Bharti Airtel, India’s No.2 telecom carrier by users, posted a bigger-than-expected rise in quarterly revenue yesterday as it signed up more subscribers for its higher-priced 4G services and benefited from tariff hikes in its base plans.

Airtel, market leader Reliance Jio and other telcos have a dual focus of migrating more customers from 2G to 4G and subsequently to 5G to grow their premium user base and of raising tariffs that have long been stagnant.

According to a Reuters report, Airtel added 5.6 million 4G subscribers from April to June, taking its total 4G customer count to 229.7 million, which is 2.5 percent higher than in January to March. These subscribers account for 70.4 percent of all its subscribers, up from 65.2 percent a year ago.

The company’s average revenue per user (ARPU), a key metric for telcos, rose about 9 percent year-on-year to Rs. 200, helped by the addition of premium 4G customers and tariff hikes on its base plans earlier this year. Jio’s ARPU was Rs. 180.5.

Airtel’s total revenue increased 14.1 percent to Rs. 374.40 billion ($4.53 billion) in the first quarter, beating analysts’ estimates of Rs. 366.24 billion, according to Refinitiv IBES.

However, its net profit was flat at 16.13 billion rupees due to a one-time charge of Rs. 34.16 billion on the devaluation of the Nigerian currency. Nigeria is a major market for mobile services in Africa, which contributes to around 30 percent of Airtel’s revenue.

Last month, Reliance Jio, the telecommunication arm of conglomerate Reliance Industries Ltd reported its slowest revenue and profit growth in six quarters due to stagnant tariffs.

Indian telecom companies have spent massively in acquiring 5G spectrums and rolling out services across the country.

Earlier this week, Airtel said it prepaid Rs. 80.24 billion to the Indian government to partly clear deferred liabilities for airwaves it acquired in 2015.

Telecom subs base up marginally; Trai withholds updated b’band data

Telecom subs base up marginally; Trai withholds updated b’band data  WAVES driven by industry; govt just a catalyst: Vaishnaw

WAVES driven by industry; govt just a catalyst: Vaishnaw  In officials’ reshuffle, Shankar moves out of MIB; Prabhat comes in

In officials’ reshuffle, Shankar moves out of MIB; Prabhat comes in  Balaji Tele elevates Viren Trivedi to finance controller

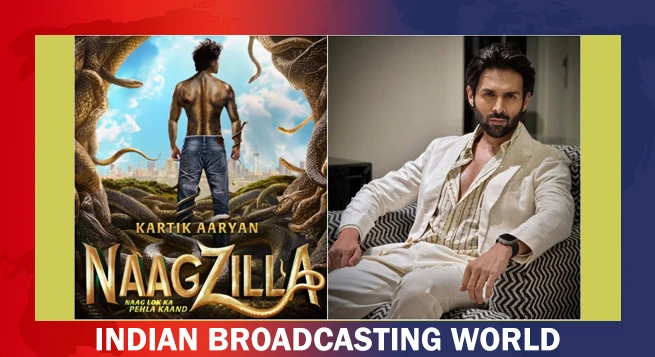

Balaji Tele elevates Viren Trivedi to finance controller  Kartik Aaryan turns shape-shifting serpent for ‘Naagzilla’

Kartik Aaryan turns shape-shifting serpent for ‘Naagzilla’  Mohit Suri’s ‘Saiyaara’ set for July 18 release

Mohit Suri’s ‘Saiyaara’ set for July 18 release  ApplaToon launches ‘Kiya & Kayaan’

ApplaToon launches ‘Kiya & Kayaan’  Jio captures a massive 85% share of India’s 5G fixed wireless market

Jio captures a massive 85% share of India’s 5G fixed wireless market  WAVES offers big opportunity to all media: Murugan

WAVES offers big opportunity to all media: Murugan