According to the data gathered in the year 2021, the top 10 OTT platforms in India had about 12 million users. Presently, this number has reached an astonishing 45 million figure. As per studies conducted and research done, the OTT market is about to be worth around 11,944 crores by the end of 2023.

“I prefer watching shows or movies that have a good storyline irrespective of the language. With easy access to content from multiple languages and genres, I watch a lot more multi-lingual content.” Says a Consumer as per BCG report on OTT 2022…Self explanatory as to how OTT has cut the language barriers across to highlight good content products, whether regional or global or the GLOCAL trend. Today regional languages enjoy 35% share on OTT platforms that covers dialects as well leading to Microgenres of content.

With a CAGR of 36 percent, the Indian market is a gift that keeps giving and more so now from the regional territories of the country.

Massification of OTT

Most of the urban cities and metropolitan cities have been penetrated with OTT platforms and it is safe to say that almost every family in the biggest cities of India have some kind of OTT service that they enjoy. However, if this is true then how is there still a 36 percent figure indicating growth even in the upcoming years for India?

Market expansion is the reason behind this predicted growth percentage in terms of OTT market as the country is now looking at regional markets and a slightly more rural based audience. As the introduction of 5G spectrum makes media dark markets more accessible; OTTs gear up to expand the content library at regional market and acquire subscribers at a further penetrated level. The fact that they will have fresh introduction to exclusive streaming services, they are more likely to be loyal and generate higher conversions if the content appeals to them.

Content resonance

India is a land of culture and dialects; masses of the country still tend to live their lives very deeply rooted in their upbringing and culture; therefore making it difficult for them to immediately align with international content. Content in regional languages is also going beyond just dubbing from one language to another.

However, watching characters that talk like them and behave like them is more likely to get them invested into the story and for them to identify themselves with the platform; for example the cult of heartland web shows on the platforms from the states of Chennai, Hyderabad, Haryana, West Bengal, Orissa like Sun NXT, Aha, Stage, Hoichoi and Kancha Lanka. These platforms have a loyal audience base as they are speaking in the language of the people of the territories. original content has better return on investment (ROI), cheaper to produce than acquiring the films.

Audience Capture

Indian men today aspire to sport a beard and become dopplegangers of Kannada actor, Yash from KGF. Never thought this would happen.

These platforms even have a huge global audience among the Indian diaspora. Some of them intend to now capture global markets via creating regional content with global actors (Indian Origin). Others plan to blend Indian regional languages with English to rope in the next. According to EY, regional content went from 27 percent of titles produced to 2020 to 46 percent in 2021. Total of 177 non-Hindi titles mainly in Bengali, Tamil & Telugu.

“Emotions, Entertainment and food are best savored as local. People never forget the local taste of language, and their ethnic values.”

(The author, Divya Dixit, has 20+ years of experience in marketing and brand building across industries — digital, broadcast, telecom, and music. Her last assignment was at ALTBalaji where she headed the platform’s Marketing, Partnerships & Revenue aspects. Prior to ALTBalaji, Divya has been in leadership positions at organizations like ZEE5, Sony, UTV, Tata Docomo and Barista. The views expressed here are personal and Indianbroadcastingworld.com does not take any responsibility for them )

Akashvani bags 6 honours at India Audio Summit & Awards

Akashvani bags 6 honours at India Audio Summit & Awards  Govt tells media to desist from live coverage of defence ops

Govt tells media to desist from live coverage of defence ops  Jio Platforms net profit up 25.7% in Jan-Mar quarter

Jio Platforms net profit up 25.7% in Jan-Mar quarter  SRK, Aamir, Big B, Ted Sarandos, WPP CEO, MPA chief, other stars, to headline WAVES

SRK, Aamir, Big B, Ted Sarandos, WPP CEO, MPA chief, other stars, to headline WAVES  TIPS Music ends FY25 on high note with 29% revenue growth

TIPS Music ends FY25 on high note with 29% revenue growth  Gaurav Sawant to anchor ‘India First’ on India Today TV

Gaurav Sawant to anchor ‘India First’ on India Today TV  ‘Bohurupi’ set for digital premiere on ZEE5

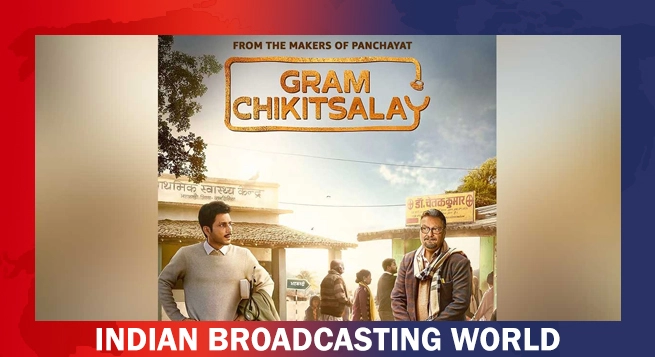

‘Bohurupi’ set for digital premiere on ZEE5  Amol Parashar’s ‘Gram Chikitsalay’ to premiere on May 9

Amol Parashar’s ‘Gram Chikitsalay’ to premiere on May 9  Sony YAY! set to host special Shin chan celebration in Noida

Sony YAY! set to host special Shin chan celebration in Noida  SC seeks Centre’s response on explicit content on OTT, SM

SC seeks Centre’s response on explicit content on OTT, SM