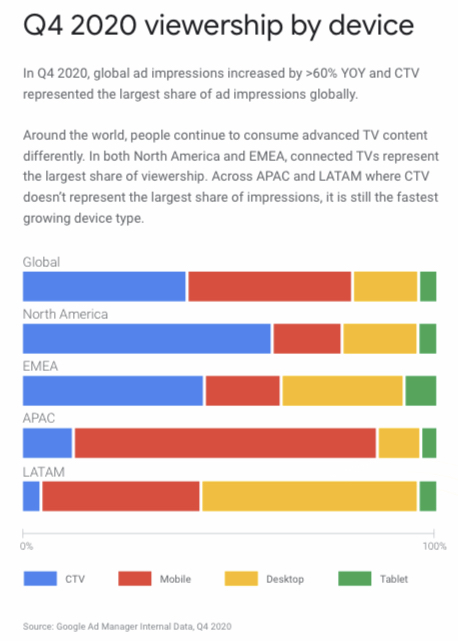

In 2020, more ads continued to be viewed on connected TVs (CTVs) than any other device globally, but the environments where people were watching are changing, according to a new Google study.

For example, in-app impressions showed significant gains in 2020 as more people moved towards over-the-top (OTT) streaming apps and adopted CTV devices.

Last year obviously impacted live events, but as live sports began to return, advanced TV served fans who couldn’t be there in person. Live impressions grew much faster than VOD in 2020, and viewers who live-streamed the content at home preferred to watch the action on the big CTV screen.

Advanced TV viewership, or the usage of digital technology to watch TV content, continues to accelerate with new direct-to-consumer apps and free ad-supported TV services, Peentoo Patel, Group Product Manager, Google Ad Manager, wrote on the company’s website yesterday while giving glimpses of the second annual Google Ad Manager advanced TV inventory report.

Although VOD represents the majority of TV ad impressions seen on digital devices (55%), live content viewership is growing. In Q4, ad impressions served to live audiences increased by 85% globally year-on-year.

“We saw the scale of live events increase significantly compared to previous years. 2020 saw 700% growth in the number of hours that our servers supported more than 1 million concurrent live viewers across all our TV partners. In Q4, 45% of ads served in live content were seen via CTV, suggesting that people prefer to live stream from their living rooms,” Patel wrote.

Conversely, 40% of ad impressions in VOD content were watched on mobile devices and Google promised to keep an eye on this trend to learn whether — and how quickly — CTV (35% of VOD ad impressions) catches up with mobile globally.

Google Ad Manager report is done help partners gain insight into how 2020 impacted advanced TV monetization trends as data can help partners understand how viewers were watching advanced TV content, what opportunities exist to monetize this content, and where to focus strategies to grow revenue.

To uncover these insights, 35 global advanced TV partners, who use Google Ad Manager, were analysed. This year’s report focuses on 2020 and is a bit different from the 2019 report. This time round the focus was on advanced TV partners who have long-form and episodic commercial break inventory to ensure Google only analyzed TV-like content. The report looks at both live and on-demand video (VOD) content, and data from 2019 through 2020 for year-over-year insights.

The report’s sections tell a story of how last year’s conditions drove transitions that point toward the industry’s future, Patel said.

COVID-19 recovery:In Q2 at the height of the downturn, advertisers pulled back from most channels, including advanced TV. However, Google found that one device type’s ad impressions grew even during the depths of Q2— CTV remained resilient as viewers streamed more content during this time.

Similarly, programmatic was also paramount in Q2, declining much less than traditional reservations as it offered both publishers and advertisers increased flexibility.

Transaction trends: Traditional reservations still led in 2020, but programmatic transactions grew faster, as advanced TV partners leaped at the opportunity to grow demand, improve efficiency and diversify their demand sources.

Live-streaming performance:When the pandemic first hit, all live events froze. But as live sports started returning around midyear, advanced TV was there to serve fans who couldn’t attend in person, and live impressions grew much faster than VOD, mostly on those big CTV screens.

For the first time ever, in-app viewership outperformed the web as consumers adopted new emerging OTT apps and CTV devices to watch content. While traditional reservations still lead advanced TV inventory sales, programmatic is advanced TV’s fastest growing deal type. And while live events decreased in 2020, they were on the upswing again by Q4, the Google report stated.

Jio, Airtel, Vi witness subs losses in Sept: TRAI data

Jio, Airtel, Vi witness subs losses in Sept: TRAI data  Expanded Creative Minds of Tomorrow edition inaugurated at IFFI

Expanded Creative Minds of Tomorrow edition inaugurated at IFFI  ZEEL’s Punit Goenka steps down as MD, retains role as CEO

ZEEL’s Punit Goenka steps down as MD, retains role as CEO  Kevin Vaz, Kiran Mani, Sanjog Gupta to head 3 verticals of JioStar

Kevin Vaz, Kiran Mani, Sanjog Gupta to head 3 verticals of JioStar  WBD elevates Deepa Sridhar to Senior Director – Corporate Communications, South Asia

WBD elevates Deepa Sridhar to Senior Director – Corporate Communications, South Asia  ‘Bhagam Bhag 2’ returns after 18 years

‘Bhagam Bhag 2’ returns after 18 years  Babil Khan’s ‘Log Out’ to premiere at Argentina’s Mar del Plata International Film Festival

Babil Khan’s ‘Log Out’ to premiere at Argentina’s Mar del Plata International Film Festival  Tips Music presents ‘Love Garage’

Tips Music presents ‘Love Garage’  Fox, Hulu ink $1.5bn streaming content partnership

Fox, Hulu ink $1.5bn streaming content partnership