The Asia Video Industry Association (AVIA) hosted over 140 delegates and speakers, including some of the satellite industry’s largest operators, for a day of discussion on the challenges and growth opportunities of the satellite connectivity market, which was valued at $11.2 bn in 2021 and is expected to reach $22.1 bn by 2031.

The conference, hosted on June 6 in Singapore, began with regional operators discussing how they would fit into the rapidly changing world of satellites, AVIA said in a media statement. The event was called the Satellite Industry Forum.

Raymond Chow, AsiaSat‘s newly appointed Chief Commercial Officer, provided an overview of the company’s business strategies and emphasised the importance of focusing on and improving AsiaSat’s video business to deliver content to both the big and small screens.

He also believes that customers understand that the quality of service is more important than a small price difference. PSN is the first private satellite operator company in Indonesia, with over 330 Gbps capacity across three satellites serving Indonesia, Malaysia, and the Philippines.

As per a company’s press release, Agus Budi Tjahjono, Director of Commercial, PSN, believes PSN will be the largest satellite capacity provider in the ASEAN region by the end of 2023.

Yutaka Moriai, Executive Officer, Group President – Global Business Group, Space Business Unit, SKY Perfect JSAT, also sees great opportunities in building highly integrated space networks for both innovative communication and data collection, with plans to invest up to 150 billion yen (US$1.1 billion) by 2030.

In addition to exploring the new domain of highly integrated space networks, SKY Perfect JSAT is planning an aggressive push into Earth Observation Space. Thaicom CEO Patompob (Nile) Suwansiri expressed similar optimism in the Earth Observation Space and GEO special intelligence arenas, particularly in their home market. Thaicom also anticipates its first commercial partnership in Thailand’s LEO satellite IOT business with Globalstar in the coming months.

While there is a trend from satellite to cloud, the role of satellite in video distribution is still a growing business, and Sanjay Duda, CEO of Planetcast Media Services, highlighted the need for satellite companies to evolve their business to support the video players’ business plans.

Similar sentiments were expressed by Alistair Roseburgh, Director of Operations APAC, A+E Networks Asia, who stated that satellite remains the preferred mode of delivery for their core pay-TV business.

Diversification and experimentation in business are also more prevalent today than in the past. While FAST (Free Ad-Supported TV) has yet to gain traction in Asia, Rajeev Gambhir, Senior Director (Technology & Policy), SatCom Industry Association, questioned the panellists on their predictions and what more needs to be done. Alistair emphasised the need for greater flexibility, such as the pay-as-you-go model commonly used by cloud services and the ability to quickly launch and discontinue a service based on its popularity. While Sanjay emphasised the importance of integrating with other technologies to provide consumers with seamless connectivity.

Building on the industry’s optimism for the future, Cyril Dujardin, General Manager, Connectivity Business Unit, Eutelsat, shared the company’s commitment to strengthening its presence in the connectivity business, specifically its decision to invest in Oneweb. Mark Rigolle, COO, of Rivada Space Networks, shared during the same panel hosted by David Bruner, CEO and Principal Consultant, Aviation Communications Advisors (ACA), that the design and market segment for Rivada remains largely similar to LeoSat, except that there is greater market acceptance than in the past and that their focus on funding is now from telco investors.

In the Philippines, where many areas remain unserved or underserved, operators believe satellite technology will be a game changer. Citing examples from ABS’s significant presence and growth in the Philippines, from the first acquisition of Mabuhay Satellite in 2009 to the current presence of five in-orbit satellites, Vincent Lim, MD, Asia Sales, ABS, stated that satellite technology remains the primary form of connectivity in the Philippines, despite consumer broadband being on the rise. Brandon Seir, Chief Commercial Officer, Kacific Broadband Satellites, agreed, noting that due to the high cost of routing fibre, the only way to reach those locations would be via satellite.

MEASAT’s Chief Commercial Officer, Ganendra Selvaraj, emphasised the company’s commitment to digital inclusion, providing people with opportunities and improving affordability through the community Wi-Fi model, which has proven to be successful in Malaysia. The panellists agreed that the Philippines market offers tremendous opportunity, but that more regional cooperation is required.

