Tata Play is in favour of removal of caps on carriage fee of TV channels on a distribution platform under a proposed National Broadcasting Policy, while also batting for putting regulatory restrictions on video OTT platforms and Doordarshan FreeDish as both presently create an imbalance in the distribution ecosystem.

“We urge the Authority to also pull in the OTT platforms distributing content, in competition with the DTH industry, under the same regulatory regime as the DTH sector,” Tata Play has said in its submission to the Telecom Regulatory of India (TRAI)’s pre-consultation paper seeking on inputs for formulation of a National Broadcasting Policy, a demand that it has repeated publicly in several forums.

Tata Play (formerly Tata Sky) has also called for immediate implementation of TRAI recommendations on the DTH sector submitted to the Ministry of Information and Broadcasting (MIB), which suggests reducing DTH license fee to three percent of the adjusted gross revenue and further bringing it down to zero over three years.

Justifying its stance on regulating the video OTT platforms — also referred to as online curated content services — Tata Play has reiterated its views on the issue saying OTT services were “conducting a similar and substitutable function” as of the licensed and registered DPOs (distribution platform operators).

“However, such OTT platforms are not presently governed by TRAI regulations. The regulatory imbalances and pricing structure relating to OTT platforms need to be addressed in the National Broadcasting Policy for a level playing field in the market,” said Tata Play, one of India’s top DTH service providers.

On the issue of applying rules meant for the private sector to the national broadcaster, Tata Play highlighted that Prasar Bharati was formed to provide accurate factual information to the masses at affordable prices in the national interest.

“However, the role of Prasar Bharati through DD Free Dish seems to have deviated over a period of time to furthering the interests of some private broadcasters who are ready to pay the auction money to get more viewership in order to gain advertisement revenue. This defeats the very foundation of Prasar Bharati as the viewership of government channels is not being promoted. If one compares the ratio of Doordarshan channels versus the private channels, then the viewership of the DD channels is far less,” it said in its submission.

Many pay TV channels are offered free to the subscribers of FreeDish, while for the same channels, the DPOs must charge subscription fees from their subscribers and pass on the collections to the broadcasters, which amounted to “discrimination not only to the DPOs, but also to the subscribers of a DPO’s platform”, Tata Play pointed out.

It advocated that DD FreeDish should stop carrying private TV channels and restrict itself to Doordarshan channels, which honestly educate the masses on matters of public interest.

Dwelling on TRAI-mandated capping on carriage fee charged by DPOs from TV channels, Tata Play batted for its removal, suggesting in the National Broadcast Policy forbearance for the same should be introduced for level playing field between the DPOs and the broadcasters.

“Broadcasters have been given the freedom to price their channels and collect advertising revenues without any regulatory capping and are not mandated to share their advertising revenue with the DPOs. DTH operators, which continue to invest heavily on better consumer experience, are incurring heavy losses in view of this provision,” it argued.

It also said that the entertainment tax, which presently is a State subject, has promoted uneven taxation structure and hinted that it should be brought under the GST regime to remove impediments of unevenness.

According to a news report in Business Standard last December, Tata Play became the first company to take the confidential pre-filing route for its initial public offering. It had pre-filed its draft red herring prospectus confidentially with the Securities and Exchange Board of India on November 29, the Tata group firm has disclosed via a newspaper advertisement.

There have also been some reports that the Tata group is also negotiating to buyout a minority equity stake of Singapore’s Temasek in Tata Play.

Avijit Dhar appointed VP-Marketing for Star Plus

Avijit Dhar appointed VP-Marketing for Star Plus  Akashvani bags 6 honours at India Audio Summit & Awards

Akashvani bags 6 honours at India Audio Summit & Awards  Govt tells media to desist from live coverage of defence ops

Govt tells media to desist from live coverage of defence ops  Jio Platforms net profit up 25.7% in Jan-Mar quarter

Jio Platforms net profit up 25.7% in Jan-Mar quarter  SRK, Aamir, Big B, Ted Sarandos, WPP CEO, MPA chief, other stars, to headline WAVES

SRK, Aamir, Big B, Ted Sarandos, WPP CEO, MPA chief, other stars, to headline WAVES  Spotify pays $100mn to podcasters in Q1 2025

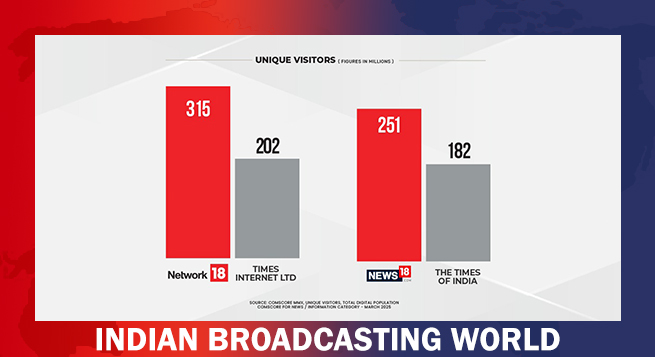

Spotify pays $100mn to podcasters in Q1 2025  News18 overtakes TOI in digital leadership

News18 overtakes TOI in digital leadership  Make in India to get fresh impetus with direct-to-mobile technology

Make in India to get fresh impetus with direct-to-mobile technology  Thermocool partners with Ajay Devgn’s ‘RAID 2’ in advertising blitz

Thermocool partners with Ajay Devgn’s ‘RAID 2’ in advertising blitz