Multiplexes should refrain from any restraint on trade in exhibition that may impinge on producers’ freedom of trade, the Competition Commisssion of India (CCI) said Friday, while highlighting the importance of self-regulation.

“Multiplexes should refrain from any restraint on trade in exhibition that may impinge on producers’ freedom of trade,” CCI said even while observing newer avenues of exhibition such as OTT are becoming an important medium for the exhibition of cinema and can even serve as a useful complement for producers (to showcase their art) that have lesser bargaining power against theatrical exhibitors.

Still, in the same vein, the antitrust body observed OTT platforms may “not be an effective alternative medium for certain theatrical exhibitions, either in terms of experience or revenue potential”.

A slew of recommendations were offered by the CCI in its report on ‘Market Study on the Film Distribution Chain in India: Key Findings and Observations’.

Associations in the film industry must refrain from ban and boycotting non-members and look at alternate dispute resolution mechanisms to address disagreements between stakeholders, the Competition Commission suggested.

The fair trade regulator has proposed self-regulations related to multiplexes and producers, Virtual Print Fee (VPF), stakeholders’ associations and digital cinema.

According to the CCI, tailor-made arrangements should be preferred between multiplexes and producers in place of standard templates for contracting.

“Standard templates for contracting between the producers and exhibitors may be avoided. In place of standard templates, arrangements between multiplexes and producers may be tailor-made, accommodating the type of content being showcased, so that smaller projects which attract larger crowds in subsequent weeks can also be remunerative for producers.

“An alternative to sliding scale arrangements in this context can be aggregate agreements, where multiplexes and producers share the aggregate revenues generated by a film based on a pre-negotiated percentage split between the parties,” the report suggested.

The study, while dwelling on various aspects of film distribution business in India, cited international best practises and lack of their adoption in India.

Globally, the film industry relies on monitoring tools that track and accurately measure box office receipts. However, the system does not seem to have taken hold in India, the watchdog pointed out.

“Adoption of box office monitoring systems…should be able to generate, record, and maintain ticketing logs and reports, and the data collected by such a system should not be alterable by any stakeholder. It might be challenging for lower-tier cinemas to adopt such systems. Stakeholders are encouraged to come together and put forward a system of box office collection monitoring that is cost-effective in order to encourage ubiquitous adoption,” it suggested.

Citing stakeholders, the regulator said that in some quarters of the industry, certain types of anti-competitive conduct, such as bans and boycotts and prohibitions on working with non-members, are still being carried out by associations, a PTI news dispatch from New Delhi added.

”Associations must refrain from engaging in bans and boycott(s) and prohibiting industry from working with non-members… Associations must consider how alternate dispute resolution mechanisms, such as mediation can be institutionalised, to address any disagreement between stakeholders,” the study said.

With respect to the Virtual Print Fee, the suggestion is that such money paid to a multiplex can be phased out first and later, the same can be phased out for single screens.

”Till the VPF sunset is decided and implemented, Digital Cinema Equipment providers and producers should negotiate on mutually acceptable VPF charges and ensure that there are no disruptions in the exhibition of films on account of VPF,” the study said.

VPF is a subsidy that producers/distributors pay to enable exhibitors to cover the cost of converting their analogue projectors into digital ones.

The study highlights some of the key competition issues in the film distribution chain as identified by stakeholders, the regulator said.

TRAI revamps website to connect with wider audience

TRAI revamps website to connect with wider audience  Prime Video to limit in India number of TV sets having access per subscription

Prime Video to limit in India number of TV sets having access per subscription  Delhi HC orders meta to remove deepfake videos of Rajat Sharma

Delhi HC orders meta to remove deepfake videos of Rajat Sharma  Zee Telugu wraps up 2024 with ‘Sa Re Ga Ma Pa Party’

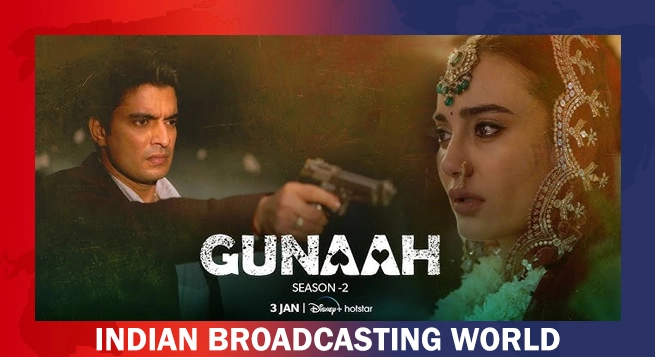

Zee Telugu wraps up 2024 with ‘Sa Re Ga Ma Pa Party’  Disney+ Hotstar unveils ‘Gunaah’ S2 teaser

Disney+ Hotstar unveils ‘Gunaah’ S2 teaser  ‘The Secret of The Shiledars’ to premiere on Disney+ Hotstar Jan 31

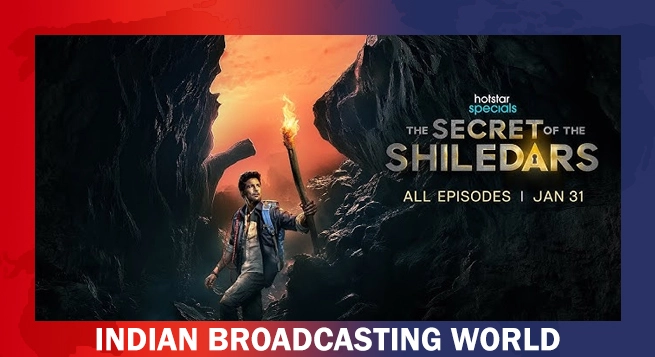

‘The Secret of The Shiledars’ to premiere on Disney+ Hotstar Jan 31  ‘All We Imagine As Light’ to stream from Disney+ Hotstar on Jan 3

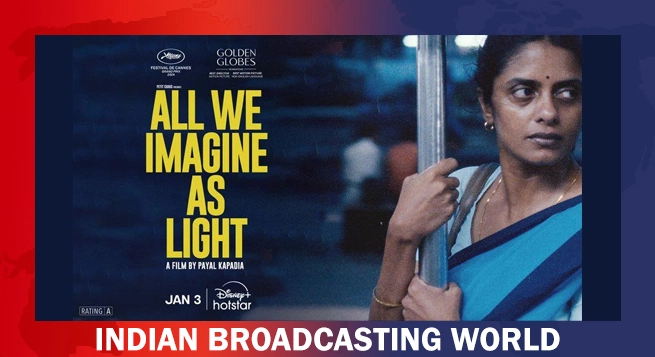

‘All We Imagine As Light’ to stream from Disney+ Hotstar on Jan 3  ‘Yeh Jawaani Hai Deewani’ returns to theatres Jan 3

‘Yeh Jawaani Hai Deewani’ returns to theatres Jan 3