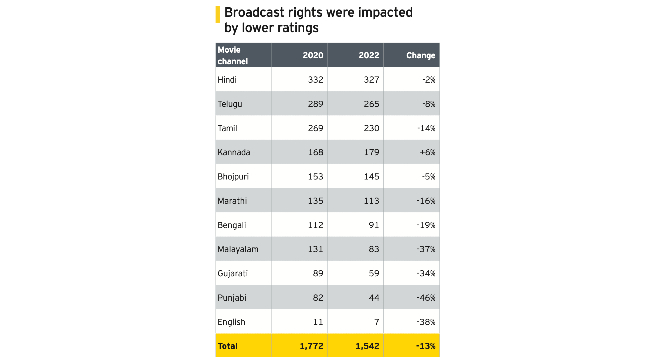

Broadcast rights of filmed entertainment remained subdued due to lower ratings of movie channels in the year 2022, while digital rights got rationalized and shed their direct-to-OTT premiums as most larger films reverted to theatrical releases, according to Ficci-EY media and entertainment report 2023

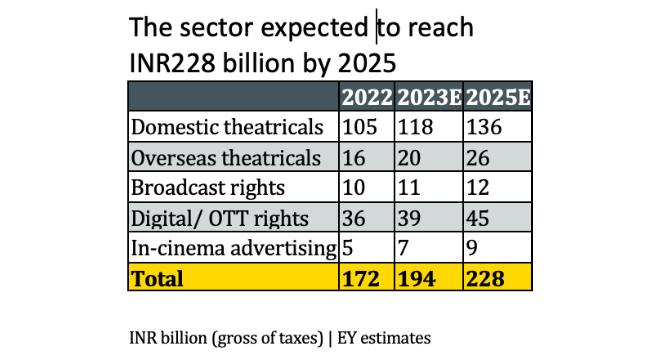

The segment is expected to grow to INR 228 billion by 2025, driven by higher per capita income, which will expand the cinema audience base to 120 to 150 million, and by segmented offerings – classy and mass-y – for distinct audience sets across markets and price points, the report observed.

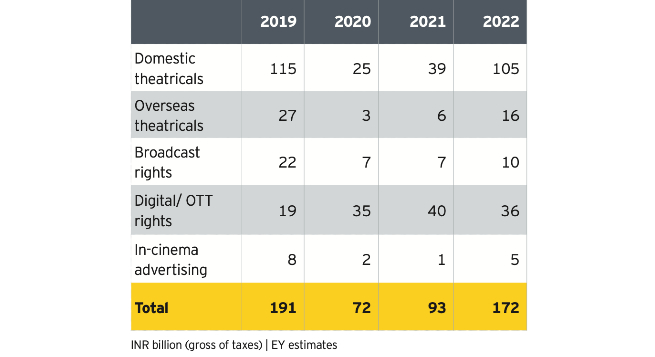

“Filmed entertainment recovered to 90 of its pre-pandemic levels. Film releases were at 200 percent of 2021 levels,” said the Ficci-EY report titled ‘Windows of Opportunity: India’s media & entertainment sector – maximizing across segments’.

Pointing out that domestic film releases were twice the 2021 levels, the report observed gross box office revenues crossed INR 100 billion, only the second time in India’s history.

Some of the other highlights of the Filmed Entertainment segment of the report are as follows:

► 335 Indian films were released abroad during 2022.

► 1,623 movies were released during the year across languages, which is 9 percent higher than 2019 levels.

► The highest number of films were released in Telugu (278), Kannada (233), followed by Tamil (288) and Malayalam (199). Only 194 films were released in Hindi.

► Screen count was 9,382, around 2 percent lower than before the pandemic as per UFO Moviez estimates.

► After three decades, Srinagar got its first multiplex cinema that was designed by INOX as a move to bring entertainment to the youth of Jammu and Kashmir.

► Gross box office revenues increased almost three times the revenues of 2021 to INR105 billion.

► Hindi cinema ceded 17 percent market share since 2019; South Indian films now command over 50 percent of box office revenues, and some South Indian films were released nationally.

► Footfalls increased to 994 million in 2022, but were still significantly lower than the 1,460 million footfalls recorded in 2019 as per Comscore. One reason for reduced footfalls was the lower urgency to view a film due to shorter digital release windows.

► Industry discussions indicated that heavy cinema goers reduced from 2-4 times a month to just once a month, while light visitors (a few times a year) also shrunk.

► Average ticket prices saw an increase from INR 106 in 2019 to INR 119 in 2022.

► 335 films released overseas contributed a gross box office collection of INR16 billion, thereby showing a growth of almost 170 percent over 2021.

► International monetization continues to be impacted vis-à-vis 2019 levels due to the geopolitical tensions with China, a market which has shown high propensity to consume Indian content in the past.

► A decline in movie channel viewership, particularly for large film premieres, kept satellite rates subdued.

► In certain cases, films were released on television after their theatrical and digital releases, often after a month or more later, which could have impacted their television performance.

► Digital rights rationalized their direct release premiums.

► Over 200 films released on digital platforms in 2022, from large films priced at over INR1 billion to small regional films available for as little as INR10 million.

► This includes over 75 films, which released directly on the platform without a theatrical release, a trend that continues even after theaters opening.

► However, most large films reinstated the initial exclusive theatrical window, which was found to be critical to market a film and, consequently, the digital rights values rationalized from INR 40 billion in 2021 to INR 36 billion in 2022 as they excluded the “theatrical make-good” and “direct-to-digital release” premiums that were being earlier paid by OTT platforms.

► The digital release window, which had reduced to between zero and four weeks, was again brought up to at least eight weeks, and was even higher in some cases where the theatrical run was successful.

