Reliance Industries Ltd (RIL) and Walt Disney Co. are finalising details of a non-binding term sheet to move ahead with plans to merge their India media and entertainment operations, said executives involved in the matter.

According to the Economic Times, the deal is likely to give the Mukesh Ambani-led group a controlling stake in what will become the country’s largest media and entertainment business if the deal goes through.

The plan, as of now, is to create a step-down subsidiary of RIL’s Viacom18, which will absorb Star India via a stock swap, said the people cited above. Reliance is pitching to be the larger shareholder with at least 51 percent in the merged company with Disney owning the residual 49 percent, they said. Both businesses are being treated as similar-sized ones, so RIL is likely to pay cash for the controlling stake.

The two sides are also negotiating a business plan to inject cash as immediate capital investment, expected to be $1-1.5 billion. The final shareholding structure of the entity will get crystallised and its value established based on the cash infusion from each of the parties.

NBF issues advisory to member news channels on Pak guests

NBF issues advisory to member news channels on Pak guests  WAVES 1st edition right mix of M&E reality-check, biz, glamour

WAVES 1st edition right mix of M&E reality-check, biz, glamour  Uday Shankar upbeat on Indian M&E sector; stresses on need for local focus

Uday Shankar upbeat on Indian M&E sector; stresses on need for local focus  MIB to unveil M&E sector statistical handbook today at WAVES

MIB to unveil M&E sector statistical handbook today at WAVES  Pay TV leaders chart course for India’s linear TV in digital age

Pay TV leaders chart course for India’s linear TV in digital age  Sudhir Chaudhary announces new show for DD News, says “Good content still has a place” at WAVES 2025

Sudhir Chaudhary announces new show for DD News, says “Good content still has a place” at WAVES 2025  Indian creators aim for global impact, say streaming is redefining storytelling

Indian creators aim for global impact, say streaming is redefining storytelling  Ashish Chanchlani unveils poster for ‘Ekaki’

Ashish Chanchlani unveils poster for ‘Ekaki’  ‘Panchayat’ S4 teaser hints at fierce election showdown

‘Panchayat’ S4 teaser hints at fierce election showdown  Network18 surges ahead of Times Internet

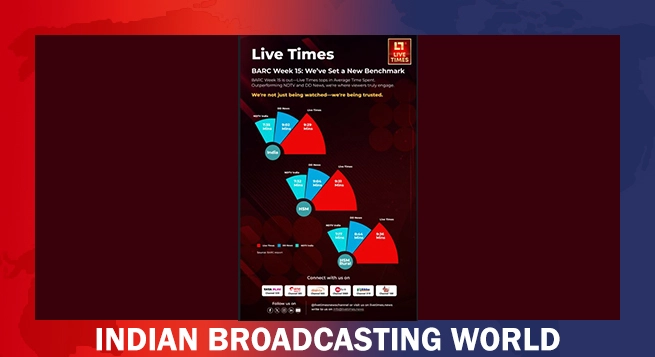

Network18 surges ahead of Times Internet  Live Times tops NDTV, DD News in viewer engagement

Live Times tops NDTV, DD News in viewer engagement