to uncover transformative consumer behaviour, attitudes, and aspirations across multiple industries ranging from e-commerce, edtech, online gaming to smartphones, presenting an unmatched opportunity to advertisers to access a hyper-enriched predisposed audience cohort across multiple demographics and geographies.

Through this series, ZEE5 aims to identify trends, map behaviours, and deliver actionable insights into consumers’ attitudes toward products and services in emerging and fast-growing industries, the press release added.

Jio, Airtel, Vi witness subs losses in Sept: TRAI data

Jio, Airtel, Vi witness subs losses in Sept: TRAI data  Expanded Creative Minds of Tomorrow edition inaugurated at IFFI

Expanded Creative Minds of Tomorrow edition inaugurated at IFFI  ZEEL’s Punit Goenka steps down as MD, retains role as CEO

ZEEL’s Punit Goenka steps down as MD, retains role as CEO  Kevin Vaz, Kiran Mani, Sanjog Gupta to head 3 verticals of JioStar

Kevin Vaz, Kiran Mani, Sanjog Gupta to head 3 verticals of JioStar  WBD elevates Deepa Sridhar to Senior Director – Corporate Communications, South Asia

WBD elevates Deepa Sridhar to Senior Director – Corporate Communications, South Asia  ‘Bhagam Bhag 2’ returns after 18 years

‘Bhagam Bhag 2’ returns after 18 years  Babil Khan’s ‘Log Out’ to premiere at Argentina’s Mar del Plata International Film Festival

Babil Khan’s ‘Log Out’ to premiere at Argentina’s Mar del Plata International Film Festival  Tips Music presents ‘Love Garage’

Tips Music presents ‘Love Garage’  Fox, Hulu ink $1.5bn streaming content partnership

Fox, Hulu ink $1.5bn streaming content partnership