Walt Disney has finalized a deal to sell its minority stake in the subscription television broadcaster Tata Play to the Tata Group, according to a report by Bloomberg.

The transaction values the satellite TV provider, Tata Play, at about $1 billion. The Tata Group took full control of the platform after buying the 29.8 percent stake from Disney.

Disney signed a binding agreement in late February to combine its India unit with billionaire Mukesh Ambani’s media arm, ‘Viacom 18 Media Pvt’, creating an $8.5 billion entertainment juggernaut that will have over 750 million viewers and dominate the media sector in India.

Tata Play was incorporated in 2001 as a joint venture between Tata Group and TFCF Corp., formerly known as Twenty-First Century Fox. The company provides pay television via set-top boxes and over-the-top (OTT) video streaming through its app and has a pan-India footprint of 23 million connections, according to Tata Sons – the holding company of the Tata Group.

Despite a decrease in valuation from its pre-pandemic target of $3 billion to $1 billion, Tata Play remains crucial for the Tata Group as its main consumer-facing business unit in the media and entertainment sector. In 2022, Tata Play filed confidentially for a domestic initial public offering (IPO) but the listing has yet to happen.

Tata Group raised its stake in Tata Play to slightly over 70 percent after buying out Temasek Holding Pte’s stake earlier this year, according to Bloomberg. Temasek first invested in Tata Sky, as it was known at the time, in 2007.

Tata Play has informed the Ministry of Information and Broadcasting about the change in shareholding, complying with regulations governing direct-to-home (DTH) companies.

The plans for both Temasek and Disney to exit Tata Play through an IPO were postponed due to market conditions and challenges in the DTH sector.

NBF issues advisory to member news channels on Pak guests

NBF issues advisory to member news channels on Pak guests  WAVES 1st edition right mix of M&E reality-check, biz, glamour

WAVES 1st edition right mix of M&E reality-check, biz, glamour  Uday Shankar upbeat on Indian M&E sector; stresses on need for local focus

Uday Shankar upbeat on Indian M&E sector; stresses on need for local focus  MIB to unveil M&E sector statistical handbook today at WAVES

MIB to unveil M&E sector statistical handbook today at WAVES  Pay TV leaders chart course for India’s linear TV in digital age

Pay TV leaders chart course for India’s linear TV in digital age  Sudhir Chaudhary announces new show for DD News, says “Good content still has a place” at WAVES 2025

Sudhir Chaudhary announces new show for DD News, says “Good content still has a place” at WAVES 2025  Network18 surges ahead of Times Internet

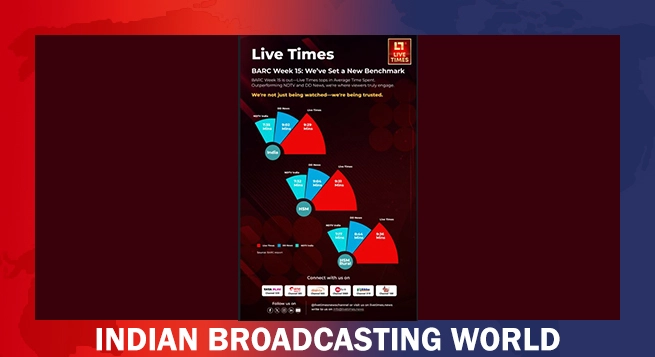

Network18 surges ahead of Times Internet  Live Times tops NDTV, DD News in viewer engagement

Live Times tops NDTV, DD News in viewer engagement  Tata Play, Airtel merger talks off

Tata Play, Airtel merger talks off  DishTV Watcho launches FLIQS to boost OTT access

DishTV Watcho launches FLIQS to boost OTT access  Balaji Originals debuts with ‘The Great Indian Cricket Fan’

Balaji Originals debuts with ‘The Great Indian Cricket Fan’