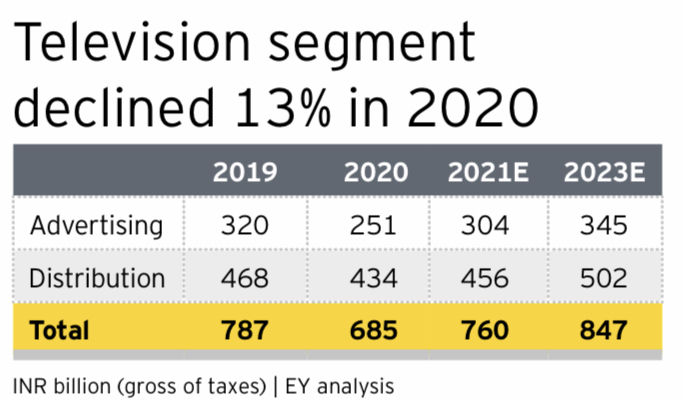

Though there was a 24 per cent decline in the growth of the Indian media and entertainment sector in 2020, some rebound towards the end has raised hopes as a new report expects television advertising in 2021 to be close to 2019 levels, growing over 20 per cent to reach INR 304 billion on the back of a lineup of fresh sports content, regional channel rate increases and continued growth of free television.

The annual Ficci-E&Y Indian M&E 2020 industry report, with the underlying theme being 2020 was the year when the sector rebooted itself, predicts that TV subscription income would grow 5% to reach INR456 billion on the back of fresh content, several marquee sports events and pending movie releases, though ARPUs may face regulatory hurdles.

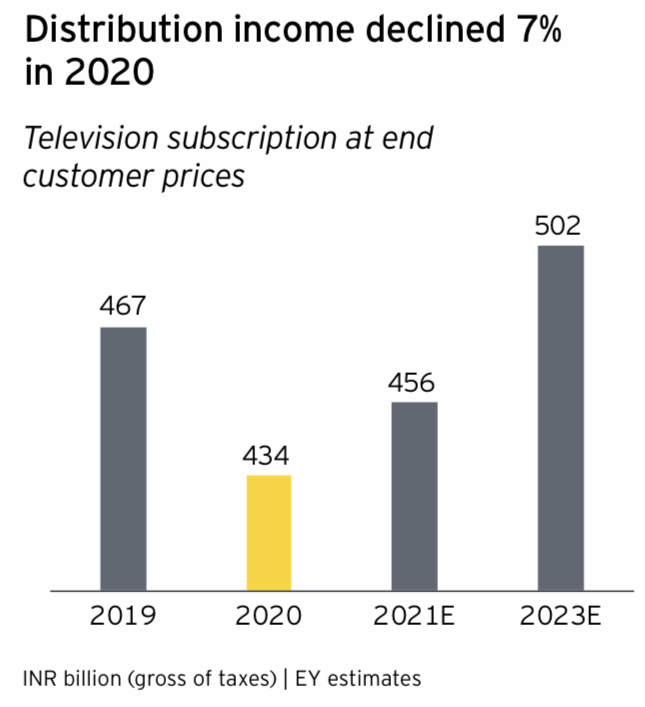

Television advertising declined by 21.5% in 2020, though ad volumes fell just 3%. Subscription de-growth of 7% was mainly due to reduction in ARPU and a reduction of two million pay TV homes.

According to the report, the Indian M&E sector fell by 24% to INR1.38 trillion (US$18.9 billion), in effect taking revenues back to 2017 levels. However. The last quarter of 2020 showed a marked improvement in revenues for most segments and the forecast is that the sector would recover 25% in 2021 to reach INR1.73 trillion (US$23.7 billion) and then to grow at a CAGR of 13.7% to reach INR2.23 trillion (US$30.6 billion) by 2023.

Some of the other 2020 trends according to the E&Y report were the following:

► While television households will continue to grow at over 5% till 2025, we expect growth to be driven by connected TVs, which could cross 40 million by 2025 and free television could cross 50 million, thereby making core television a more mass product.

► The smart television will usher in an era of connected viewing which will enable viewers to interact with each other, as well as the broadcaster, through the content.

► The importance of regional and sports programming will increase, driving up both ad rates as well as end-consumer package pricing, subject to regulatory action.

► The number of channels increased marginally between December 2019 and March 2020, but had declined by December 2020 as a result of channel shutdowns, led by the English entertainment genre.

