AT&T Inc., which houses media assets like Warner Media, including streamer HBO Max, is in talks to combine content assets with Discovery Inc. in a deal that could create an entertainment giant to better compete with Netflix Inc. and Walt Disney Co., people with knowledge of the matter said.

Discussions are ongoing and there’s no certainty they will lead to a transaction, the people said, asking not to be identified because the information is private, Bloomberg reported on Sunday.

Any deal would mark a major shift in AT&T’s strategy after years of work to combine telecommunications and media assets under one roof.

AT&T gained some of the biggest brands in entertainment through its acquisition of Time Warner Inc., which was completed in 2018.

Through its WarnerMedia unit, AT&T owns CNN, HBO, Cartoon Network, TBS, TNT and the Warner Bros. studio. Discovery, backed by cable mogul John Malone, controls networks including HGTV, Food Network, TLC and Animal Planet.

Chief Executive Officer David Zaslav has helped Discovery bulk up through acquisitions, including a purchase of HGTV owner Scripps Networks Interactive Inc. that closed in 2018.

Discovery’s class A shares have risen more than 18 per cent this year, valuing the company at almost $24 billion. AT&T has gained 12 per cent, giving it a market capitalization of $230 billion in New York.

The companies are still negotiating the structure of a transaction, and details could change, the people said. Representatives for AT&T and Discovery declined to comment, Bloomberg said.

AT&T CEO John Stankey has been cleaning house at the sprawling telecom titan, cutting staff and selling underperforming assets. The company has been funneling money into rolling out its 5G wireless network, which requires billions of dollars of investment, as well as expanding its fiber-optic footprint.

The company has been boosting movie and television production to attract subscribers to its HBO Max streaming service. It also needs cash to pay down debt.

Any move involving AT&T’s content assets would come just months after it reached a deal to spin off its DirecTV operations in a pact with buyout firm TPG. AT&T agreed in December to sell its anime video unit Crunchyroll to a unit of Sony Corp. for $1.2 billion.

The company has also parted with its Puerto Rico phone operations, a stake in Hulu, a central European media group and almost all its offices at New York’s Hudson Yards.

NBF issues another advisory to member TV news channels

NBF issues another advisory to member TV news channels  Govt directs OTT platforms to stop airing Pak content

Govt directs OTT platforms to stop airing Pak content  Netflix to have AI-powered iOS search in TV app revamp

Netflix to have AI-powered iOS search in TV app revamp  India sets up panel to review copyrights laws, AI disputes

India sets up panel to review copyrights laws, AI disputes  Can Trump’s foreign movie tariff threat impact Indian films’ biz?

Can Trump’s foreign movie tariff threat impact Indian films’ biz?  ZEEL appoints Rohit Suri as Chief Human Resource Officer

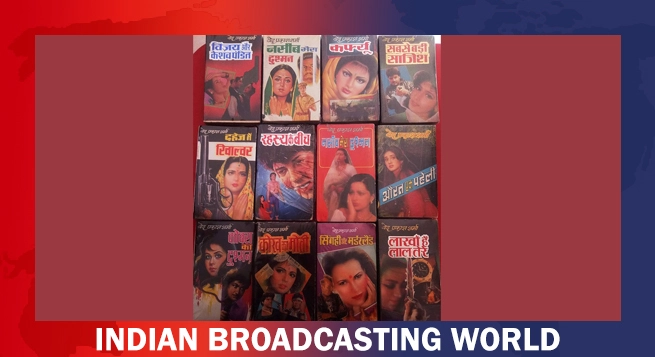

ZEEL appoints Rohit Suri as Chief Human Resource Officer  Ved Prakash Sharma’s bestselling novels to get film adaptations

Ved Prakash Sharma’s bestselling novels to get film adaptations  Ultra Play celebrates iconic Bollywood mothers with content lineup

Ultra Play celebrates iconic Bollywood mothers with content lineup  Sony PAL records 15.6% weekly reach in Week 17: BARC Report

Sony PAL records 15.6% weekly reach in Week 17: BARC Report  Dolby announces Mother’s Day special content lineup

Dolby announces Mother’s Day special content lineup