The next wave of disruption may lie with Generation Z — at least the American ones — who prefer to play video games, stream music, and engage on social media, rather than just watch TV or movies, according to a Deloitte research.

While for a majority of Millennials, Generation X, and Boomers respondents watching TV and movies at home continued to be the overall favorite (57% ranking it in their top three out of 16 entertainment activities), Generation Z, however, showed there were distinct differences.

Playing video games was Gen Z’s favorite activity (26%), followed by listening to music (14%), browsing the Internet (12%), and engaging on social platforms (11%). Only 10% of Generation Z said that watching TV or movies at home was their favorite form of entertainment, the Deloitte research said.

The findings are from the 15th edition of the Digital media trends survey, which was conducted by Deloitte’s Technology, Media & Telecommunications practice and fielded by an independent research firm. The online survey of 2,009 US consumers was conducted in February 2021.

If the Generation Z preferences for gaming, music, and social media persist over time, the dominant position that video entertainment has held could be challenged. If this is the case, media companies should be prepared to evolve and take a diversified approach, starting with gaming. All of these options are dividing and fragmenting the market considerably. Providers should now understand the nuances among customer segments, generations, and differing kinds of media, the researchers observed.

Generation Z & the entertainment landscape: The Deloitte research saw that Generation Z has strikingly different entertainment preferences, often seeking video games and music before watching TV and movies. They have grown up with social media, instant messaging, video games, and live-streaming influencers.

In fact, Generation Z could be viewed as early adopters who are influencing the behaviors of Millennials and Generation X—and possibly younger generations that follow them.

This begs the question: Are M&E companies prepared for a future that could be shaped by Generation Z?

Video games were already growing significantly before COVID-19 but have been amplified during the pandemic. 87% of Generation Z, 83% of Millennials, and 79% of Generation X said they play video games on devices such as smartphones, gaming consoles, or computers at least weekly. Many are playing daily to fill idle time, connect with friends, compete with opponents, and escape into stories.

Most Generation Z, Millennials, and Generation X respondents said that during the pandemic, video games helped them stay connected to other people and get through difficult times.

More than half of Millennials and Generation X said that video games have taken away time from other entertainment activities.

When they aren’t playing video games—and even when they are—Generation Z is streaming music.

In 2019, streaming music services generated around 80% of total music revenues across ad-supported and premium paid services. In 2020, streaming was one of the few bright spots for the music industry. One study showed that half of young adults ages 18 to 29 are streaming music every day, the research observed.

Generation Z isn’t alone in its love of music, however. Forty percent of respondents from all generations placed listening to music as a top-three favorite entertainment activity in our survey. Around 60% said they have a paid streaming music service, and the same amount use a free, ad-supported music service.

For those who pay, the library of music was the primary reason, followed by an ad-free and reasonably priced experience. For those using a free, ad-supported music service, zero cost was the primary reason, followed by ease of access and access to a broad range of content. Most said they tune out ads, suggesting that advertisers on streaming music services face challenges for ROI.

Media companies and advertisers may still be video-first, but younger generations may not be. To understand this potential shift, providers can work through these questions:

- How can we better understand the nuances across different media?

- How can we leverage these channels to reach younger audiences, expand our brands, and bring more people onto our franchises?

- Does our strategy address the impacts of gaming, streaming music, and social media?

Entertainment services: Consumers are facing growing pressure to manage and pay for so many entertainment services. As they chase niche content and trending entertainment, people are showing strong interest in ad-supported options that subsidize or remove subscription costs.

At the same time, subscription fatigue and sub-optimal user experiences are creating friction, which is causing some audiences to jump to competitors or other forms of entertainment. The COVID-19 pandemic has also impacted productions and the ability to deliver new video content.

All of this is driving subscriber churn and posing challenges for media companies vying to retain audiences.

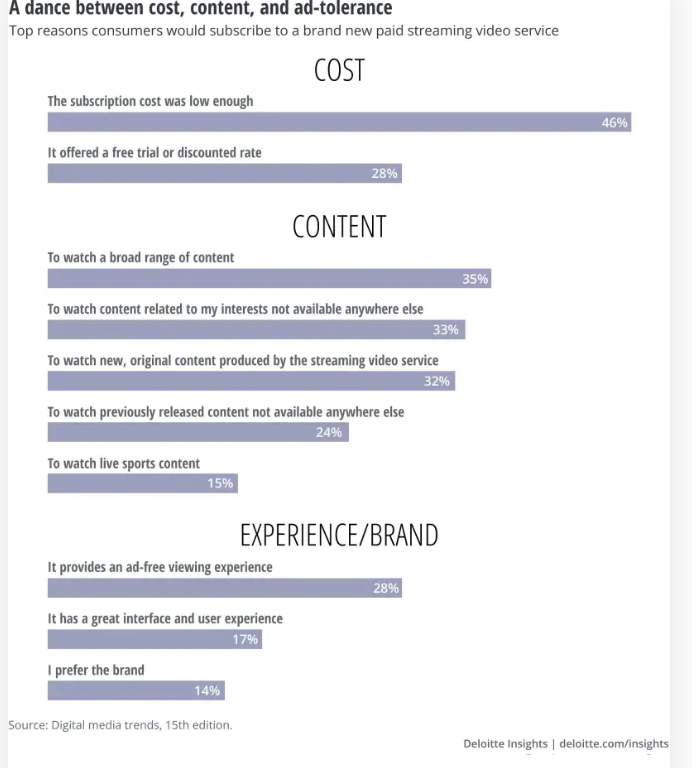

Cost sensitivity of streaming video: As providers buy up content and spend billions to produce their own, consumers are increasingly aware of—and sensitive to—costs adding up.

