In a recent decision, the 50th GST Council announced that a 28% Goods and Services Tax (GST) will be levied on online gaming, horse racing, and casinos. However, industry stakeholders have strongly criticized this decision, calling it “unconstitutional, irrational, and egregious.” They argue that the move will have a detrimental impact on the skilled online gaming sector in the country.

Roland Landers, CEO of the All India Gaming Federation, expressed his concerns, stating that the decision ignores over 60 years of settled legal jurisprudence and wrongly categorizes online skill gaming with gambling activities. He believes that this decision will not only wipe out the entire Indian gaming industry but also lead to significant job losses, with only illegal offshore platforms benefiting from it.

Joy Bhattacharjya, Director-General of the Federation of Indian Fantasy Sports (FIFS), expressed disappointment with the decision to apply a 28% GST on the total entry amount, including prize money. He warned that this change in valuation will cause irreversible damage to the industry, result in a loss of revenue for the government, and lead to job losses for skilled engineers, IANS reported.

Industry leaders argue that this decision will drive users towards illegal betting platforms, posing risks to users and causing a loss of revenue for the government. They believe that a tax rate of 18% would have been more reasonable and beneficial for the gaming industry.

Finance Minister Nirmala Sitharaman, however, stated that the decisions regarding the 28% GST on online gaming and casinos were not aimed at targeting any particular industry. She emphasized that the decisions were made after consultation with all members, including those representing states like Goa and Sikkim, where casinos play a significant role in the tourism sector.

Aaditya Shah, COO of IndiaPlays, highlighted the challenges that the 28% tax rate will bring to the gaming industry. He expressed concerns that this higher tax burden will limit companies’ ability to invest in innovation, research, and business expansion. Shah emphasized the importance of distinguishing between skill-based games and casinos/betting apps, urging that they should not be treated the same way.

MIB to unveil M&E sector statistical handbook today at WAVES

MIB to unveil M&E sector statistical handbook today at WAVES  Pay TV leaders chart course for India’s linear TV in digital age

Pay TV leaders chart course for India’s linear TV in digital age  WAVES 2025: Media dialogue backs creativity, heritage & ethics in AI Era

WAVES 2025: Media dialogue backs creativity, heritage & ethics in AI Era  Sudhir Chaudhary announces new show for DD News, says “Good content still has a place” at WAVES 2025

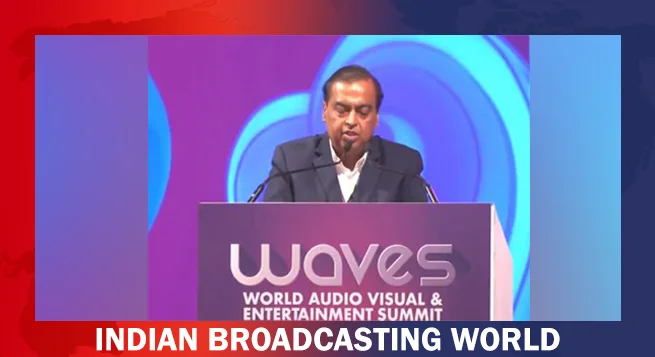

Sudhir Chaudhary announces new show for DD News, says “Good content still has a place” at WAVES 2025  India can lead global entertainment revolution: Mukesh Ambani

India can lead global entertainment revolution: Mukesh Ambani  TRAI chief not in favour of separate rules for OTT, legacy b’casters

TRAI chief not in favour of separate rules for OTT, legacy b’casters  Language no bar; stars say Indian cinema is united by emotion, culture

Language no bar; stars say Indian cinema is united by emotion, culture  Spielberg recognised me from ‘3 Idiots’, says Kareena at WAVES 2025

Spielberg recognised me from ‘3 Idiots’, says Kareena at WAVES 2025  Digital Radio is the future, but analog must co-exist says at WAVES 2025

Digital Radio is the future, but analog must co-exist says at WAVES 2025