The rate of growth of the Indian media and entertainment (M&E) sector slowed down in 2024 despite some other milestones being achieved, including the fact that digital medium overtook the television to emerge as the biggest segment, according to a new report released yesterday.

While the digital segment contributed an unprecedented 32 percent to the overall sectoral revenue, interestingly, pay TV homes decreased by six million.

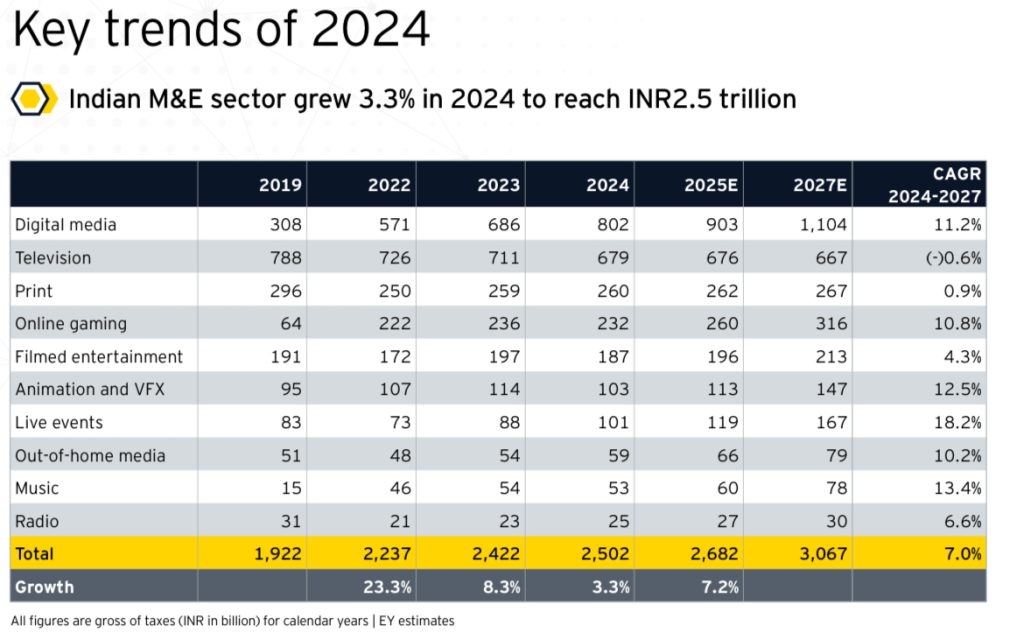

The latest FICCI-EY report titled, ‘Shape the Future: Indian Media & Entertainment is Scripting a New Story’, has revealed a remarkable milestone for the sector in 2024, which reached a total value of INR2.5 trillion (US$29.4 billion). This represents a growth of INR 81 billion from the previous year, marking a 3.3 percent increase.

Growth slowed down from 8.3 percent in 2023, due to falling subscription revenues, and a global decline in animation and VFX work outsourced to India. The sector contributed 0.73 percent to India’s GDP in 2024.

The Indian M&E sector is expected to grow by 7.2 percent in 2025, reaching INR2.7 trillion (US$31.6 billion), and then expand at a CAGR of 7 percent to reach INR3.1 trillion (US$36.1 billion) by 2027. This growth trajectory is poised to be shaped by innovative business models, strategic alliances, and industry consolidation.

The Indian M&E sector’s advertising revenues have seen an impressive growth of 8.1 percent, predominantly led by performance advertising on digital platforms, including e-commerce websites, and a surge in demand for premium and digital Out-of-Home (OOH) media.

This growth has been further bolstered by the resilience of print and radio retail advertising revenues. Digital media (17 percent), live events (15 percent) and OOH media (10 percent) have been key drivers of growth, the report stressed.

Kevin Vaz, Chairman, FICCI, Media and Entertainment Committee, in a statement said, “The Indian media and entertainment industry is at a defining moment, driven by rapid digital adoption and evolving consumer preferences. This transformation is unlocking immense opportunities for content creators, advertisers, and technology innovators across all segments of the M&E ecosystem.

“With India’s media and entertainment market expected to surpass INR 3 trillion by 2027, the future is brimming with untapped potential. FICCI remains committed to fostering collaboration and innovation to ensure that India’s M&E sector continues to thrive as a global powerhouse.”

Ashish Pherwani, Partner and M&E leader at EY, said, “The digital revolution has not only transformed how content is created and consumed, but has also redefined the very essence of the M&E industry. From immersive storytelling and interactive experiences to innovative business models and strategic alliances, the landscape is continually reshaping itself.

“As digital media overtakes traditional mediums, we are witnessing a paradigm shift, where the value delivered across information, escapism, materialism, and self-actualization becomes the new benchmark for success.”

