Despite the noises being made that streaming is displacing linear TV in India, cord-cutting is in nascent stages, but, admittedly, digital consumption of video has shown growth to reach a stage where scaling up is possible — and is also visible — according to a BCG-CII report on the country’s media and entertainment sector.

Pointing out that there are some “real constraints” that are holding back consumers from going in for large-scale cord cutting, the report stated whatever examples of migration to digital can be seen is because of several reasons — convenience, ad-free content (mostly), access to specific content and personalized screen.

“Fixed broadband penetration (is) much lower (in India) than the US and the UK,” the report, titled ‘Blockbuster Script for the New Decade: Way Forward for Indian Media and Entertainment Industry’ stated, explaining the low cases of cord-cutting, adding that while the fixed line broadband in India is about 8-9 percent, in the US it is almost 95 percent.

The report also added that the high cost of OTT subscription, plus the broadband cost, versus more affordable cable/pay TV services is also one of the reasons Indian consumers are still siding with traditional TV. In the US, for example, the cost difference between pay Tv and streaming services is 0.8x, while the corresponding figure in India is 2.5x.

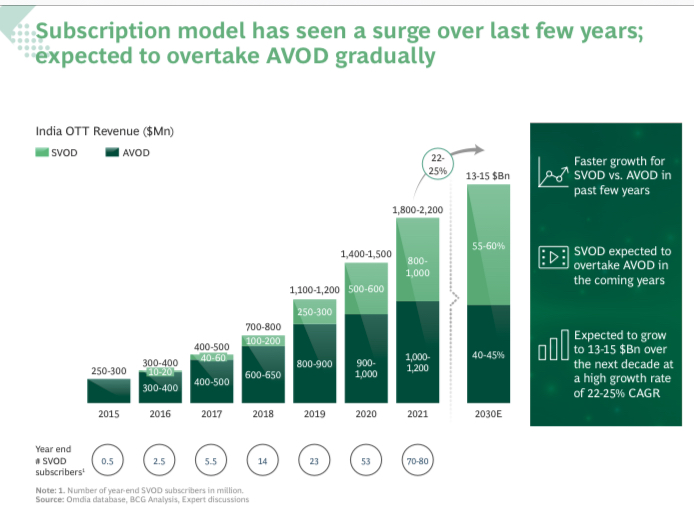

But there’s no denying that Indian OTT has progressed from early stage to scaling stage.

In the early stage cheaper data and increased smart-phone penetration was a driving factor for adoption with streamers predominantly adopting AVOD models. But in the scaling stage, most streamers have transitioned from AVOD to SVOD model with trends of high SVOD penetration and small percentage of pay TV cord cutting visible, the report, formally released earlier this month, stated, adding the next wave could very well witness ‘live’ OTT.

The OTT platforms have been focusing on driving subscriptions with India specific pricing. “Pricing of global streaming services in India has been made affordable to drive adoption,” the BCG report said, “Global players like Netflix, Prime Video, Disney+ offering plans in India at 70-90 percent cheaper than the US.”

A strong library of local language content is also part of the strategy to drive consumer numbers.

The report, for example, pointed out that for Disney+Hotstar has 40+ percent of total content consumption coming from regional languages, which is, of course, helped by the media company’s presence in broadcasting in regional languages.

Prime Video gives much importance to regional content — regional being the new national — with 50 percent of viewership for regional language movies coming from outside home States. Zee5 offers content in 12 languages and “plans to increase investments in regional content from 15 percent to 30-40 percent,” the report stated.

Predominantly AVOD platform MX Player, part of the Times of India Group, offers content in 10+ languages and has introduced a new category, ‘MX VDesi’, which brings international content dubbed in Indian languages like Hindi, Tamil and Telugu.

Strong content is also helping capture eyeballs outside India for streamers.

The report stated that Indian OTT platforms can cater to international demand by targeting the Indian diaspora, markets that have language similarities with India (Bangladesh, Sri Lanka and some other South- East Asian countries, for instance) and create presence in the global market with original content focussed on ‘glocal’ stories.

Examples of such demand can be seen in ‘Sacred Games’S1 (Netflix) attracting two out of three viewers from outside India; Tamil film ‘Jagame Thandhiram’ (Netflix) saw 50 percent of the viewers coming from outside India in the first week of release as the film was subtitled and dubbed in multiple languages, including English, Spanish, French and Portuguese, enabling wider access.

IMDB Top 50 most popular web series include ‘Kota Factory’, ‘Made in Heaven’, ‘Flames’, ‘Yeh Meri Family’, ‘TVF Tripling’, ‘Little Things’ and ‘Permanent Roommates’, the report stated, highlighting the pull of Indian content.

But the big question that the report did not delve into is: When would a ‘Squid Game’ arrive from India? A poser worth pondering.

TRAI revamps website to connect with wider audience

TRAI revamps website to connect with wider audience  Prime Video to limit in India number of TV sets having access per subscription

Prime Video to limit in India number of TV sets having access per subscription  Delhi HC orders meta to remove deepfake videos of Rajat Sharma

Delhi HC orders meta to remove deepfake videos of Rajat Sharma  Govt. blocked 18 OTT platforms for obscene content in 2024

Govt. blocked 18 OTT platforms for obscene content in 2024  Broadcasting industry resists inclusion under Telecom Act

Broadcasting industry resists inclusion under Telecom Act  ‘Cobra Kai Season 6 Part 3’ set for February 2025 release on Netflix

‘Cobra Kai Season 6 Part 3’ set for February 2025 release on Netflix  Radio City unveils ‘WOKA Santa’ to spread Christmas cheer across 10 cities

Radio City unveils ‘WOKA Santa’ to spread Christmas cheer across 10 cities  ‘Squid Game 2’ comes to Sunburn Goa 2024

‘Squid Game 2’ comes to Sunburn Goa 2024  Zee Telugu to premiere ‘Saripodhaa Sanivaaram’ on Dec 29

Zee Telugu to premiere ‘Saripodhaa Sanivaaram’ on Dec 29  &pictures announces ‘Khichdi 2’ premieres December 29

&pictures announces ‘Khichdi 2’ premieres December 29