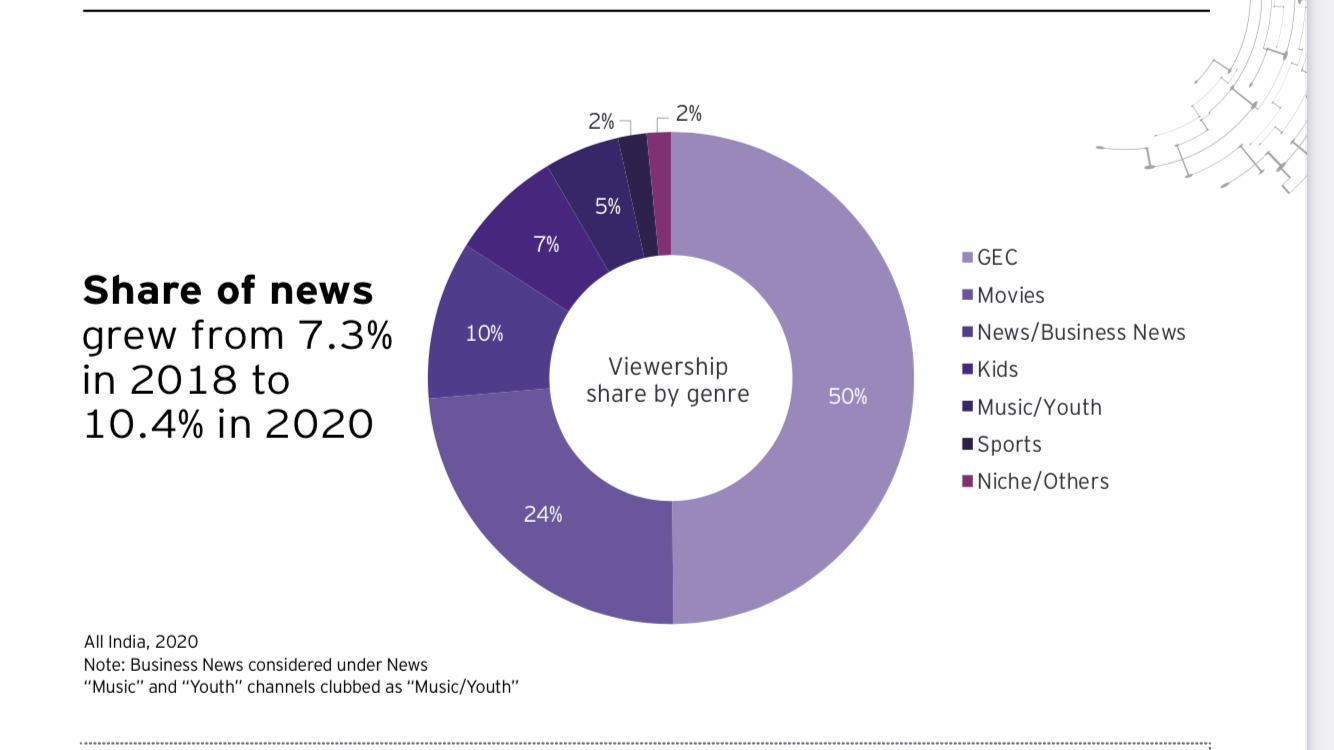

► News channels comprised 43% of total registered channels in India, up from 42% in 20191

► 64% of channels were free-to-air as compared to 63% in 2019.

► MSO registrations increased only by 4% during 2020 as compared to 11% in 2019, mainly due to the implementation of the NTO 2.0 and ongoing impact of COVID-19.

► The Indian market is serviced by four paid DTH providers and one free DTH provider as of 2020. Operating platforms include Dish + VideoconD2H+, TataSky, Airtel, Sun Direct and Doordarshan Free Dish.

► InCable continues to operate the lone HITS service.

► Due to the ongoing impact of the COVID-19 pandemic, approximately 1,200 advertisers put a complete halt on their television ad spends during the April to June quarter, while many large advertisers cut their ad spends considerably during the year

► This inevitably led to rate discounting across genres by many broadcasters, which we estimate at an average of 19% compared to the prior year. Major sport events got postponed, but IPL Season 13 provided a much-needed revival push9

► Tokyo Olympics 2020, Wimbledon, ICC Men’s T20 World Cup, Swiss Open, India Open, Orleans Masters, Malaysia Open, Singapore Open and the German Open were among the sports events which were postponed due to pandemic, along with several domestic sports leagues

► However, IPL Season 13 in 2020 surpassed the viewership of IPL Season 12 by 23% with a total of 400 billion viewing minutes as compared to 326 billion viewing minutes for the 2019 edition and generated 112 hours of commercial ad volumes.

