Wall Street expects Alphabet Inc. and Facebook Inc. to report a surge in digital ad sales this week after smaller rivals showed soaring demand, bolstering expectations that the impact of Apple Inc.’s privacy changes has not yet been felt.

Together, Google and Facebook generated about $70 billion in revenue through digital ads in the first quarter, a business that faced initial hits from the COVID-19 pandemic but which analysts said is now looking robust.

Upbeat second-quarter results from Snap and Twitter have been seen as positive indicators for the larger players due to report this week.

“The market is just too strong for Facebook to not have a good quarter,” Reuters quoted Ygal Arounian, a research analyst at Wedbush Securities, as saying.

Evercore ISI analyst Mark Mahaney said Google’s exposure to travel and small businesses such as physical stores would boost ad revenue both as re-opening continues and the online shopping trends that boomed during COVID are maintained.

The Context:Apple’s privacy changes to its iOS operating software earlier this year, to ask users of each app for permission to track their activity, has raised concerns in the $100 billion mobile advertising market because opt-outs could restrict advertisers from accessing valuable data for targeting ads. Facebook has voiced loud opposition to the change.

However, analysts said the impact of the update, which was only rolled out in late April, on overall ad spend across Google and Facebook is unclear and should not have a major impact on this week’s results.

Brokerage firm Evercore ISI said data shows over 70 percent of iOS devices were using the most recent version of iOS as of late June. Of those, fewer than 33 percent of users have opted to allow tracking.

Analysts and ad buyers also pointed out that the “walled gardens” of Facebook and Google, which are already rich in first-party data, could benefit from the privacy changes.

Simon Poulton, vice president of digital intelligence at WPromote, a digital marketing agency, highlighted Facebook’s moves to increase commerce on its own platforms: “Those are powerful things to be doing, because that’s the ultimate place they want to play,” he said.

“The less they have to rely on external eco-systems, the easier it is for them to showcase the actual value driven by the platform,” he added.

GTPL Hathway Q4 revenue at Rs. 8,989 mn signals 10% YoY growth

GTPL Hathway Q4 revenue at Rs. 8,989 mn signals 10% YoY growth  Bodhitree appoints Sudip Roy CRO; launches new revenue division

Bodhitree appoints Sudip Roy CRO; launches new revenue division  SonyLIV drops ‘Black, White & Gray-Love Kills’ trailer

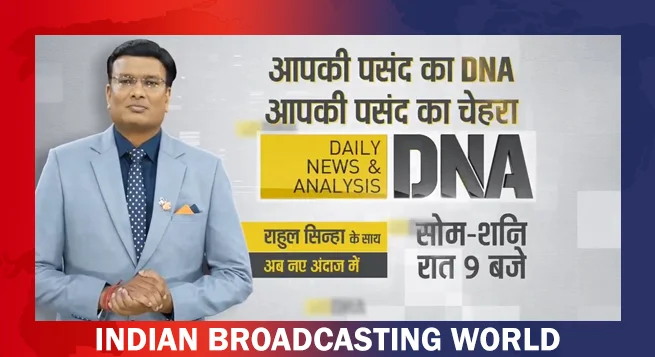

SonyLIV drops ‘Black, White & Gray-Love Kills’ trailer  Rahul Sinha takes charge of Zee News’ DNA

Rahul Sinha takes charge of Zee News’ DNA  Sushant Mohan joins IndiaDotcom as Chief Editor, biz manager

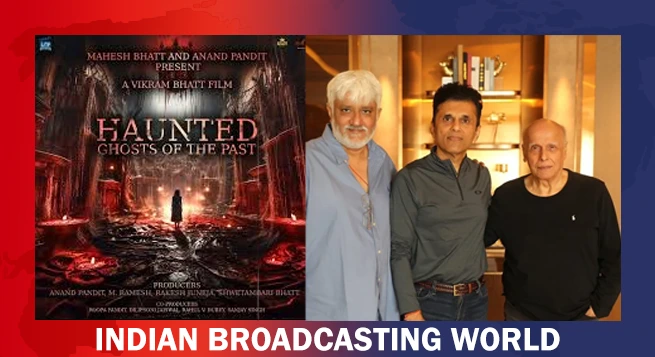

Sushant Mohan joins IndiaDotcom as Chief Editor, biz manager  Mahesh & Vikram Bhatt, Anand Pandit reunite to revive 3D horror

Mahesh & Vikram Bhatt, Anand Pandit reunite to revive 3D horror  Ananya Panday becomes CHANEL’s Indian brand ambassador

Ananya Panday becomes CHANEL’s Indian brand ambassador  Ananta ties up with Kuku TV for micro-dramas

Ananta ties up with Kuku TV for micro-dramas