Newly renamed Meta is investing heavily in its futuristic “metaverse” project, but for now, relies on advertising revenue for nearly all its income. So when it posted sharply higher costs but gave a weak revenue forecast late Wednesday, investors got spooked — and knocked almost $200 billion off the valuation of the company formerly known as Facebook.

The metaverse is sort of the internet brought to life, or at least rendered in 3D. Meta CEO Mark Zuckerberg has described it as a “virtual environment” in which you can immerse yourself instead of just staring at a screen. Theoretically, the metaverse would be a place where people can meet, work and play using virtual reality headsets, augmented reality glasses, smartphone apps or other devices.

But building it is not likely to be cheap as AP and Reuters reported on how weak revenue forecasts wiped off billions of dollars in market value.

Meta invested more than $10 billion in its Reality Labs segment, which includes its virtual reality headsets and augmented reality technology, in 2021, contributing to the quarter’s profit decline. It expanded its workforce by 23 percent, ending the year with 71,970 employees, mostly in technical roles.

The company also said revenue in the current quarter is likely to come in below market expectations, due in part to growing competition from TikTok and other rival platforms vying for people’s attention.

Sheryl Sandberg, Meta’s chief operating officer, said in a conference call with analysts that global supply chain issues, labor shortages and earlier-than-usual holiday spending by advertisers put pressure on the company’s advertising sales.

Another problem: Recent privacy changes by Apple make it harder for companies like Meta to track people for advertising purposes, which also puts pressure on the company’s revenue.

For months now, Meta has been warning investors that its revenue can’t continue to grow at the breakneck pace they are accustomed to.

“It is time for a reality check on Meta’s position for the metaverse,” said Raj Shah, an analyst at the digital consulting firm Publicis Sapient, “The metaverse is a long way from being profitable or filling the gap in ad revenue after Apple’s policy change.”

People’s changing online behavior is also limiting Meta’s money-making abilities. More people are watching video, such as Instagram’s Reels (a TikTok clone), and this makes less money than more established features.

The Menlo Park, California, based company said it earned $10.29 billion, or $3.67 per share, in the final three months of 2021. That’s down 8 percent from $11.22 billion, or $3.88 per share, in the same period a year earlier. Revenue rose to 20 percent to $33.67 billion.

Analysts, on average, were expecting earnings of $3.85 per share on revenue of $33.36 billion, according to a poll by FactSet.

Meta Platforms Inc. took on its new name last fall to emphasize Zuckerberg’s new focus on the metaverse. Since then, the company has been shifting resources and hiring engineers — including from competitors like Apple and Google — who can help realize his vision.

Zuckerberg is betting that the metaverse will be the next generation of the internet. For now, though, the metaverse exists only as an amorphous idea envisioned — and named — by the science fiction author Neal Stephenson three decades ago.

Meta said it expects revenue between $27 billion and $29 billion for the current quarter, below the $30.2 billion analysts are forecasting.

The after-hours slump in Meta shares vaporized $200 billion worth of its market value, and peers Twitter Inc., Snap Inc. and Pinterest Inc. saw $15 billion in lost value.

“People may have enjoyed a false sense of security following Alphabet’s/Google’s very healthy and strong Q4 results,” said Scott Kessler of Third Bridge. Apple’s change to its operations system in the middle of last year, said, would hit much of the mobile advertising world in 2022.

Apple allowed users to block some tracking of their internet use, which has made it harder for brands to target and measure their ads on Facebook and Instagram, which is also owned by Meta.

Meta CFO David Wehner said on a conference call with analysts that the impact from Apple’s privacy changes could be “in the order of $10 billion” for 2022.

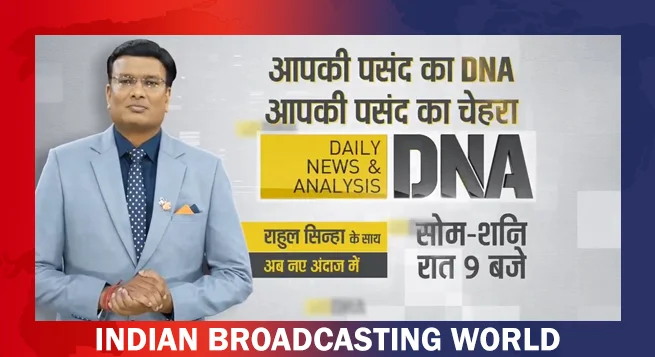

Rahul Sinha takes charge of Zee News’ DNA

Rahul Sinha takes charge of Zee News’ DNA  JioStar vice-chair Uday Shankar on surge in streaming subs, trade tariff challenges

JioStar vice-chair Uday Shankar on surge in streaming subs, trade tariff challenges  AIDCF team discusses industry issues with Vaishnaw

AIDCF team discusses industry issues with Vaishnaw  PM Modi: WAVES will empower Indian content creators go global

PM Modi: WAVES will empower Indian content creators go global  Sunrise Spices, Hoichoi celebrate Bengal’s essence with ‘Swadkahon’ cultural showcase

Sunrise Spices, Hoichoi celebrate Bengal’s essence with ‘Swadkahon’ cultural showcase  Spotify launches Ad Exchange, generative AI ads in India

Spotify launches Ad Exchange, generative AI ads in India  Riteish Deshmukh unveils trailer of ‘ Zapuk Zupuk’

Riteish Deshmukh unveils trailer of ‘ Zapuk Zupuk’  John Malone to step down from WBD board

John Malone to step down from WBD board  ‘Khudaya Ishq’ song from ‘Abir Gulal’ released today

‘Khudaya Ishq’ song from ‘Abir Gulal’ released today