Key findings of the FICCI-EY report include the following:

# Indian advertising grew 8.1 percent in 2024. Digital media comprised 55 percent of total ad spends.

# M&A value grew 9.5x in 2024 with 9 deals over INR5 billion each.

# Digital media is expected to be the first M&E segment to cross INR1 trillion in ad revenues in 2026.

Segmental performance in 2024

Digital advertising: Digital advertising grew 17 percent to reach INR700 billion, which is 55 percent of total advertising revenues. Growth was led by short video and social media (11 percent) and e-commerce advertising (50 percent), which reached INR147 billion. Included in digital advertising are spends by SME and long-tail advertisers of over INR258 billion

Digital subscription: Revenues grew 15 percent to INR102 billion. Paid video subscriptions increased to 111 million, across 47 million households. Paid music subscriptions rose from 7 million to 10.5 million, while news subscriptions remained at 3.1 million.

Live events: The organized segment grew 15 percent driven by increased spends across government and election related events, personal events and weddings, and ticketed events, including several international acts and concert formats that played to packed venues in India.

OOH: This media grew 10 percent in 2024 across both traditional and transit media. Premium properties and locations led the growth. Digital OOH grew 78 percent and contributed 12 percent of total segment revenues, up from 7 percent in 2023.

Radio: Radio segment revenues grew 9 percent in 2024 to INR25 billion on the back of a growth in ad volumes, and alternate revenue streams. On an average, 20 percent of radio revenues are related to events, content production and other revenue streams.

Print: Ad revenues grew one percent in 2024, with premium ad formats driving growth. Subscription revenues fell one percent, while digital revenues remained sub scale, at under 5 percent of total print revenues

Music: Revenues fell by 2 percent due to a push to reduce free music consumption and lower streaming royalty rates. Paid subscriptions grew from 7 million to 10.5 million. Free alternatives like YouTube and radio limit the growth of the paid subscriber base.

Online gaming: Growth slowed significantly due to imposition of 28 percent GST on deposits and the rise of illegal offshore sites. Accordingly, net revenues for transaction-based gaming fell by 6 percent. However, casual and free-to-play gaming grew by 16 percent, resulting in an overall 2 percent decline in the segment.

Film: Though over 1,600 films released in 2024, theatrical admissions declined, and only 11 Hindi films grossed INR1 billion, down from 17 in 2023. Revenues dropped 5 percent to INR187 billion. Both digital and satellite rights values fell by 10 percent as broadcast and OTT buyers focused on profitability.

Television: Linear TV revenues fell for the second consecutive year with a 6 percent drop in advertising revenue and a 3 percent decline in subscription revenue. Pay TV homes decreased by six million, while Free TV and Connected TV homes increased. Weekly active CTVs grew to 30 million in 2024 from 23 million in 2023.

Animation & VFX: The Hollywood writers’ strike and struggling international studios led to a 9 percent revenue decline in 2024. Reduced broadcast ad revenues also impacted the production of animated content in India.

Future Projections

According to the FICCI-EY report, the M&E sector is expected to grow at over 7 percent over the next three years to cross INR3 trillion.

Key trends will include a focus on growing subscription revenues, 360 degree monetisation of content intellectual property, consolidation within segments and increased exports of content and content services — making in India for the world.

All segments will focus on digital extensions or integrations, and measurement will evolve to provide an integrated view of audiences across platforms.

The online gaming segment could struggle unless illegal offshore platforms are not curbed, and Indian companies could look to build out business in foreign countries with a more conducive regulatory environment.

Artificial intelligence will play a large role in bring efficiencies across content production, distribution and personalization, as well as operating efficiencies.

Akashvani’s Aradhana channel to air special Navratri shows

Akashvani’s Aradhana channel to air special Navratri shows  Digital overtakes TV as Indian M&E growth slows down

Digital overtakes TV as Indian M&E growth slows down  News18 India dominates hindi news viewership, retains No. 1 spot ahead of Aaj Tak

News18 India dominates hindi news viewership, retains No. 1 spot ahead of Aaj Tak  Asim Riaz, Rajat Dalal, Rubina Dilaik, Abhishek Malhan to lead ‘Battleground’

Asim Riaz, Rajat Dalal, Rubina Dilaik, Abhishek Malhan to lead ‘Battleground’  Kapil Sharma drops first look of ‘Kis Kisko Pyaar Karoon 2’

Kapil Sharma drops first look of ‘Kis Kisko Pyaar Karoon 2’  93% LCOs say monthly income dipped since 2018: Survey

93% LCOs say monthly income dipped since 2018: Survey  For Helen Mirren, Bond franchise ‘drenched’ in sexism

For Helen Mirren, Bond franchise ‘drenched’ in sexism  WAVES to host India’s biggest cosplay championship

WAVES to host India’s biggest cosplay championship