Advertising agency Crayons Advertising Ltd yesterday said it has filed draft papers with NSE Emerge for its initial public offering (IPO).

The company plans to offer 64.30 lakh equity shares of face value Rs 10 each through the book-building process, according to a statement.

Proceeds to the tune of Rs 15.28 crore from the issue will be used in building infrastructure and cutting-edge technology for expansion and Rs 14.5 crore for funding working capital requirements, a PTI report stated.

Corporate Capital Ventures is the book-running lead manager to the issue and Skyline Financial Services is registrar to the issue.

Crayons Advertising’s services span from brand strategy, creative solutions, events and activations, digital media and traditional media planning and buying.

Recently, the company announced that it won mandates, including Tata Sons, National Skill Development Corporation, Indian Oil Corporation, Tata Croma and Bank of Baroda. The mandate of the National Skill Development Corporation is to transform the brand notion and strengthen the connection with youth.

The agency’s experience in handling government businesses played a major role in the final selection for taking over its social media mandate.

TRAI revamps website to connect with wider audience

TRAI revamps website to connect with wider audience  Prime Video to limit in India number of TV sets having access per subscription

Prime Video to limit in India number of TV sets having access per subscription  Delhi HC orders meta to remove deepfake videos of Rajat Sharma

Delhi HC orders meta to remove deepfake videos of Rajat Sharma  Govt. blocked 18 OTT platforms for obscene content in 2024

Govt. blocked 18 OTT platforms for obscene content in 2024  Broadcasting industry resists inclusion under Telecom Act

Broadcasting industry resists inclusion under Telecom Act  ‘Cobra Kai Season 6 Part 3’ set for February 2025 release on Netflix

‘Cobra Kai Season 6 Part 3’ set for February 2025 release on Netflix  Radio City unveils ‘WOKA Santa’ to spread Christmas cheer across 10 cities

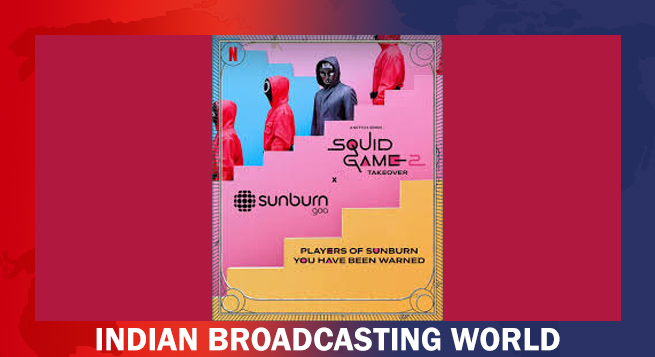

Radio City unveils ‘WOKA Santa’ to spread Christmas cheer across 10 cities  ‘Squid Game 2’ comes to Sunburn Goa 2024

‘Squid Game 2’ comes to Sunburn Goa 2024  Zee Telugu to premiere ‘Saripodhaa Sanivaaram’ on Dec 29

Zee Telugu to premiere ‘Saripodhaa Sanivaaram’ on Dec 29  &pictures announces ‘Khichdi 2’ premieres December 29

&pictures announces ‘Khichdi 2’ premieres December 29