India’s Bharti Airtel yesterday reported a steep drop in second-quarter profit, hurt by a one-time charge, but its revenue rose as it added more 4G and 5G subscribers.

Consolidated net profit fell to Rs. 13.41 billion ($161.1 million) for the quarter ended September 30, from Rs. 21.45 billion a year ago, a Reuters report from Bengaluru stated.

The latest quarter’s results included a one-time charge of Rs. 13.50 billion as interest payable on an additional tax provision amount related to a Supreme Court ruling on variable license fees.

It also included a Rs. 2.20 billion charge related to re-assessment of regulatory levies.

Airtel and rival Reliance Jio Infocomm, India’s top two telecom operators, have been racing to capture a bigger market share with investments worth billions of dollars on network infrastructure to expand 5G services in urban areas and 4G coverage in the rural areas.

Airtel said it added 7.7 million 4G and 5G data customers in the quarter. Its total 5G subscriber count stood above 50 million, compared to Jio’s over 70 million, the Reuters report said.

Its revenue from operations rose 7.3 percent to Rs. 370.44 billion, while expenses climbed 3.5 percent, led by higher network operating and marketing expenses.

Last week, Jio reported its slowest profit growth in seven quarters, while Vodafone Idea posted a wider loss as its subscriber base continued to shrink.

The company’s average revenue per user (ARPU), a key performance metric for telecom firms, rose 6.8 percent year-on-year to Rs. 203, but was up only marginally from last quarter.

Meanwhile, the official media statement from Bharti Airtel on its quarterly results, reviewed by Indianbroadcastingworld.com, highlighted that the company’s media business continues to grow.

“Digital TV continues to consolidate its strong market position with 15.7 mn. customer base at the end of quarter. Company’s focus on market specific strategy coupled with simplified pricing and convergence portfolio ensured that the business continues to hold its market share,” Bharti Airtel said.

It elaborated that it has been scaling digital capabilities to deliver best-in-class experience and offering differentiated digital services to customers. There were more than 210 Mn MAUs (monthly active users) across its key digital assets —Thanks, Xstream and Wynk, Airtel added.

In a statement, Bharti Airtel MD Gopal Vittal said: “This has been yet another quarter of solid revenue growths and improved margins. Our India revenue continues to gain momentum and grew sequentially by 2.4 percent. Our consolidated revenue, however, was impacted by the devaluation of the Nigerian Naira.

“Consolidated EBITDA margins expanded to 53.1 percent supported by a strong war on Waste program. We added 7.7 million 4G/5G net adds and exited the quarter with an industry leading ARPU of (Rs.) 203. Our Postpaid and Homes businesses continued their strong growth trajectory as we added the highest ever net adds in both these segments in any single quarter. Our performance is underpinned by a simple and consistent strategy of focusing on quality customers and delivering the best experience to them in a seamless digital way.”

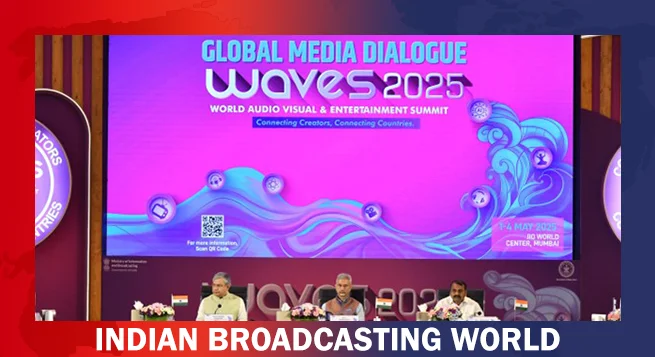

MIB to unveil M&E sector statistical handbook today at WAVES

MIB to unveil M&E sector statistical handbook today at WAVES  WAVES 2025: Media dialogue backs creativity, heritage & ethics in AI Era

WAVES 2025: Media dialogue backs creativity, heritage & ethics in AI Era  Pay TV leaders chart course for India’s linear TV in digital age

Pay TV leaders chart course for India’s linear TV in digital age  Sudhir Chaudhary announces new show for DD News, says “Good content still has a place” at WAVES 2025

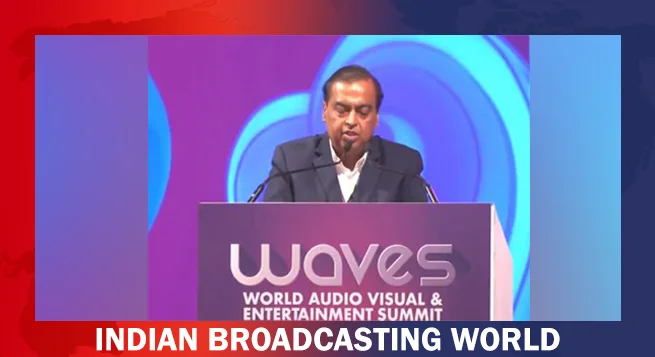

Sudhir Chaudhary announces new show for DD News, says “Good content still has a place” at WAVES 2025  India can lead global entertainment revolution: Mukesh Ambani

India can lead global entertainment revolution: Mukesh Ambani  TRAI chief not in favour of separate rules for OTT, legacy b’casters

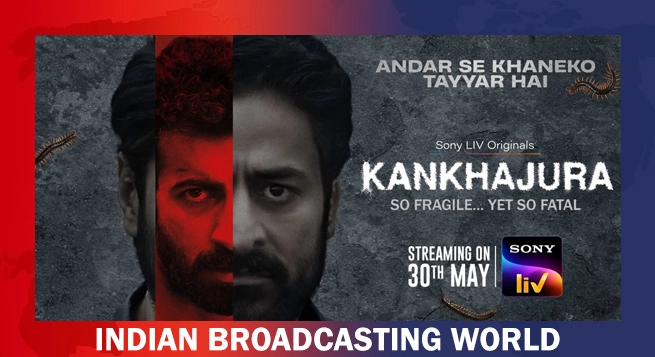

TRAI chief not in favour of separate rules for OTT, legacy b’casters  ‘KanKhajura’ start streaming on Sony LIV from May 30

‘KanKhajura’ start streaming on Sony LIV from May 30  Koyal.AI debuts at WAVES 2025, set to revolutionise music videos with GenAI

Koyal.AI debuts at WAVES 2025, set to revolutionise music videos with GenAI  Zee Cinema to premiere ‘Pushpa 2: The Rule’ on May 31

Zee Cinema to premiere ‘Pushpa 2: The Rule’ on May 31  ‘Create in India Challenge’ S1 honours global talent at WAVES

‘Create in India Challenge’ S1 honours global talent at WAVES  Amazon MX Player adds 20+ dubbed international titles

Amazon MX Player adds 20+ dubbed international titles