Discovery Inc. beat Wall Street’s revenue expectations for its fourth-quarter, buoyed by live sports and higher advertising revenue, as it moves closer to completing its acquisition of AT&T’s WarnerMedia unit.

Revenue rose 10 percent to $3.19 billion for the quarter ending in December, slightly above Wall Street’s consensus estimate of $3.12 billion, according to Refinitiv. Net income fell to $38 million from $271 million a year earlier.

Total paid streaming subscribers, including those from Discovery+, reached 22 million at the end of December, up from 20 million in the third quarter, the company said, Reuters reported.

Advertising revenue continued to recover from the pandemic pullback, up 10 percent internationally from the same time a year earlier. Domestic (the US) distribution revenue was also up from a year ago.

Investors are focused on Discovery’s $43 billion acquisition of WarnerMedia that is expected to close in the second quarter, creating one of the world’s largest media companies. The deal will combine Discovery’s thousands of hours of reality programming with the Warner Bros. film and television studios, HBO and the

former Turner Broadcasting networks.

Discovery Chief Executive David Zaslav has been christened “America’s King of Content” by Vanity Fair, but he will be inheriting the challenges that come with that crown.

The abrupt exit of WarnerMedia’s CNN chief Jeff Zucker after nine years at the helm of newsroom leaves the network without its seasoned leader as it prepares to launch a high-stakes streaming service.

The recent tumble in Netflix’s stock, after it forecast slowing subscriber growth for its first quarter, reflects Wall Street’s gathering concerns about the economics of streaming.

That is likely to put pressure on the new Warner Bros. Discovery and its marquee streaming service, HBO Max, to deliver bottom-line results in addition to subscriber gains.

Discovery said it ended the year with nearly $4 billion in cash on hand.

SRK, Aamir, Big B, Ted Sarandos, WPP CEO, MPA chief, other stars, to headline WAVES

SRK, Aamir, Big B, Ted Sarandos, WPP CEO, MPA chief, other stars, to headline WAVES  TIPS Music ends FY25 on high note with 29% revenue growth

TIPS Music ends FY25 on high note with 29% revenue growth  WAVES’ Bharat Pavillion to showcase Indian media’s evolution,culture

WAVES’ Bharat Pavillion to showcase Indian media’s evolution,culture  Sony AATH to launch ‘Jiyo Gopuda’ on April 26

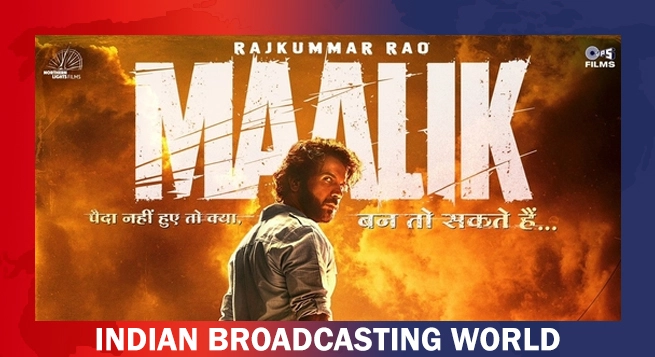

Sony AATH to launch ‘Jiyo Gopuda’ on April 26  Rajkummar Rao’s ‘Maalik’ gets new theatrical release date

Rajkummar Rao’s ‘Maalik’ gets new theatrical release date  Kriti Sanon joins Dreame as brand’s first-ever ambassador in India

Kriti Sanon joins Dreame as brand’s first-ever ambassador in India  YO YO Honey Singh, Stage Aaj Tak wrap up ‘Millionaire Tour’

YO YO Honey Singh, Stage Aaj Tak wrap up ‘Millionaire Tour’  Prime Video announces global premiere for ‘Crazxy’

Prime Video announces global premiere for ‘Crazxy’