Domestic online gaming companies will be required to deduct 28 per cent GST on bets placed from overseas locations, including by foreign players, as such bets will also be treated as actionable claims.

The amendment to this effect was approved by Parliament in the Integrated GST (IGST) Act on Friday, PTI reported from New Delhi yesterday.

Another report on the issue, done by Reuters, adds that the Indian government has mandated offshore online gaming companies operating in the country to register the business locally or appoint a representative to pay tax on funds collected from customers.

The GST Council had last week cleared changes in Central GST (IGST) and IGST laws to levy 28 per cent tax on full face value of bets in online gaming, casinos, and horse race clubs.

According to the PTI report, the amendment in IGST Act gives powers to the Government to notify such goods, so that in case of import of such goods IGST can be levied and collected as regular inter-State supply under provisions of IGST Act.

Tax experts said this amendment is aimed at plugging the loophole with regard to the collection of IGST from bets coming from overseas locations.

Currently, in case of import of intangible goods such as actionable claims involved in or by way of online money gaming, which do not physically cross customs frontier, IGST cannot be collected through Customs.

AMRG & Associates Senior Partner Rajat Mohan said the government has amended the tax law to provide that international players paying money for betting, gambling, horse racing, lottery or online money gaming from outside India would be treated at par with domestic players for payment of taxes.

“Thereby online gaming companies would need to pay full tax on ‘buy-ins’, irrespective of the payor and his source of payment. This IGST Act amendment results in a new provision of law that will arrest any future litigation on technical grounds,” Mohan added.

The provision to tax offshore online gaming companies through a simplified registration in India, and the stringent provisions to curb tax evasion by such players show the seriousness of the government to enforce the regulation and collect the intended revenue from the industry.

“The government has not made a distinction between games of skill and games of chance. Further, the taxation is imposed on a higher amount that may not be actually recorded as revenue for a gaming company. Given that the above is in the teeth of Supreme Court precedents and provisions of the GST laws, judicial challenges can be forecast in writ jurisdiction, in both the central and state legislation,” Bose said.

Meanwhile, on Wednesday, gaming app Mobile Premier League had said it would lay off 350 employees as it takes steps to “survive” the tax imposed by the government, a Reuters report said.

SonyLIV drops ‘Black, White & Gray-Love Kills’ trailer

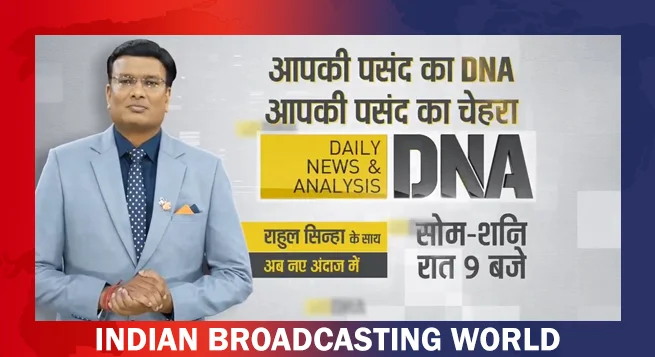

SonyLIV drops ‘Black, White & Gray-Love Kills’ trailer  Rahul Sinha takes charge of Zee News’ DNA

Rahul Sinha takes charge of Zee News’ DNA  JioStar vice-chair Uday Shankar on surge in streaming subs, trade tariff challenges

JioStar vice-chair Uday Shankar on surge in streaming subs, trade tariff challenges  ‘Fellow Travelers’ to stream on Prime Video India from April 17

‘Fellow Travelers’ to stream on Prime Video India from April 17  Times Network emerges as digital news powerhouse with 107 mn monthly users

Times Network emerges as digital news powerhouse with 107 mn monthly users  HBO unveils key cast for upcoming ‘Harry Potter’ TV series

HBO unveils key cast for upcoming ‘Harry Potter’ TV series  NDTV brings new ‘Unplan Life’ podcast

NDTV brings new ‘Unplan Life’ podcast  Anna Kendrick, Blake Lively reunite for twisted wedding thriller

Anna Kendrick, Blake Lively reunite for twisted wedding thriller