India’s parliamentary Standing Committee on Communications and IT, which also has the cable TV broadcast sector under its jurisdiction, discussed recently in detail the issue of GST levied on cable TV distributors and its impact, apart from other industry related matters.

According to a report in the Hindustan Times earlier this week, the 90-minute meeting saw presentations made by Meenakshi Gupta, Acting Chairperson of broadcast and telecom regulator TRAI, and representations from the All India Digital Cable Federation (AIDCF).

The financial burden on viewers imposed by being forced to subscribe to bouquets of television channels and the burden of GST on local cable operators dominated the Wednesday meeting of the parliamentary panel, the HT report stated. (https://www.hindustantimes.com/india-news/house-panel-focuses-on-gst-on-cable-operators-viewers-financial-burden-101701286245989.html)

It is understood that the members raised the issue of companies forcing channel bouquets upon viewers which increases the cost for the end user.

When an MP queried TRAI why channels could not be unbundled and why the local cable operators (LCOs) should not be allowed to offer individual channels, the regulator’s representative is understood to have explained that bundling was better as it reduced the costs for TV channels and the burden on the consumers.

Apart from some representation from the AIDCF, which is a cable industry body of MSOs, senior officials from the Ministry of Information and Broadcasting, including the secretary Apurva Chandra, also attended the meeting.

The multi-system operators (MSOs) that were present in the room, including Hathway, said that they were forced to pay GST on what the local cable operator (LCO) charged its customer. The problem arose because LCOs were usually small operators who generally did not fall within the GST’s ambit, and may have a different billing system and/or plan for different customers. Officials from MIB said any decision on GST has to be taken by the Ministry of Finance, according to the HT ereport.

India ad agencies’ body warns against sharing sensitive data, info

India ad agencies’ body warns against sharing sensitive data, info  GTPL Hathway Q4 revenue at Rs. 8,989 mn signals 10% YoY growth

GTPL Hathway Q4 revenue at Rs. 8,989 mn signals 10% YoY growth  Bodhitree appoints Sudip Roy CRO; launches new revenue division

Bodhitree appoints Sudip Roy CRO; launches new revenue division  Ryan Gosling to headline ‘Star Wars: Starfighter’

Ryan Gosling to headline ‘Star Wars: Starfighter’  Jennifer Lopez to star in ‘The Last Mrs. Parrish’

Jennifer Lopez to star in ‘The Last Mrs. Parrish’  ‘Kull’ premieres May 2 on JioHotstar

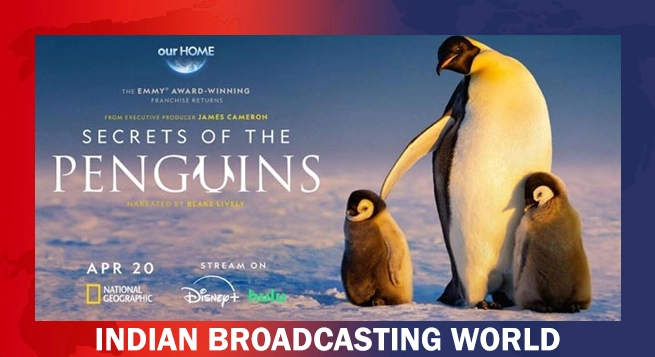

‘Kull’ premieres May 2 on JioHotstar  James Cameron, Blake Lively team up for ‘Secrets of the Penguins’

James Cameron, Blake Lively team up for ‘Secrets of the Penguins’  Ben Fogle returns to Sony BBC Earth ‘Where the Wild Men Are’S10

Ben Fogle returns to Sony BBC Earth ‘Where the Wild Men Are’S10