India’s Bharti Airtel reported third-quarter profit below estimates yesterday, as flat tariffs and higher expenses outweighed a growth in subscribers.

The telecom operator reported a consolidated net profit of Rs. 24.42 billion ($294 million) for the quarter ended December 31, compared to analysts’ estimate of Rs. 28.69 billion as per LSEG data, a Reuters report said.

Airtel and rival Reliance Jio Infocomm are racing to capture a bigger share of India’s telecom market, with billions of dollars of investments to expand 4G and 5G services.

Jio’s market share stands at 39.49 percent as of November 30 and Airtel has a 32.91 percent share, while Vodafone Idea trails with 19.44 percent, according to the Telecom Regulatory Authority of India.

Airtel’s 4G/5G subscriber base rose to 244.9 million users, up 13 percent from a year ago and 3.1 percent from last quarter.

Average revenue per user (ARPU), a key financial metric where Airtel leads its rivals by a wide margin, rose to Rs. 208 rupees from Rs. 193 a year ago and 203 in the last quarter.

Analysts had estimated ARPU in the range of Rs. 205-208. Airtel, however, did not raise tariffs – a trend it has followed since 2021, but which analysts expect will end in mid-2024 after India’s general elections.

Revenue rose 5.9 percent to Rs. 379 billion, below analysts’ estimate of Rs. 381.30 billion. Expenses climbed 4.2 percent to Rs.180.85 billion on higher spectrum charges, marketing and network operations. Its tax expenses also rose nearly 15 percent.

Airtel also reported a one-time charge of Rs. 1.30 billion, attributing it to a foreign exchange loss due to currency devaluation.

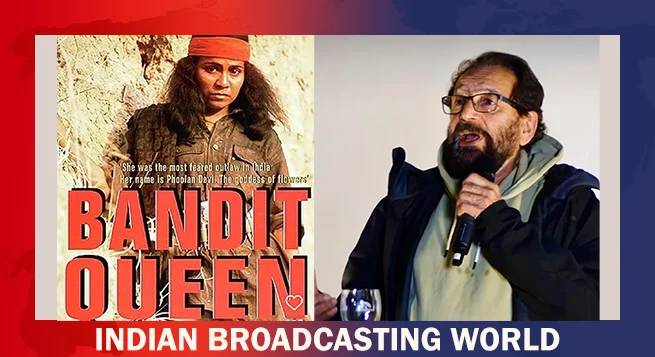

Amazon says no edits made on ‘Bandit Queen’ version available

Amazon says no edits made on ‘Bandit Queen’ version available  Parliamentary panel recommends unified media council

Parliamentary panel recommends unified media council  SATCAB Symposium 2025: Industry experts debate future of distribution, AI & CTV revolution

SATCAB Symposium 2025: Industry experts debate future of distribution, AI & CTV revolution  Symphony of spirituality & science with Sri Sri on ‘Duologue’

Symphony of spirituality & science with Sri Sri on ‘Duologue’  NDTV YUVA meet returns today for 6th edition

NDTV YUVA meet returns today for 6th edition  Zupee new campaign turns IPL sixes into winning moments

Zupee new campaign turns IPL sixes into winning moments  ‘Hunterrr’ returns to theatres on April 4

‘Hunterrr’ returns to theatres on April 4  ‘Battleground’ to have April premiere on Amazon MX Player

‘Battleground’ to have April premiere on Amazon MX Player  ‘Chhorii 2’ to premiere on Prime Video April 11

‘Chhorii 2’ to premiere on Prime Video April 11