Online gaming grew 35 percent in 2022 even as the number of gamers too increased to over 400 million, a new report stated, adding that the segment is expected to reach INR 231 billion by 2025 at a CAGR of 20 percent.

While brands are now exploring online gaming worlds to launch products, hold events and enable new monetization opportunities, 5G and cloud gaming can enable uptake of subscription models, said the Ficci-EY report titled ‘Windows of Opportunity: India’s media & entertainment sector – maximizing across segments’

“The online gaming segment grew 35 percent in 2022 to reach INR135 billion. It is the fourth largest segment of the Indian M&E sector,” the report said, adding, “The count of online gamers in India grew to reach 421 million in 2022 and of these, around 90 to 100 million are frequent players of games.”

Transaction-based game revenues grew 39 percent, while casual gaming grew 20 percent due to increased awareness and better perception of online gaming, significant marketing spends, use of brand ambassadors and gaming influencers, among other reasons.

“We expect premium content (films and OTT series) based on games will generate 20 hours to 30 hours a year going forward,” the authors of the reports observed.

With the split of sports media rights across four major broadcasters, the opportunity for play-along games will increase significantly and the report estimated there will be over 50 large online gaming tournaments in 2025

Some of the major highlights of online gaming segments are the following:

► Transaction-based game revenues crossed INR100 billion in 2022.

► Fantasy sports growth was driven by the resumption of sporting events, including some marquee events like FIFA, Asia Cup, IPL and T20 World Cup.

► Close to 25 percent of online gamers are paid gamers.

► Online game viewing and streaming became an alternate entertainment option to OTT consumption and social media.

► The count of online gamers in India grew to reach 421 million in 2022 and is expected to reach 442 million by 2023.

► Of the above, around 90 to 100 million are frequent players of games.

► Gaming influencers such as Total Gaming (33.5 million subscribers), TechnoGamerz (31.5 million subscribers), CarryisLive (11.6 million), Live Insaan (9.86 million) have attracted new cohorts of players.

► Greater online gaming awareness through marketing and use of brand ambassadors like MS Dhoni for WinZO, Shah Rukh Khan for Ace23, Hrithik Roshan for Games 24×7, Virat Kohli for MPL also contributed to increase in awareness and trial.

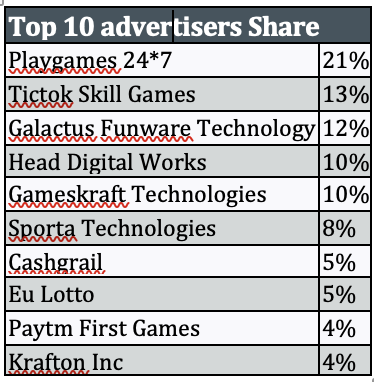

► Ecom-Gaming category advertising volumes on television increased two folds between Jan-Aug’22 as compared to Jan-Aug’21.

► Transaction-based game revenues crossed INR100 billion (gross of taxes).

► Transaction-based game revenues increased by 39 percent in 2022 from 2021, where they had grown 27 percent.

► Growth in rummy and poker was driven by a sharper focus on user retention through data analytics; acquiring new audiences through increased awareness through marketing; enhancing trust; increasing popularity of online tournaments with substantial prize money and creating separate, focussed communities for each game to increase engagement levels.

► Fantasy sports growth was driven by the resumption of sporting events, including some marquee events like FIFA, Asia Cup, IPL and T20 World Cup. The user base for fantasy sports is estimated to have grown by at least 14 percent in 2022.

► As per the EY-Loco gamer survey 2022, 39 percent of respondents were ok to pay for playing real money games, while 50 percent of respondents were willing to pay to play fantasy sport.

► The propensity of Indian consumers to pay for online games is increasing YoY, with India’s percentage of first- time paying users increasing to 67 percent in 2022.

► Close to 25 percent of online gamers are paid gamers and increasing by approximately 2 million per month.

Future Outlook

► Transaction based gaming is estimated to grow at a CAGR of 21 percent to reach INR183 billion and contribute 79 percent of total segment revenues.

► Casual gaming will grow at a CAGR of 15% to reach INR48 billion. Drivers for this growth include access to high-speed internet in India’s Tier-II,III and rural areas; clarity on the new IT rules enabling compliance and building gamers’ trust; Conversion of the next 100 million to 150 million feature phones into smartphones by 2025-26;

►5G and cloud gaming is bringing more sophisticated games to the masses.

► Simplification of legislation and regulation with clarity on permitted games, leading to more investment in the country’s gaming sector.

► New monetization models will emerge.

► Brands are now exploring online gaming worlds to launch products, hold events and enable new monetization opportunitie

► United Colors of Benetton debuted in online gaming with a virtual collection specifically designed for Animal Crossing: New Horizons. Benetton Island is a destination in the game that users can discover by walking around and creating different looks with virtual renditions of the brand’s iconic garments. Benetton shared access codes via print articles, social media, and popular Italian influencers to drive traffic to the island.

► Toyota engaged with its audience across Asia by organizing an e-Motorsport event TOYOTA GAZOO Racing GT Cup on Gran Turismo, a racing simulation video game, which allowed gamers to use Toyota sports cars for racing and was streamed live on Twitch, Facebook, YouTube and Twitter25.

► Brands will continue to leverage gaming audiences through innovations in product awareness, product or service trial/ experience, bookings and after-sales service

► 5G and cloud gaming can enable uptake of subscription models.

► With 5G services being introduced, the opportunity for cloud gaming as a medium to experience higher-end games, on regular devices/ handsets is set to grow.

► This shall also enable the evolution towards AR/ VR in games.

► Mass access to high-end games can open up opportunities around subscription gaming and ticketed games, competitions and events; almost two-thirds of respondents to the EY-Loco gamer survey 2022 were willing to pay for gaming subscriptions

Sony MAX 1 set to launch on May 1

Sony MAX 1 set to launch on May 1  Avijit Dhar appointed VP-Marketing for Star Plus

Avijit Dhar appointed VP-Marketing for Star Plus  Akashvani bags 6 honours at India Audio Summit & Awards

Akashvani bags 6 honours at India Audio Summit & Awards  Govt tells media to desist from live coverage of defence ops

Govt tells media to desist from live coverage of defence ops  Jio Platforms net profit up 25.7% in Jan-Mar quarter

Jio Platforms net profit up 25.7% in Jan-Mar quarter  SRK, Aamir, Big B, Ted Sarandos, WPP CEO, MPA chief, other stars, to headline WAVES

SRK, Aamir, Big B, Ted Sarandos, WPP CEO, MPA chief, other stars, to headline WAVES  India M&E sector can unlock $6bn in untapped value by ‘30: Report

India M&E sector can unlock $6bn in untapped value by ‘30: Report  Top creative minds named Jury Chairs for ABBY Awards 2025

Top creative minds named Jury Chairs for ABBY Awards 2025  Pankaj Tripathi returns in ‘Criminal Justice’ S4

Pankaj Tripathi returns in ‘Criminal Justice’ S4  Balaji Digital unveils royal thriller ‘Kull’ on JioHotstar

Balaji Digital unveils royal thriller ‘Kull’ on JioHotstar  Netflix Tudum Live set to stream globally on May 31

Netflix Tudum Live set to stream globally on May 31