Digital media in India grew to INR 571 billion in 2022, a rise of 30 percent, and is expected to grow to INR 862 billion by 2025 at a 15 percent CAGR, according to a Ficci-EY report on media and entertainment industry released earlier this week.

While India has the second largest base of Internet subscribers at over 800 million, second only to China, on an average, 25 million smart TVs are connected to the Internet each month. However, not more than 8 to 10 million of them are connected to the Internet on a daily basis, said the report titled ‘Windows of Opportunity: India’s media & entertainment sector – maximizing across segments’.

Interestingly, in the times of streaming vs. TV debate, the report states paid video subscriptions will increase to 114 million (from the 2022 figure of 99 million) across 52 million households if current pricing is maintained. However, they could exceed 100 million households if pricing is reduced to around INR1,000 per year for 3-4 services.

According to the report, Internet penetration increased by 4 percent to 866 million subscriptions in December 2022 and video viewers increased 6 percent (30 million) in 2022 to reach 527 million.

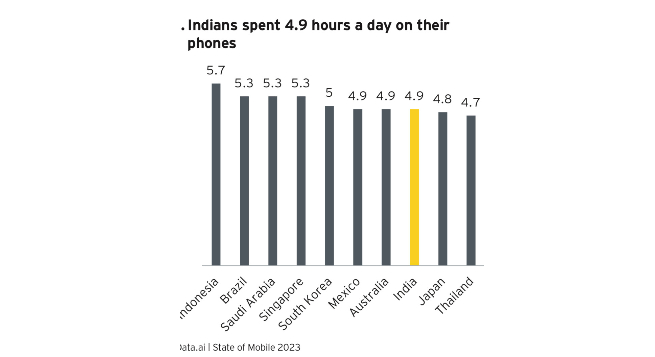

With comparatively cheap data available these days in India, at 4.9 hours per day, Indians came eighth in the world for the most amount of time spent on phone apps in 2022,which is a 32 percent growth since 2019.

Some highlights of the digital media in the report are as follows:

► Telecom subscriptions remained stable at 1.17 billion in 2022

► Smartphone users reached 538 million in 2022. Growth has tapered down since mid-2021 since the average cost of buying a smartphone increased, resulting in just 35 million new smartphone additions during 2022

► 32 million Indian households had a wired broadband connection

► Indians downloaded almost 28.9 billion apps in 2022, the second most in the world, at a growth of around 8 percent over 2021.

► In terms of revenue, India lagged many smaller markets and did not feature in the top 20 revenue generating markets in 2022.

► Average monthly mobile data usage per smartphone was 25GB per month in 2022, and this is set to increase at a CAGR of 14 percent to reach 54GB by 2028.

► In 2020, 30 percent of OTT originals were in regional languages and this increased to 50 percent in 2022.

► In 2022, almost 3,000 hours of fresh, original content was produced for streaming platforms, which is 19 percent higher than 2021.

► Total online video content investment in India stood at INR 82 billion in 2022.

► Around 75 films released on streaming platforms directly, without a theatrical release, which is lower than the 100+ such film releases in 2021.

► Digital advertising grew 30 percent to reach INR 499 billion in 2022, almost half of total ad spends in 2022.

► Of the total, share of ad revenues generated by e-commerce platforms increased to over INR70 billion, crossing 14 percent of total digital advertising (12 percent in 2020)

► Ad insertions increased 52 percent in 2022 vs. 2021 and there were over 360 categories, which had higher insertions on digital than on print, television or radio.

►Digital subscription grew 27 percent to reach INR72 billion.

► Video subscription revenues grew 27 percent in 2022 to INR68 billion.

► Paid video subscriptions reached 99 million in 2022, across almost 45 million households in India, with a total viewership of around 135 to 180 million users.

► Audio subscription grew 37 percent in 2022 as paying consumers reached around 4.6 million.

► News subscription reached around INR1.2 billion primarily for premium and exclusive content.

Projections

► The report estimates around 1.5 million paid subscribers across all news platforms, which can double by 2025 on the back of more specialty news and custom knowledge products.

► The report expects digital subscriptions to grow at a CAGR of 11 percent till 2025.

► Digital advertising will grow at a 15 percent CAGR; its share will increase from 48 percent of total advertising in 2022 to 50 percent by 2023, and further to 54 percent by 2025.

► SME and long-tail advertising, included in the above, will grow from INR180 billion in 2022 to INR276 billion by 2025.

► E-commerce advertising will reach INR150 billion by 2025.

► Entertainment OTT platforms, including sports, will generate around INR60 billion of advertising by 2025.

► ChatGPT, Bard, etc., will impact news publishers’ revenues if they scale significantly.

► To build first party data, the report expects a higher focus on registrations, contests, and interactivity.

► Subscription revenues will grow at 11 percent CAGR to reach INR97 billion in 2025.

► Bundling of various OTT platforms by ISPs and telcos will gain scale.

► TVOD could generate over INR10 billion by 2025.

► The share of vernacular content will increase to over 62 percent of total content produced as regional OTTs flourish and achieve scale on the back of dubbing and subtitling.

► Custom recommendation-based connected TV products to serve top-end audiences will come into being, both ad supported and subscription-based, across many areas of interest.

► Demand for original content will increase from 3,000 hours in 2021 to over 4,000 hours by 2025

Sunny Deol says ready for fresh starts with streaming projects

Sunny Deol says ready for fresh starts with streaming projects  Sudhir Chaudhary steps down from Aaj Tak, begins new chapter with DD News

Sudhir Chaudhary steps down from Aaj Tak, begins new chapter with DD News  Dish TV’s Content Summit brings global spotlight to Indian M&E

Dish TV’s Content Summit brings global spotlight to Indian M&E  Rahul Kanwal quits TVTN; rumoured to be joining NDTV group

Rahul Kanwal quits TVTN; rumoured to be joining NDTV group  Esports to make debut at Khelo India Youth Games 2025

Esports to make debut at Khelo India Youth Games 2025  WWE enters ‘Netflix Era’ with new ad film

WWE enters ‘Netflix Era’ with new ad film  WinZO celebrates creator economy, felicitates gaming influencers, developers

WinZO celebrates creator economy, felicitates gaming influencers, developers  PM Modi to deliver keynote at News18 Rising Bharat Summit 2025

PM Modi to deliver keynote at News18 Rising Bharat Summit 2025  BrandPulse decodes evolving consumer sustainability behaviours

BrandPulse decodes evolving consumer sustainability behaviours