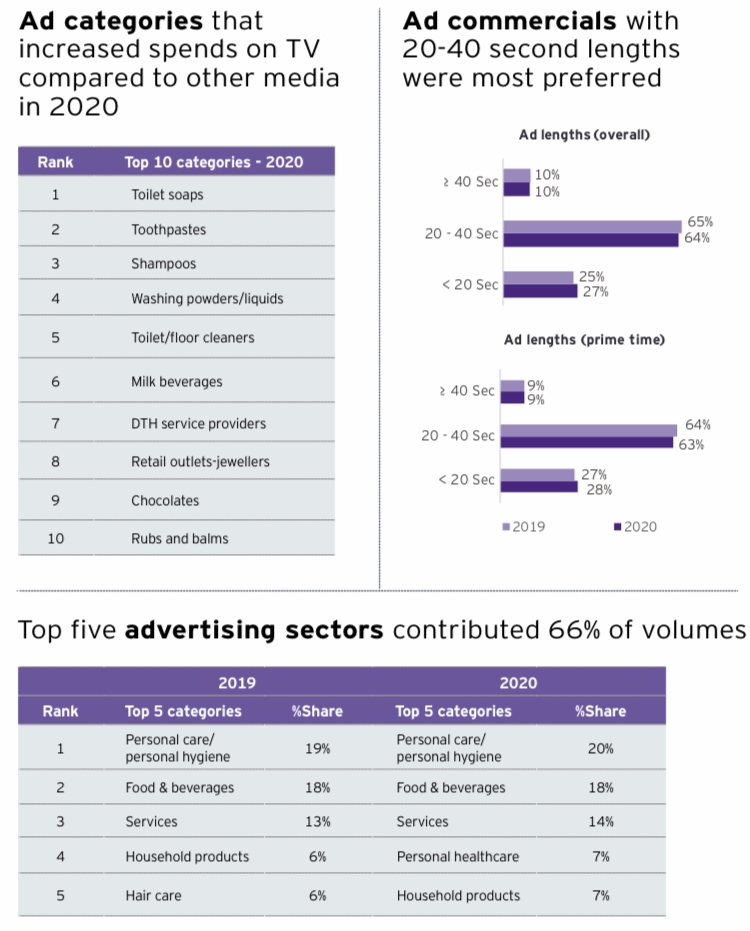

► 51% of ad spends on TV were contributed by FMCG increasing its share from 49%, though in value terms category de-grew by 9%.

► Other large contributors to decline in value growth were telecom, household durables and auto, which added to the decline at over 28% each.

► The biggest growth came from e-commerce and education sector with them growing at 95% and 193% respectively.

► The huge growth in e-commerce sector caused it to overtake telecom to become the second largest category.

The news genre led with 31% share of ad volumes followed by the GEC genre with 27% share.

► Hindi movies remained the top language genre for ad volumes and grew its share of ad volumes to 11%.

► Regional channels (666 hours/channel) received 27% more ad volumes than national channels (526 hours/channel) in 2020; in 2019 regional channels had received 13% more volumes.

► The top categories contributed 78% of ad volumes in 2020, up from 72% in 2019.

► FMCG increased its contribution to television ad volumes from 54% in 2019 to 61% in 2020 with a 9% increase in absolute volumes.

► Amongst the categories, auto reduced absolute volumes by 23% and durables by 40%. Ads continued to become shorter.

► As per TAM AdEX, 27% of ads on television in 2020 were 20 seconds or less, as compared to 25% of ads in 2019

► In prime time, sub-20 second ads were 28% in 2020 compared to 27% in 2019.

► The share of ads 40 seconds or longer remained constant at 9%.

Television subscription revenues in India decreased 7% in 2020, mainly due to a fall in ARPUs and reduction in the paid subscriber base by around two million television homes.

While 2020 was impacted by COVID-19, the report said it is expected the subscription base for traditional unidirectional television services (cable, DTH, HITS) to keep growing as penetration levels increase over the next few years.

While DTH and HITS were relatively stable in 2020, cable saw a decline of 3% compared to 2019 numbers.

The fall in paid subscriptions is attributed to metro subscribers who went back to their hometowns and subscribers who did not renew their subscriptions specially due to lack of fresh content on major GECs and live sports.

The report said it was observed 131 million paid subscriptions for which broadcasters earned revenues in 2020, as compared to 133 million we had reported in 2019.

End-customer prices declined 5% on average to reach INR226 net of taxes as compared to INR 239 in 2019.

Industry discussions indicate that over 70% subscribers had opted for DPO designed packages in the beginning of 2020 before the lockdown, but that number reduced as subscribers started to let go of channels they did not wish to watch which caused a fall in ARPUs.

DPOs implemented different strategies for customer retention – including suggesting lower cost DPO packages cheaper than the ones originally subscribed to by users.

