Elon Musk’s huge Twitter investment took a new twist Tuesday with the filing of a lawsuit alleging that the colorful billionaire illegally delayed disclosing his stake in the social media company so he could buy more shares at lower prices.

The complaint in the New York federal court accuses Musk of violating a regulatory deadline to reveal he had accumulated a stake of at least 5 percent. Instead, according to the complaint, Musk didn’t disclose his position on Twitter until he’d almost doubled his stake to more than 9 percent.

That strategy, the lawsuit alleges, hurt less wealthy investors who sold shares in the San Francisco company in the nearly two weeks before Musk acknowledged holding a major stake, AP reported from San Francisco.

Musk’s regulatory filings show that he bought a little more than 620,000 shares at USD 36.83 apiece on Jan. 31 and then continued to accumulate more shares on nearly every single trading day through April 1.

The lawsuit alleges that by March 14, Musk’s stake in Twitter had reached a 5% threshold that required him to publicly disclose his holdings under U.S. securities law by March 24. Musk didn’t make the required disclosure until April 4.

That revelation caused Twitter’s stock to soar 27 percent from its April 1 close to nearly USD 50 by the end of April 4’s trading, depriving investors who sold shares before Musk’s improperly delayed disclosure of the chance to realize significant gains, according to the lawsuit filed on behalf of an investor named Marc Bain Rasella. Musk, meanwhile, was able to continue to buy shares that traded in prices ranging from $37.69 to $40.96.

The lawsuit is seeking to be certified as a class action representing Twitter shareholders who sold shares between March 24 percent and April 4, a process that could take a year or more.

Musk spent about $2.6 billion on Twitter stock a fraction of his estimated wealth of $265 billion, the largest individual fortune in the world. In a regulatory filing Monday, Musk disclosed he may increase his stake after backing out of an agreement reached last week to join Twitter’s board of directors.

Jacob Walker, one of the lawyers that filed the lawsuit against Musk, told The Associated Press that he hadn’t reached out to the Securities and Exchange Commission about Musk’s alleged violations about the disclosure of his Twitter stake. I assume the SEC is well aware of what he did,” Walker said.

GTPL Hathway reports stable performance in Q3 FY25

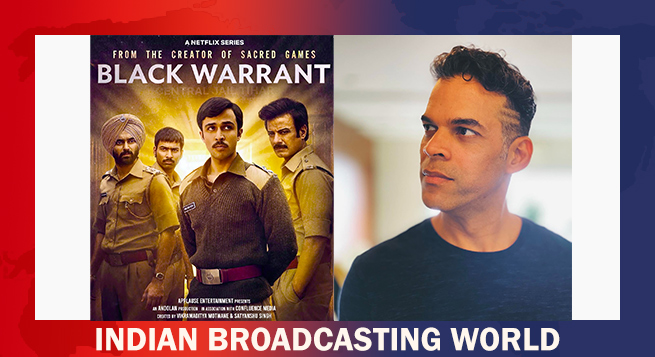

GTPL Hathway reports stable performance in Q3 FY25  ‘Black Warrant’: Motwane’s aimed to make an entertaining jail series

‘Black Warrant’: Motwane’s aimed to make an entertaining jail series  Draft data protection rules aims to balance rules & innovation: Minister

Draft data protection rules aims to balance rules & innovation: Minister  NDTV Profit unveils video podcast series ‘The Disruptors’

NDTV Profit unveils video podcast series ‘The Disruptors’  Tata Play celebrates Hrithik Roshan’s 51st birthday with his iconic hits

Tata Play celebrates Hrithik Roshan’s 51st birthday with his iconic hits  NDTV hosts ‘Mahakumbh ka Arthashastra’ conclave

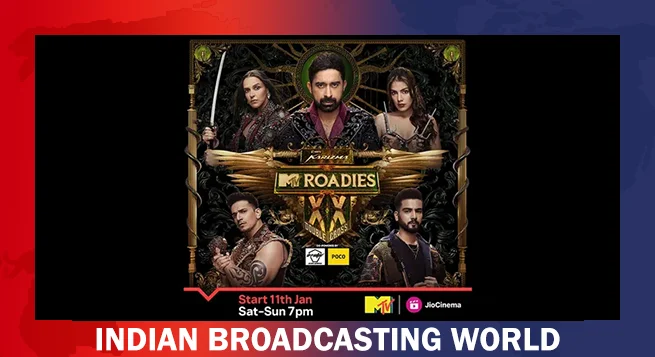

NDTV hosts ‘Mahakumbh ka Arthashastra’ conclave  ‘MTV Roadies’ S20 returns Jan 11 with ‘Double Cross’ twist

‘MTV Roadies’ S20 returns Jan 11 with ‘Double Cross’ twist