Discovery Inc. stockholders have approved various matters relating to the acquisition of WarnerMedia from AT&T to create Warner Bros., Discovery Inc. — a premier, global entertainment company. The transaction will bring together WarnerMedia’s premium entertainment, sports and news assets with Discovery’s leading non-fiction and international entertainment and sports businesses.

At a special meeting of Discovery shareholders, held Friday, shareholders voted to approve the charter amendment proposals, share issuance proposal and the advisory (non-binding) compensation proposal. The approvals mark the completion of one of the few remaining closing conditions for the merger, Discovery said in a statement.

The acquisition is expected to close early in the second quarter of 2022, subject to other customary closing conditions.

The Boards of Directors of both AT&T and Discovery have approved the transaction.

In May 2021, AT&T Inc. and Discovery Inc. had announced a definitive agreement to combine WarnerMedia’s premium entertainment, sports and news assets with Discovery’s leading nonfiction and international entertainment and sports businesses to create a premier, standalone global entertainment company.

Under the terms of the agreement, which was structured as an all-stock, Reverse Morris Trust transaction, AT&T would receive $43 billion (subject to adjustment) in a combination of cash, debt securities, and WarnerMedia’s retention of certain debt, and its shareholders would receive stock representing 71 percent of the new company, while Discovery would own 29 percent of the new company.

For AT&T and its shareholders, this transaction provided an opportunity to unlock value in its media assets and to better position the media business to take advantage of the attractive DTC trends in the industry. Additionally, the transaction would allow the company to better capitalize on the longer-term demand for connectivity.

Prime Video to limit in India number of TV sets having access per subscription

Prime Video to limit in India number of TV sets having access per subscription  Delhi HC orders meta to remove deepfake videos of Rajat Sharma

Delhi HC orders meta to remove deepfake videos of Rajat Sharma  Govt. blocked 18 OTT platforms for obscene content in 2024

Govt. blocked 18 OTT platforms for obscene content in 2024  Broadcasting industry resists inclusion under Telecom Act

Broadcasting industry resists inclusion under Telecom Act  DTH viewing going down & a hybrid ecosystem evolving: Dish TV CEO

DTH viewing going down & a hybrid ecosystem evolving: Dish TV CEO  Abhishek Singh Rajput shines in ‘Swipe Crime’ on MX Player

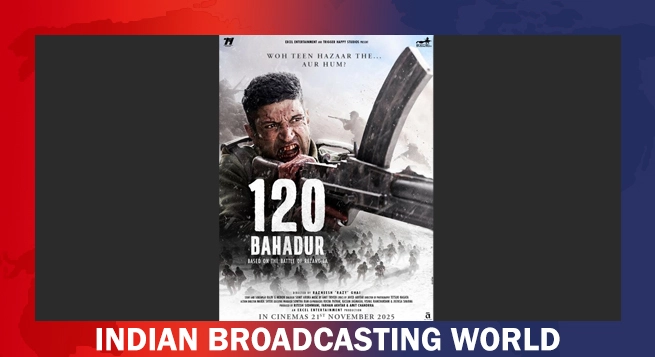

Abhishek Singh Rajput shines in ‘Swipe Crime’ on MX Player  Farhan Akhtar’s ‘120 Bahadur’ to hit theatres on November 21, 2025

Farhan Akhtar’s ‘120 Bahadur’ to hit theatres on November 21, 2025  COLORS announces 2025 lineup

COLORS announces 2025 lineup  Sony YAY! announces holiday wishes from Toon-Town this Christmas

Sony YAY! announces holiday wishes from Toon-Town this Christmas  8Bit Creatives partners with ESFI to elevate WAVES esports championship 2025

8Bit Creatives partners with ESFI to elevate WAVES esports championship 2025