India’s online gaming sector, currently valued at $3.1 billion, has the potential to expand to a staggering $60 billion by 2034 amid challenges surrounding regulation and taxation, stated a report by USISPF and TMT Law Practice, released yesterday.

According to an IANS report from New Delhi, the US has been a significant contributor to India’s gaming sector, with $1.7 billion of the total $2.5 billion in foreign direct investment (FDI) coming from the US alone.

“This reflects the immense confidence global investors have in India’s rapidly growing gaming market, which is projected to become a $60 billion opportunity by 2034,” said Dr Mukesh Aghi, President and CEO, United States India Strategic Partnership Forum (USISPF).

Notably, 90 percent of this FDI is in the pay-to-play segment, which also accounts for 85 per cent of the sector’s overall valuation.

However, challenges surrounding regulation and taxation persist. India stands out for its high tax rate, imposing a 28 percent Goods and Services Tax (GST) for all formats on the total deposits made by players

The report also highlighted that the United Nations Central Product Classification (UN CPC), which forms the basis for taxation in domestic jurisdictions globally, defines online gaming separately from online gambling.

“With a large consumer base of over 600 million gamers, this space is rapidly being monetized and presents a substantial export opportunity. However, for Indian companies to compete globally, we need a level playing field with progressive tax and regulatory policies that align with international standards,” said Aghi.

The report examined the regulatory frameworks and taxation policies in 12 key gaming markets. It revealed that all 12 countries have a separate legal definition for games of chance, ensuring a clear distinction from skill gaming formats.

It emphasized that adopting platform revenue or the commission collected as the tax base is crucial not only for ensuring fair taxation but also for preventing the proliferation of unregulated, untaxed illegal offshore markets that could undermine both industry viability and government revenue.

“A more nuanced regulatory and taxation regime, similar to those adopted in global markets, would not only provide clarity but also foster sustainable growth in the online gaming sector,” said Abhishek Malhotra, partner at TMT Law Practice.

Delhi HC orders meta to remove deepfake videos of Rajat Sharma

Delhi HC orders meta to remove deepfake videos of Rajat Sharma  Govt. blocked 18 OTT platforms for obscene content in 2024

Govt. blocked 18 OTT platforms for obscene content in 2024  Broadcasting industry resists inclusion under Telecom Act

Broadcasting industry resists inclusion under Telecom Act  DTH viewing going down & a hybrid ecosystem evolving: Dish TV CEO

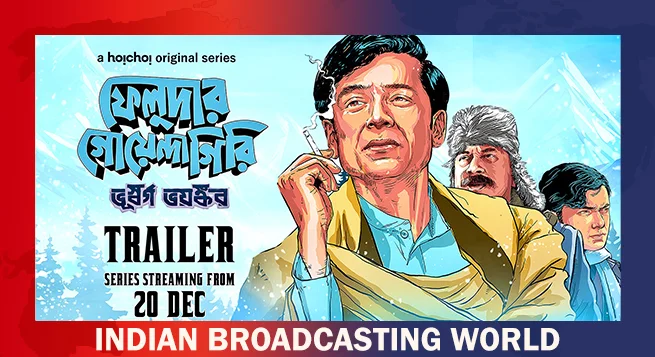

DTH viewing going down & a hybrid ecosystem evolving: Dish TV CEO  New adventure of detective Feluda debuts on Hoichoi Dec. 20

New adventure of detective Feluda debuts on Hoichoi Dec. 20  ‘Pushpa 2’ breaks records as most watched film of 2024: BookMyShow Report

‘Pushpa 2’ breaks records as most watched film of 2024: BookMyShow Report  Hungama OTT unveils ‘Pyramid’

Hungama OTT unveils ‘Pyramid’  Amazon MX Player to premiere ‘Party Till I Die’ on Dec 24

Amazon MX Player to premiere ‘Party Till I Die’ on Dec 24  aha Tamil launches ‘aha Find’ initiative with ‘Bioscope’

aha Tamil launches ‘aha Find’ initiative with ‘Bioscope’  Netflix India to stream WWE content starting April 2025

Netflix India to stream WWE content starting April 2025