The Twitter-Musk drama continues to throw up new twists and turns, almost every day.

A filing with US regulators showed on Thursday that Elon Musk has secured $ 46.5 billion in funding to buy Twitter Inc. and is considering a tender offer for its shares,

Musk himself has committed to put up $33.5 billion, which will include $21billion of equity and $12.5 billion of margin loans, to finance the transaction, Reuters reported.

Banks, including Morgan Stanley, have agreed to provide another $13 billion in debt secured against Twitter itself, according to the filing.Twitter was not immediately available for comment.

Musk’s latest move comes after Twitter failed to respond to his offer and adopted a “poison pill” to thwart the billionaire’s effort to buy the social media platform for $43 billion.

Musk, a self-described “free speech absolutist,” has said the social media company needs to be taken private to grow and become a platform for free speech.

The offer from Musk, who is the second-largest shareholder of Twitter, has drawn private equity interest in participating in a deal for Twitter, Reuters reported, citing people familiar with the matter.

Apollo Global Management Inc. is considering ways it can provide financing to any deal and is open to working with Musk or any other bidder, while Thoma Bravo has informed Twitter that it is exploring the possibility of putting together a bid.

Musk, an active Twitter user with over 80 million followers on the platform, has made a number of announcements on the platform, including some that have landed him in hot water with US regulators.

Delhi HC orders meta to remove deepfake videos of Rajat Sharma

Delhi HC orders meta to remove deepfake videos of Rajat Sharma  Govt. blocked 18 OTT platforms for obscene content in 2024

Govt. blocked 18 OTT platforms for obscene content in 2024  Broadcasting industry resists inclusion under Telecom Act

Broadcasting industry resists inclusion under Telecom Act  DTH viewing going down & a hybrid ecosystem evolving: Dish TV CEO

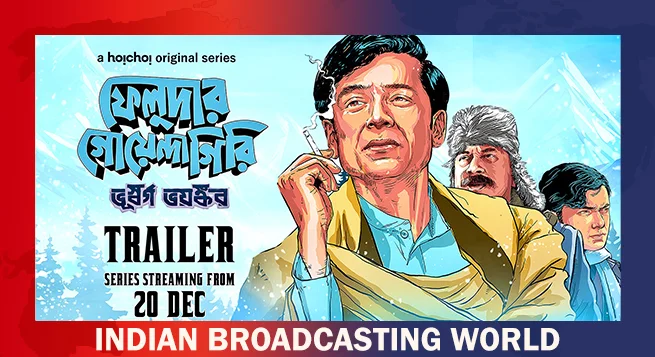

DTH viewing going down & a hybrid ecosystem evolving: Dish TV CEO  New adventure of detective Feluda debuts on Hoichoi Dec. 20

New adventure of detective Feluda debuts on Hoichoi Dec. 20  ‘Pushpa 2’ breaks records as most watched film of 2024: BookMyShow Report

‘Pushpa 2’ breaks records as most watched film of 2024: BookMyShow Report  Hungama OTT unveils ‘Pyramid’

Hungama OTT unveils ‘Pyramid’  Amazon MX Player to premiere ‘Party Till I Die’ on Dec 24

Amazon MX Player to premiere ‘Party Till I Die’ on Dec 24  aha Tamil launches ‘aha Find’ initiative with ‘Bioscope’

aha Tamil launches ‘aha Find’ initiative with ‘Bioscope’  Netflix India to stream WWE content starting April 2025

Netflix India to stream WWE content starting April 2025