The report also made the following forecast for the TV sector:

► Television advertising in 2021 is expected to be close to 2019 levels, growing over 20% to reach INR 304 billion on the back of a lineup of fresh sports content, regional channel rate increases and continued growth of free television.

► Subscription income would grow 5% to reach INR456 billion on the back of fresh content, several marquee sports events and pending movie releases, though ARPUs may face regulatory hurdles.

► Television segment revenues are expected to grow at a CAGR of 7% to reach INR 847 billion by 2023 driven by increased base of subscribers as households.

►Mass television will require different content.

► As top-end subscribers gravitate to smart and connected television sets and the free television audience crosses 150 million by 2025, the affluence of the average television audience will reduce.

► Consequently, it is expected content on television will adopt to become more escapist and mass in nature.

► This fact can help control the increase in average content costs for television programming, though marquee / tent-pole programs and reality shows will always have their place.

► Low-budget direct-to-television programmed as well as low cost IPs created by news channels will generate differentiation between channels.

►Regional television will drive ad rate growth.

► Companies like Zee have already started to segment the Hindi speaking market (HSM) market.

► Regional ad rates have been rising over the last two years faster than HSM and the trend is expected to continue.

► This will be driven by increase in regional content consumption on TV to 60% of total TV consumption, improved quality and higher quantity of content on regional channels.

► Pay TV will continue to grow marginally as states like UP, Bihar, Rajasthan and West Bengal get electrified.

► However, more new users will enter the free TV market as Free Dish channel count increases to around 200 by 2022 (from 120 in 2019), providing a low-cost advertising opportunity to marketers.

► Growth of unidirectional TV will be far outstripped by the growth of connected TVs, which could reach 40 to 50 million connected sets by 2025, on the back of 46 Indian cities that have a population of over a million each and a total population of 122 million that can be wired-up more easily for broadband as well as telcos partnering with LCOs to drive broadband services.

► This means that overall TV connections will keep growing at a healthy pace of over 5% per year to cross 71% of Indian households by 2025.

►End-consumer pricing will be benchmarked to OTT.

► For television subscription to grow, it would need to remain cost efficient as compared to the price of [OTT + data] packages.

► Consequently, the impact of data prices and bundling of popular OTT packages will be the benchmark against which television subscription will need to be maintained.

► The report says it expected more [linear + digital] bundled products from broadcasters and DPOs come into force in order to retain gross reach of their products.

► The move of sports programming to prime-time (through day-night matches, evening scheduling, etc.) can have an impact on GEC viewership.

► Having a sports product in the bouquet will become increasingly important for broadcasters An era of “connected consumption” will emerge.

► Connected TVs will change the way people consume content, enabling people to interact with each other from their homes while viewing content.

► Several innovations around connected TV content are expected like

live chats between viewers, live polls and contests play-along games (specially around sports) with real-time leaderboards and challenge-a-friend formats to enable community interactivity.

► Large Indian broadcasters are sitting on content libraries of over a million hours between them. Innovation around monetizing these libraries on new platforms (e.g., DD Retro on Free Dish), digital syndication, aggregator OTT platforms, etc. is likely.

► In addition, promos and short clips of current programming can be used to generate ad revenues on social media platforms

► Measurement will go wider. While the BARC product will become extremely robust due to the oversight it receives, it is expected an additional measurement system, on a non-editable blockchain-based platform with a reach crossing millions of television households, will come into existence to strengthen the current measurement system.

Kevin Vaz, Kiran Mani, Sanjog Gupta to head 3 verticals of JioStar

Kevin Vaz, Kiran Mani, Sanjog Gupta to head 3 verticals of JioStar  Govt & industry to prime gaming space for global dominance: MIB Secy Jaju

Govt & industry to prime gaming space for global dominance: MIB Secy Jaju  Netflix ad-supported tier touches 70mn MAUs globally

Netflix ad-supported tier touches 70mn MAUs globally  Minister Murugan likens IFFI to Cannes fest; ‘Better Man’ opening film

Minister Murugan likens IFFI to Cannes fest; ‘Better Man’ opening film  Ali Fazal wraps up filming for ‘Metro In Dino’

Ali Fazal wraps up filming for ‘Metro In Dino’  ‘The Fable’ wins best film at the 38th Leeds International Film Festival

‘The Fable’ wins best film at the 38th Leeds International Film Festival  Sony SAB brings back ‘Tenali Rama’ at 8 pm slot

Sony SAB brings back ‘Tenali Rama’ at 8 pm slot  Zee Telugu to premiere ‘Aay’ on November 17

Zee Telugu to premiere ‘Aay’ on November 17  Release date of Pratik Gandhi, Divyenndu-starrer ‘Agni’ announced

Release date of Pratik Gandhi, Divyenndu-starrer ‘Agni’ announced