Among the respondents, 46% said that a low enough price was the most important factor in deciding to subscribe to a new paid streaming video service. This represents a significantly greater number than those who listed content as their main consideration.

While some consumers lost income or employment due to the COVID-19 pandemic, many sought to balance costs across multiple paid entertainment services.

This cost sensitivity is driving more consumer interest in ad-supported options that subsidize or remove subscription fees, Deloitte said, adding 55% respondents said they now carry a free, ad-supported video service.

Content and cost are the factors that drive paid streaming video subscriptions, while content, no cost, and ease of access are the selling points for ad-supported video services.

When asked which factors would motivate them to cancel a paid video, music, or gaming service, an increase in price was most often cited, although interesting nuances emerged among different media types.

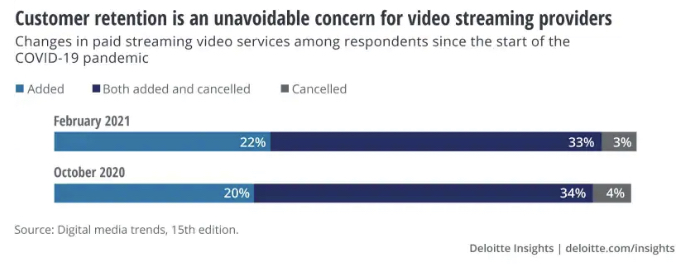

Persistent churn: With more streaming video services, people are finding it increasingly difficult to manage subscriptions, find the entertainment they’re looking for, and balance costs against their tolerance for advertising.

66% of people were frustrated when content they wanted to watch was removed from a service, and 53% were frustrated by having to subscribe to multiple services to access the content they wanted.

Consumers also face difficulties finding content—a challenge for providers spending billions on new productions. Among respondents, 52% found it difficult to access content across so many services, and 49% were frustrated if a service failed to provide them with good recommendations.

These challenges reinforce subscriber churn. From October 2020 to February 2021, the churn rate for streaming video services held at around 37%.

According to the research, content providers understand that keeping audiences around after they’ve binged the latest hits may require more than just good content. And, given what they spend on marketing, advertising, discounts, free trials, and new content to acquire subscribers, it may make more sense for providers to retain subscribers at a lower price than lose them, at least right now.

Churn will erode ROI and customer value, making retention essential.

With greater cost sensitivity, subscribers may want more pricing options based on their usage and ad tolerance, and an easy way to move between tiers to meet their needs and level of engagement, Deloitte observed.

Providers can also develop stronger, more customized user experiences, which would make it easier for subscribers to find content that fits their interests. By improving this interface, streaming video services can personalize the experience and strengthen the relationship they have with audiences.

Here are some questions streaming media providers can ask themselves to determine next steps:

- How can we get closer to customers to deliver engaging content, pricing, and advertising?

- Can we predict churn better, and then use membership perks to entice hesitant subscribers to stay?

- If younger people are becoming less engaged with more traditional video formats, does this represent a potential sea change for our business?

- How can we best leverage our intellectual property to engage with audiences on other entertainment platforms and entice them to use our services?

The overall message of the market research: The pandemic has accelerated preexisting industry trends and altered entertainment-related behaviors. There is competition for audiences among a crowded field of streaming video providers, but also with other forms of entertainment. More people are turning to social media for entertainment and news. But they only have so much time, attention, and money. As M&E companies vie for consumers, the next wave of disruption may lie with Generation Z.

Delhi HC orders meta to remove deepfake videos of Rajat Sharma

Delhi HC orders meta to remove deepfake videos of Rajat Sharma  Govt. blocked 18 OTT platforms for obscene content in 2024

Govt. blocked 18 OTT platforms for obscene content in 2024  Broadcasting industry resists inclusion under Telecom Act

Broadcasting industry resists inclusion under Telecom Act  DTH viewing going down & a hybrid ecosystem evolving: Dish TV CEO

DTH viewing going down & a hybrid ecosystem evolving: Dish TV CEO  New adventure of detective Feluda debuts on Hoichoi Dec. 20

New adventure of detective Feluda debuts on Hoichoi Dec. 20  Sony YAY! announces holiday wishes from Toon-Town this Christmas

Sony YAY! announces holiday wishes from Toon-Town this Christmas  8Bit Creatives partners with ESFI to elevate WAVES esports championship 2025

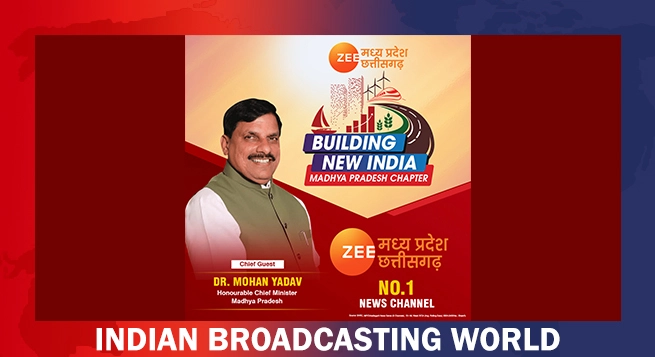

8Bit Creatives partners with ESFI to elevate WAVES esports championship 2025  Zee MPCG’s ‘Building New India’ event celebrates MP’s progress

Zee MPCG’s ‘Building New India’ event celebrates MP’s progress  Republic, Samsung forge content-tech partnership

Republic, Samsung forge content-tech partnership  BSNL launches free Intranet TV in Puducherry

BSNL launches free Intranet TV in Puducherry