AT&T, owner of HBO and Warner Bros studios, and Discovery, home to lifestyle TV networks such as HGTV and TLC, said on Monday they will combine their content assets to create a standalone global entertainment and media business.

Discovery Chief Executive David Zaslav will lead the proposed new company, which will span one of Hollywood’s most powerful studios, including the Harry Potter and Batman franchises, news network CNN, Cartoon Network, sports programming and Discovery’s unscripted home, cooking and nature and science shows, Reuters reported.

How the merger will impact Indian operations of the two companies is still not clear as these are early days and the deal is expected to formally close some time in the middle of 2022. Disney took almost a year to assimilate within itself Star Network in Asia that it bought from Rupert Murdoch as part of a global deal.

The new company will be 71 per cent owned by AT&T shareholders and 29 per cent by Discovery investors.

AT&T said it will use the $43 billion proceeds from the tax-free spin off of its media assets to pay down its more than $160 billion of debt.

The name of the new company will be disclosed by next week, while other details, including the future role of WarnerMedia CEO Jason Kilar and how the combined properties and services will be arranged have yet to be worked out, executives said on a call with reporters after the deal was announced, the Reuters dispatch said.

Monday’s move marks the unwinding of AT&T’s $108.7 billion acquisition of U.S. media conglomerate Time Warner in 2018, and underscores its recognition that TV viewership has moved to streaming, where scale is required to take on the likes of Netflix Inc and Walt Disney Co.

“The opportunities in direct to consumer streaming are rapidly evolving, and to keep pace and maintain a leadership position, several things are required — global scale, access to capital, a broad array of high-quality content and industry best talent,” AT&T Chief Executive John Stankey told a news briefing.

The combined company will spend about $20 billion on content, more than Netflix’s $17 billion it will spend this year. Zaslav said he expected the company to increase its programming investment in the future.

“While further details have yet to emerge, the proposed horizontal combination would create a global content behemoth uniting Warner Media’s premier news and entertainment assets with Discovery’s industry-leading cache of non-scripted programming networks,” Keith Snyder at CFRA Research said.

The deal is not surprising, Snyder added, after pressure on traditional pay TV ramped up during the coronavirus pandemic as consumers binge-watched streaming shows while stuck at home.

With Time Warner, AT&T’s former Chief Executive Randall Stephenson sought to create a media and telecoms powerhouse, combining content and distribution. The deal was challenged by former U.S. President Donald Trump’s antitrust regulators, but won court approval in June 2018.

Yet it proved a costly strategy as AT&T simultaneously sought to expand next generation wireless services, most recently borrowing $14 billion to buy more spectrum.

AT&T is not the first telecoms company to shed its media assets. On May 3, Verizon Communications Inc announced plans to get rid of its media businesses that include iconic brands Yahoo and AOL for $5 billion, ending an expensive and unsuccessful run in the media and advertising world.

AT&T and Discovery’s new company is projected to have 2023 revenue of about $52 billion and adjusted EBITDA of about $14 billion as well as $3 billion in expected annual cost synergies.

The deal is anticipated to close in mid-2022, pending green-lighting by Discovery shareholders and regulatory approvals.

The new company is expected to see $3 billion in cost synergies and has no plans to sell any assets.

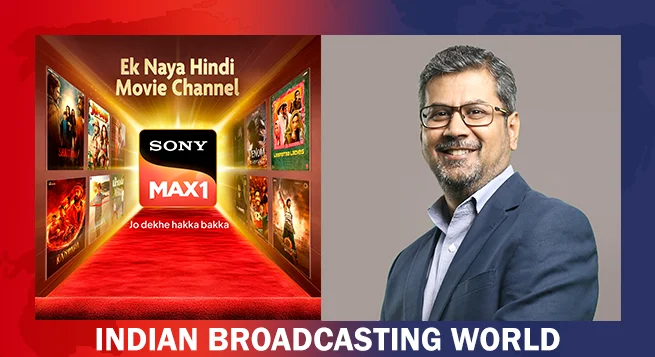

Sony MAX 1 set to launch on May 1

Sony MAX 1 set to launch on May 1  Avijit Dhar appointed VP-Marketing for Star Plus

Avijit Dhar appointed VP-Marketing for Star Plus  Akashvani bags 6 honours at India Audio Summit & Awards

Akashvani bags 6 honours at India Audio Summit & Awards  Govt tells media to desist from live coverage of defence ops

Govt tells media to desist from live coverage of defence ops  Jio Platforms net profit up 25.7% in Jan-Mar quarter

Jio Platforms net profit up 25.7% in Jan-Mar quarter  BollywoodLife.com unveils sleek new revamp

BollywoodLife.com unveils sleek new revamp  Hoopr unveils ‘Smash’ platform to simplify Bollywood music licensing

Hoopr unveils ‘Smash’ platform to simplify Bollywood music licensing  Bhanushali Studios, True Story Films forge three-film collaboration

Bhanushali Studios, True Story Films forge three-film collaboration  Tamannaah Bhatia joins Sidharth Malhotra in ‘Vvan’

Tamannaah Bhatia joins Sidharth Malhotra in ‘Vvan’  Snapchat crosses 900 mn monthly active users globally

Snapchat crosses 900 mn monthly active users globally