Media reports are raising concerns about the financial stability of OpenAI, the organization behind ChatGPT, a popular language model.

According to IANS, OpenAI might face bankruptcy by the end of 2024 if it does not secure additional funding shortly.

Analytics India Magazine recently highlighted a significant decline in the usage of the ChatGPT website during the first half of the year. Data from analytics company SimilarWeb revealed a decline in users from 1.9 billion in May to 1.7 billion in June and further down to 1.5 billion in July. This data does not even include usage from APIs or the ChatGPT mobile app.

There are multiple theories surrounding this decline. One theory attributes it to the fact that students were out of school in May, leading to reduced usage. Another theory suggests that users are now opting to build their own chatbots rather than relying on the original ChatGPT offering. A user’s tweet mentioned, “I am no longer allowed to use ChatGPT at work, but we have developed our internal model based on ChatGPT.”

The situation is compounded by the fact that OpenAI’s financial losses have reportedly doubled to approximately $540 million in the last year. This increase in losses followed the development of ChatGPT, which sparked concerns about potential job displacement due to automation and AI advancements.

Running ChatGPT is also reportedly costly, with operational expenses estimated at an astonishing $700,000 (Rs 5.80 crore) per day. OpenAI CEO Sam Altman acknowledged the high computational costs in a tweet, describing them as “eye-watering.”

Adding to the challenges, billionaire entrepreneur Elon Musk has announced his intentions to develop a competing chatbot, further increasing competitive pressures.

While OpenAI has projected annual revenue of $200 million in 2023, with aspirations to reach $1 billion in 2024, its mounting losses have raised questions about its financial sustainability. OpenAI’s financial situation is currently propped up by a substantial $10 billion investment from Microsoft. However, reports suggest that it might be too early for leading AI companies, including OpenAI, to consider initial public offerings (IPOs) due to the typical requirement of at least a decade of operation and $100 million in revenue for a successful IPO.

As the landscape of AI development and adoption continues to evolve, OpenAI faces the challenge of balancing its ambitions with financial stability, all while navigating the dynamics of a competitive market and changing user behaviors.

SonyLIV drops ‘Black, White & Gray-Love Kills’ trailer

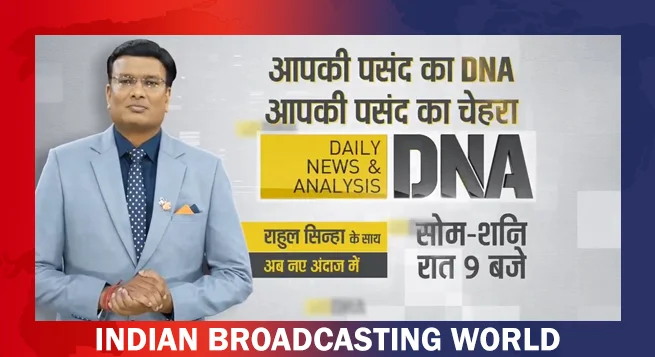

SonyLIV drops ‘Black, White & Gray-Love Kills’ trailer  Rahul Sinha takes charge of Zee News’ DNA

Rahul Sinha takes charge of Zee News’ DNA  JioStar vice-chair Uday Shankar on surge in streaming subs, trade tariff challenges

JioStar vice-chair Uday Shankar on surge in streaming subs, trade tariff challenges  ‘Fellow Travelers’ to stream on Prime Video India from April 17

‘Fellow Travelers’ to stream on Prime Video India from April 17  Times Network emerges as digital news powerhouse with 107 mn monthly users

Times Network emerges as digital news powerhouse with 107 mn monthly users  HBO unveils key cast for upcoming ‘Harry Potter’ TV series

HBO unveils key cast for upcoming ‘Harry Potter’ TV series  NDTV brings new ‘Unplan Life’ podcast

NDTV brings new ‘Unplan Life’ podcast  Anna Kendrick, Blake Lively reunite for twisted wedding thriller

Anna Kendrick, Blake Lively reunite for twisted wedding thriller