► Three films crossed the 24 million viewership mark — Akshay Kumar-starer ‘Cuttputlli’ (26.9 million views), Yami Gautam’s ‘A Thursday’ (25.5 million views) and ‘Govinda Naam Mera’ (24.4 million views).

► Disney+ Hotstar streamed seven out of the top 15 most- watched films, followed by Prime Video and Netflix at four films each.

► In-cinema advertising recovered to INR 4.5 billion.

► The promising consumer footfall at the beginning of the year and a strong content pipeline rekindled advertisers’ interest in cinema advertising and ‘KGF’ alone got 280 brands on board for cinema advertising.

► However, in-cinema advertising remained muted for the latter part of 2022 as some of the big releases did not receive a lot of attention from the audience and average ad revenue per screen declined to INR 0.7 million and INR 0.4 million for PVR and INOX, respectively from their pre-COVID-19 revenues of INR 1.2 million and INR 0.7 million.

Future Outlook

► The report projected the sector to reach INR 228 billion by 2025, continuing to grow driven by theatrical revenues as Hindi movies go mass in their storytelling, incorporate more VFX to enhance the movie-going experience and expand into tier-II and III cities.

► Common Service Centre(CSC), a Government of India arm, has tied up with October Cinemas to bring cinema back to the villages of India. The target for 2023 is 200 cinemas and the ultimate aim is to set up 100,000 cinemas.

► Broadcast rights will remain muted as they have become a distant third window after theatrical and digital releases. Further, movie viewership will be determined by content type, and will not grow until movie content is created for the masses as against the classes. In effect, content that appeals to multiplex and OTT audiences will be different than content that appeals to single-screen and television audiences.

► Digital rights growth will be volume driven, with a similar number of tent-pole films, but more mid-budget films.

► The report also said it is expected that a shared risk model will evolve, where talent shares to a great extent in the risk of the film’s performance.

► This will also ensure that all monetization windows are optimally utilized.

► Changed content preferences need to be addressed. During the pandemic related lockdowns, audiences binged on content from not just the South and other parts of the country, but also from overseas, which led to a significant shift in content preferences and refined their palettes.

► Star studded content such as Aamir Khan’s ‘Laal Singh Chadha’, Akshay Kumar’s ‘Rakshabandhan’, Vijay Devarakonda’s ‘Liger’, failed to perform as expected at the box office, reinstating that it is only relatable and escapist content that appeals to the audiences and draws incremental footfall and not stars that work their magic on the big screens.

► Consequently, relatable stories and best-in-class production values will be required to ensure theatrical success going forward, which will revive genres with a healthy mix of mass-y escapism — like India’s glorious past, family comedy, action thrillers, crime, etc.

► A dual-product model will evolve.

► As a collective initiative to celebrate the successful reopening of the cinemas and to market a theatrical experience to moviegoers, the industry organized National Cinema Day wherein audiences could watch movies for as low as INR 75 per ticket. The slashing of ticket prices generously contributed to the net collections and PVR and INOX sold 0.69 million and 0.5 million tickets, respectively in a single day. The phenomenal success of this initiative triggered discussions around finding that sweet spot between footfalls and ticket prices, which will result in both increased footfalls and higher collections.

► More exhibition pricing innovation in future around loyalty programs, discounting, group pricing, rentals, etc. is expected.

► In the medium term, it is expected that cinema would split into two distinct products with different price-points — expensive premium “multiplex-type” content, appealing to 30 to 40 million audience and less expensive mass-y content that appeals to 100 to 120 million audience.

(Bhumika film poster image, which is from private archive of SMM Ausaja & Mona Merchant, courtesy Ficci-EY report)

NBF issues advisory to member news channels on Pak guests

NBF issues advisory to member news channels on Pak guests  WAVES 1st edition right mix of M&E reality-check, biz, glamour

WAVES 1st edition right mix of M&E reality-check, biz, glamour  Uday Shankar upbeat on Indian M&E sector; stresses on need for local focus

Uday Shankar upbeat on Indian M&E sector; stresses on need for local focus  Sudhir Chaudhary announces new show for DD News, says “Good content still has a place” at WAVES 2025

Sudhir Chaudhary announces new show for DD News, says “Good content still has a place” at WAVES 2025  Indian creators aim for global impact, say streaming is redefining storytelling

Indian creators aim for global impact, say streaming is redefining storytelling  Ashish Chanchlani unveils poster for ‘Ekaki’

Ashish Chanchlani unveils poster for ‘Ekaki’  ‘Panchayat’ S4 teaser hints at fierce election showdown

‘Panchayat’ S4 teaser hints at fierce election showdown  Network18 surges ahead of Times Internet

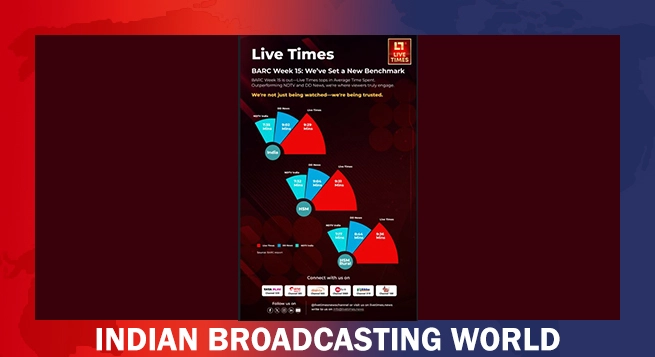

Network18 surges ahead of Times Internet  Live Times tops NDTV, DD News in viewer engagement

Live Times tops NDTV, DD News in viewer engagement