Apple Inc.’s market value hovered just shy of the $3 trillion mark on Monday, following a stunning run in company’s shares over the past decade that was underpinned by top-selling product launches and a fast-growing services business.

The stock needs to reach $182.86 to record $3 trillion in market value. It rose about 11 percent last week, extending gains for the year as investors remain confident that consumers will continue to shell out top dollar for iPhones, MacBooks and services such as Apple TV and Apple Music, Reuters reported.

The iPhone maker’s march from $2 trillion to near $3 trillion in market value took just 16 months, as it led a group of megacap tech companies that benefited from people and businesses relying heavily on technology during the pandemic.

In comparison, Apple’s move to $2 trillion from $1 trillion took two years.

Eclipsing the milestone would add another feather in the cap for Chief Executive Tim Cook, who took over after Steve Jobs resigned in 2011 and oversaw the company’s expansion into new products and markets.

“Tim Cook has done an amazing job over the past decade, taking Apple’s share price up over 1,400 percent,” OANDA analyst Edward Moya said.

Apple shares have returned 22 percent per year since the 1990s, while the S&P 500 has returned less than 9 percent annually in the same period.

If Apple hits the $3 trillion milestone, Microsoft Corp will be the only company in the $2 trillion club, while Alphabet, Amazon and Tesla have crossed $1 trillion.

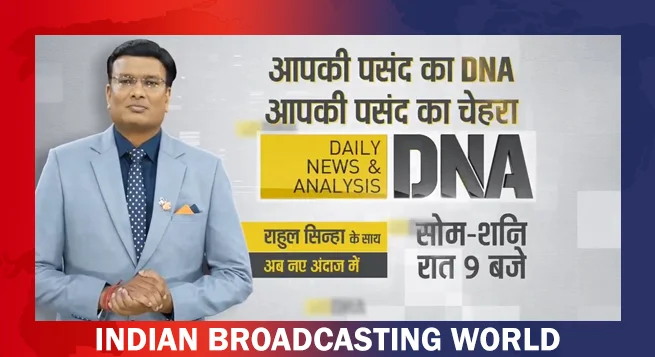

Rahul Sinha takes charge of Zee News’ DNA

Rahul Sinha takes charge of Zee News’ DNA  JioStar vice-chair Uday Shankar on surge in streaming subs, trade tariff challenges

JioStar vice-chair Uday Shankar on surge in streaming subs, trade tariff challenges  AIDCF team discusses industry issues with Vaishnaw

AIDCF team discusses industry issues with Vaishnaw  PM Modi: WAVES will empower Indian content creators go global

PM Modi: WAVES will empower Indian content creators go global  Spotify launches Ad Exchange, generative AI ads in India

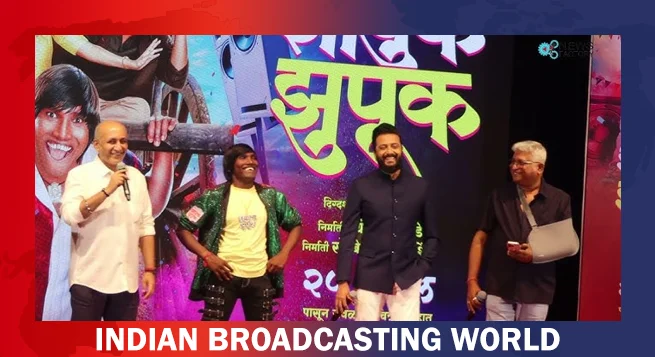

Spotify launches Ad Exchange, generative AI ads in India  Riteish Deshmukh unveils trailer of ‘ Zapuk Zupuk’

Riteish Deshmukh unveils trailer of ‘ Zapuk Zupuk’  John Malone to step down from WBD board

John Malone to step down from WBD board  ‘Khudaya Ishq’ song from ‘Abir Gulal’ released today

‘Khudaya Ishq’ song from ‘Abir Gulal’ released today  Milind Mehta unveils ‘Andar Kya Hai?’ a bold new series

Milind Mehta unveils ‘Andar Kya Hai?’ a bold new series