Sample some facts. India’s television industry was worth INR 68,5002 crore in 2020. Subscription revenues account for around 60-65 percent of the overall industry revenue. There are over 900 TV channels and 1,500 MSOs licenced by the government. As per latest data from Broadcast Audience Research Council India, in June 2021, in the first half of 2021, weekly TV viewership stood at an average of 921 billion viewing minutes. Phew!

And, amidst all these, OTT platforms are offering Indians more choices and options to consume content.

As admitted by India’s Telecom Regulatory Authority of India recently in a consultation paper, the consumers have choices at fairly affordable prices. “On an average price of $5.53, Indian consumer pays around 20 to 25 percent as compared to a TV consumer in UK, USA, Thailand, or Malaysia,” it observed.

Though some critics are questioning as to why the TRAI is once again examining the market structure and competition in cable TV services in India, the background note on the consultation paper on India’s competition in cable TV sector says it quite clearly.

“A counterpoint can be that the level of competition in the MSOs’ business is not uniform across the country. Certain States (e.g., Delhi, Karnataka, Rajasthan, West Bengal, and Maharashtra) have many MSOs providing their services. Whereas in certain other states like Tamil Nadu, Punjab, Orissa, Kerala, Uttar Pradesh, and Andhra Pradesh the cable television market is dominated by one or two MSOs,” TRAI has observed.

It goes on to add: “DTH service providers do offer an alternate option for consumers. However, one may opine that DTH services are not perfectly substitutable, as certain factors are unique to the cable industry. Cable TV operators can provide broadband and voice services in addition to the distribution of TV channels, which DTH operators cannot. Furthermore, even for the distribution of TV channels, competition within the cable TV sector is essential as cable TV networks operate on a State/regional basis and can choose specific channels to be supplied according to the demand in a particular area whereas DTH services operate on a national basis and transmit the same channels throughout the country irrespective of variations in demand of channels in different markets.”

TRAI has made it clear that big MSOs have used their monopolistic position in certain States to create imbalance in distribution of TV channels and, in some extreme cases, have also blocked access of TV channels to consumers.

Dwelling on the competition offered by OTT services, TRAI observed that in the financial year 2019-20, digital and OTT sector registered a growth of 26 percent, the highest growth amongst other segments of the M&E sector. To derive benefit from OTT platforms, many Internet Service Providers (ISPs) across the country are bundling subscription-based video streaming OTT platforms to attract new subscribers.

For example, Jio Fiber, started to bundle a variety of OTT platforms like Disney+Hotstar, Zee5 and Amazon Prime Video. Reliance Jio also launched JioTV+ in July 2020, which enables consumers to access over 12 OTT platforms via its STB. Similarly, Airtel has launched its Airtel Xstream box with Netflix, Amazon Prime Video and Zee5 bundled for its broadband subscribers as per their monthly plans.

“This pattern of bundling OTT services in their offerings is used by almost all the telecom service providers. Smart TVs that enable consumers to connect to the internet and other OTT platforms, besides providing access to the regular cable TV channels, are gaining market share, and are enabling increasing traction to OTT based video streaming services. Thus, with the convergence of technologies, broadband and telecom service providers are also providing alternate to broadcasting services, thereby providing consumers another avenue/ option.

Therefore, one may consider that the consumers have sufficient options to avail television broadcasting services,” TRAI has pointed out.

Therefore, it was important to re-examine the subject of monopoly of cable services keeping in mind the overall scenario and all alternative options into consideration, the regulator said.

TRAI has furnished some additional figures about the Indian media and entertainment industry that quite boggles the mind. As on August 2021, there were 357 broadcasters; 1733 registered MSOs as on September 1, 2021; approximately 1,55,303 cable operators as on March 2021, one HITS operator, 4 pay DTH operators and few IPTV operators , in addition to the public service broadcaster Doordarshan, which provides a free-to-air DTH service in India.

At the end of March 2021, there are estimated 184.14 million TV households that are being served by the cable TV, DTH, HITS and IPTV services in addition to a terrestrial TV network of Doordarshan.

The pay TV universe consists of around 73 million cable TV subscribers, 70.99 million active DTH subscribers and 2.15 million Headend In The Sky (HITS) subscribers. In addition, there are 38 million subscribers of free-to-air DTH and terrestrial TV services provided by Doordarshan. As per data shared by the service providers to TRAI in May 2021, top 14 MSOs of the country serve approximately 45.7 million customers.

Top India Ministers pitch WAVES ’25 to foreign envoys in New Delhi

Top India Ministers pitch WAVES ’25 to foreign envoys in New Delhi  JioStar secures 20 top brands for TATA IPL 2025

JioStar secures 20 top brands for TATA IPL 2025  After Airtel, Reliance announces pact with Starlink

After Airtel, Reliance announces pact with Starlink  In a surprise move, Airtel joins hands with Musk’s Starlink for India

In a surprise move, Airtel joins hands with Musk’s Starlink for India  For Sheeba Chadha, films, web series are the same work-wise

For Sheeba Chadha, films, web series are the same work-wise  YRF’s ‘War2’ to release in theatres Aug 14

YRF’s ‘War2’ to release in theatres Aug 14  KALP Foundation, WION unveil ‘Token: Money Magnet’

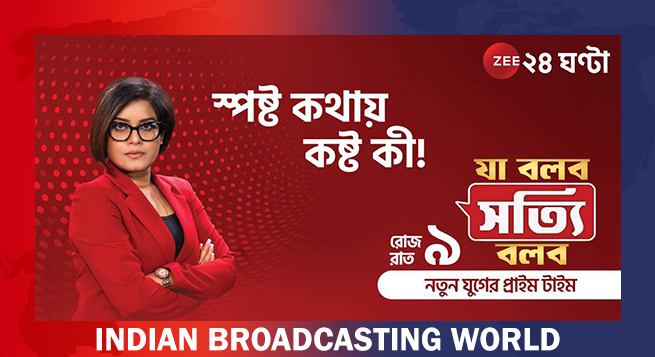

KALP Foundation, WION unveil ‘Token: Money Magnet’  Zee 24 Ghanta launches ‘Jaa Bolbo Shotyi Bolbo’

Zee 24 Ghanta launches ‘Jaa Bolbo Shotyi Bolbo’  Hoichoi unveils ‘TV+’ to redefine Bengali storytelling

Hoichoi unveils ‘TV+’ to redefine Bengali storytelling