Amazon.com Inc on August 3 reported sales growth and profit that beat Wall Street’s expectations as the company delivered goods faster and more cheaply to shoppers, while recent cloud-computing headwinds began to subside.

Facing an array of challenges, the company has aimed to keep its mantle as the world’s biggest cloud provider and online retailer, a Reuters report stated.

Amazon recently answered AI front-runners Google and Microsoft with rival services of its own, drawing thousands of customers and touting the breadth of technology it has on offer, similar to what is powering the human-like chatbot ChatGPT.

In retail, Amazon has reorganized its fulfillment network and opened warehouses for same-day shipping closer to big metro areas, saving time and costs on delivery.

Brian Olsavsky, Amazon’s chief financial officer, said on a call with reporters that faster speeds have meant Prime loyalty customers are “shopping more often”.

For the second quarter, Amazon’s revenue grew 11 percent to $134.4 billion, beating estimates of $131.5 billion from analysts polled by Refinitiv.

Amazon’s cloud-computing division has been key. In recent months, Amazon Web Services (AWS) saw its sales growth slow as wary businesses scrutinized their cloud bills. Olsavsky said such “cost optimization” continued, but big companies were embracing the cloud anew, a lift to the division this spring and summer.

CEO Andy Jassy said in a statement, “Our AWS growth stabilized.”

The unit beat estimates of around $21.7 billion in second-quarter cloud sales, increasing them 12 percent to $22.1 billion. Its rivals posted bigger jumps off smaller bases: 28 percent growth in Alphabet’s June-quarter cloud revenue and a 26 percent quarterly increase for Microsoft’s Azure.

Jassy said AWS’s spending on the technology represented a “significant” amount of the more than $50 billion in capital investments Amazon projected for 2023. Such investments, offset by lower fulfillment expenditures, are down from $59 billion in 2022.

The company forecast current-quarter net sales in the range of $138 billion to $143 billion. Analysts polled by Refinitiv were expecting revenue of $138.25 billion.

Longer-term, Amazon aims to turn one unit, its $35 billion in yearly gross business-to-business e-commerce sales, into $100 billion, Jassy told analysts.

Amazon has sought cost cuts all, with 27,000 people affected by layoffs, or what had been nine percent of its roughly 300,000-person staff. It recently revealed more reductions at Amazon Fresh stores while searching for months for the right grocery strategy.

The company reported a quarterly profit of $6.7 billion, nearly double what analysts expected.

NBF issues advisory to member news channels on Pak guests

NBF issues advisory to member news channels on Pak guests  WAVES 1st edition right mix of M&E reality-check, biz, glamour

WAVES 1st edition right mix of M&E reality-check, biz, glamour  Uday Shankar upbeat on Indian M&E sector; stresses on need for local focus

Uday Shankar upbeat on Indian M&E sector; stresses on need for local focus  Sudhir Chaudhary announces new show for DD News, says “Good content still has a place” at WAVES 2025

Sudhir Chaudhary announces new show for DD News, says “Good content still has a place” at WAVES 2025  Indian creators aim for global impact, say streaming is redefining storytelling

Indian creators aim for global impact, say streaming is redefining storytelling  Ashish Chanchlani unveils poster for ‘Ekaki’

Ashish Chanchlani unveils poster for ‘Ekaki’  ‘Panchayat’ S4 teaser hints at fierce election showdown

‘Panchayat’ S4 teaser hints at fierce election showdown  Network18 surges ahead of Times Internet

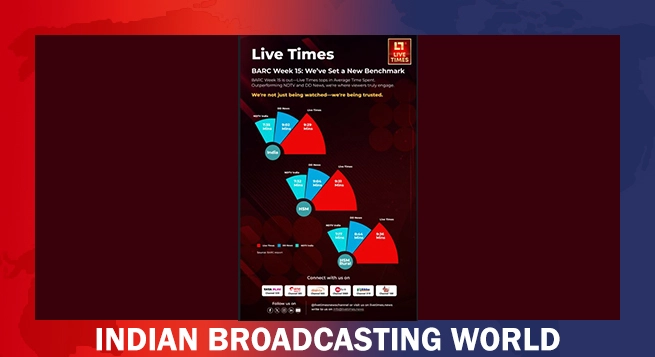

Network18 surges ahead of Times Internet  Live Times tops NDTV, DD News in viewer engagement

Live Times tops NDTV, DD News in viewer engagement