Alan Cheng, Sales Manager, Pacific, SES, disagreed that there is an oversupply in the market and emphasised the need for more capacity in the Pacific region, drawing attention to the vast market that is not yet connected. Northtelecom CTIO Mahdi Nazari Mehrabi noted that while GSO operators may see LEO as a threat, which all three GSO operators denied in unison, it could also be an opportunity, citing Starlink as an example, and emphasising the importance of great marketing to put traditional satellite industry for general consumers.

Beatrice Mok, Corporate Development Director, Kacific Broadband Satellites, added that it is a fallacy that no contract and low pricing is unique to LEO and cautioned about the attractive pricing from new entrants attempting to capture market share, as well as the role of regulators in preventing predatory pricing in the satellite industry.

Robert Suber, Director, Asia Pacific Sales, Intelsat, elaborated on why GSO operators do not see LEO as a threat, stating that telco and mobile network operators across the Pacific are concerned about OTT and connectivity players bypassing their network and eroding revenues.

As the conference came to close, female leaders took the stage to discuss how to address industry challenges, particularly the lack of women in leadership positions. Jacinth Lau, Deputy Director (Industry), Office for Space Technology & Industry (OSTIn), spoke on a panel moderated by Irina Petrov, VP MarCom & Membership at GSOA, about the lack of awareness of career opportunities among the younger generation, the lack of space technology degrees and courses at local tertiary institutions, and the difficulties in securing talents due to global competition.

Nonetheless, she was optimistic about Singapore’s concentrated efforts in research investments centred on the city-state’s core strengths as an aviation and maritime hub, as well as collaboration with universities and research institutes.

Rachelle Radpour, CTO of Boeing Satellite, elaborated not only on the importance of diversity in the space industry, but also on the importance of equal access to opportunities, work-life balance, and maintaining a pipeline and culture that supports all stages of an employee’s career, regardless of gender.

Despina Panayiotou Theodosiou, Co-CEO of TOTOTHEO MARITIME, emphasised the importance of having a role model for young women, as well as the need for new ideas, patience, and persistence to make changes.

MIB to unveil M&E sector statistical handbook today at WAVES

MIB to unveil M&E sector statistical handbook today at WAVES  WAVES 2025: Media dialogue backs creativity, heritage & ethics in AI Era

WAVES 2025: Media dialogue backs creativity, heritage & ethics in AI Era  Pay TV leaders chart course for India’s linear TV in digital age

Pay TV leaders chart course for India’s linear TV in digital age  Sudhir Chaudhary announces new show for DD News, says “Good content still has a place” at WAVES 2025

Sudhir Chaudhary announces new show for DD News, says “Good content still has a place” at WAVES 2025  India can lead global entertainment revolution: Mukesh Ambani

India can lead global entertainment revolution: Mukesh Ambani  TRAI chief not in favour of separate rules for OTT, legacy b’casters

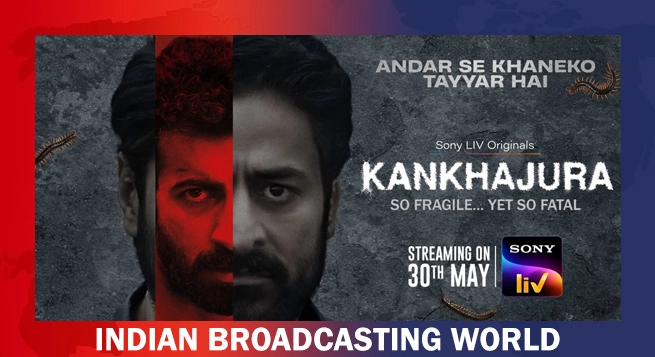

TRAI chief not in favour of separate rules for OTT, legacy b’casters  ‘KanKhajura’ start streaming on Sony LIV from May 30

‘KanKhajura’ start streaming on Sony LIV from May 30  Koyal.AI debuts at WAVES 2025, set to revolutionise music videos with GenAI

Koyal.AI debuts at WAVES 2025, set to revolutionise music videos with GenAI  Zee Cinema to premiere ‘Pushpa 2: The Rule’ on May 31

Zee Cinema to premiere ‘Pushpa 2: The Rule’ on May 31  ‘Create in India Challenge’ S1 honours global talent at WAVES

‘Create in India Challenge’ S1 honours global talent at WAVES  Amazon MX Player adds 20+ dubbed international titles

Amazon MX Player adds 20+ dubbed international titles