The global pandemic and the shift to remote work/schooling engendered a captive audience that accelerated trends within the media and entertainment industry. Streaming video subscriptions climbed and gaming saw over 22 per cent YoY growth, according to a new global study.

As households stacked subscriptions, driving subscription revenues to over US$69 billion in 2020, gaming saw YoY growth of over 22 with ISPs and CDNs reporting heavy traffic from game downloads.

According to new research from global tech market advisory firm ABI Research, in total, the online video and gaming markets reached US$330 billion in 2020.

“While the amount of media consumption will taper off from the peaks seen during lockdowns as the world returns to a sense of normalcy, the appetite for digital content and services are expected to remain strong,” said Michael Inouye, Principal Analyst of Next-Gen Content Technologies at ABI Research.

“The common consensus from most industry insiders is a shift in the growth curve rather than an expected dip to pre-pandemic forecasts,” he added.

Connected TV (CTV) viewing has been steadily increasing over the past few years, but 2020 generated a significant boost to CTV as many ad tech companies and platforms reported strong shifts in the advertising mix toward CTV.

The growing presence of CTV speaks of the opportunities for live and linear programming as the lean-back TV viewing experience remains a significant component of consumers’ viewing behavior.

The rapid growth in subscriptions and signups from newer entrants like Disney Plus, HBO Max, and NBC Peacock support a new look at the “pay-TV” bundle or package – one that is put together by the consumer rather than the operator, ABI Research said in a statement.

The content landscape is shifting, but in some regards, it is not too dissimilar from the previous status quo.

“If a consumer puts together a list of streaming video subscriptions and spends the same as a traditional pay-TV package, is that not pay-TV? Ultimately these changes create opportunities for new entrants, but it also allows for incumbents to enact strategic changes to remain competitive – for example, pay-TV operators becoming service aggregation hubs. What these changes do speak to are alterations in the distribution channels like cloud delivery and opportunities stemming from new technologies like 5G and out-of-home entertainment and advertising,” Inouye concludes.

These findings are from ABI Research’s Next-Gen Content and Services market data report. This report is part of the company’s Next-Gen Content Technologies research service, which includes research, data, and ABI Insights.

ABI Research provides strategic guidance to visionaries, delivering actionable intelligence on the transformative technologies that are dramatically reshaping industries, economies, and workforces across the world.

Prime Video to limit in India number of TV sets having access per subscription

Prime Video to limit in India number of TV sets having access per subscription  Delhi HC orders meta to remove deepfake videos of Rajat Sharma

Delhi HC orders meta to remove deepfake videos of Rajat Sharma  Govt. blocked 18 OTT platforms for obscene content in 2024

Govt. blocked 18 OTT platforms for obscene content in 2024  Broadcasting industry resists inclusion under Telecom Act

Broadcasting industry resists inclusion under Telecom Act  DTH viewing going down & a hybrid ecosystem evolving: Dish TV CEO

DTH viewing going down & a hybrid ecosystem evolving: Dish TV CEO  Abhishek Singh Rajput shines in ‘Swipe Crime’ on MX Player

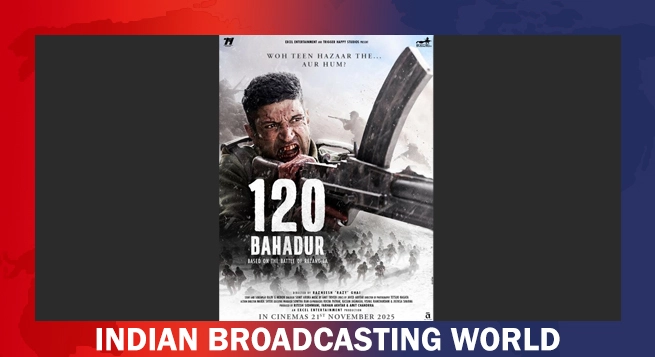

Abhishek Singh Rajput shines in ‘Swipe Crime’ on MX Player  Farhan Akhtar’s ‘120 Bahadur’ to hit theatres on November 21, 2025

Farhan Akhtar’s ‘120 Bahadur’ to hit theatres on November 21, 2025  COLORS announces 2025 lineup

COLORS announces 2025 lineup  Sony YAY! announces holiday wishes from Toon-Town this Christmas

Sony YAY! announces holiday wishes from Toon-Town this Christmas  8Bit Creatives partners with ESFI to elevate WAVES esports championship 2025

8Bit Creatives partners with ESFI to elevate WAVES esports championship 2025