Bharti Airtel is exploring around a $1-billion (approximately ₹8,330 crore) fundraise, including a potential offshore bonds issue, to prepay a bulk of its remaining dues relating to spectrum bought in the 2015 auction.

India’s second-largest telco is likely to engage with top global banks including Barclays and Citi later this month to decide on the preferred fundraising mode and pricing, people aware of the matter said.

Sunil Mittal-led Bharti Airtel needs to clear around ₹12,000 crore of deferred liabilities (inclusive of 10 percent annual interest) about spectrum buys in the 2015 auction, according to Economic Times.

“They (Bharti Airtel) have been intermittently making enquiries about the most cost-effective way to raise the funds and whether or not to tap the bond route…That decision hinges on whether the current environment for dollar funds is competitive enough vis-a-vis the domestic market,” a senior banker aware of the matter told ET. “In the past, sometimes they have opted for NCDs and tapped into mutual funds.”

Refinancing of high-cost spectrum debt will help Airtel save on annual interest costs, fortify its balance sheet, and boost cash flows even as it rapidly expands 5G coverage and looks to offer the next-gen mobile broadband services nationally in a few months, people aware of the matter said.

“Talks between Airtel and several foreign banks will start shortly…Both sides will try to zero in on the specific financial instrument and its pricing for the proposed offshore fundraising,” one of the people cited above said.

India ad agencies’ body warns against sharing sensitive data, info

India ad agencies’ body warns against sharing sensitive data, info  GTPL Hathway Q4 revenue at Rs. 8,989 mn signals 10% YoY growth

GTPL Hathway Q4 revenue at Rs. 8,989 mn signals 10% YoY growth  Bodhitree appoints Sudip Roy CRO; launches new revenue division

Bodhitree appoints Sudip Roy CRO; launches new revenue division  Ryan Gosling to headline ‘Star Wars: Starfighter’

Ryan Gosling to headline ‘Star Wars: Starfighter’  Jennifer Lopez to star in ‘The Last Mrs. Parrish’

Jennifer Lopez to star in ‘The Last Mrs. Parrish’  ‘Kull’ premieres May 2 on JioHotstar

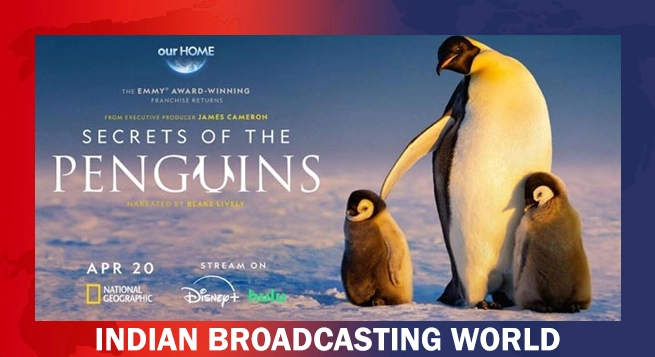

‘Kull’ premieres May 2 on JioHotstar  James Cameron, Blake Lively team up for ‘Secrets of the Penguins’

James Cameron, Blake Lively team up for ‘Secrets of the Penguins’  Ben Fogle returns to Sony BBC Earth ‘Where the Wild Men Are’S10

Ben Fogle returns to Sony BBC Earth ‘Where the Wild Men Are’S10