Even as a senior Finance Ministry official in Delhi ruled out any review of the decision to slap 28 percent tax on online gaming and other betting games, the State government of Goa said it would lobby with the federal administration to reconsider the decision.

The Goa government will write to Union Finance Minister Nirmala Sitharaman seeking to reconsider the GST council’s decision to levy a 28 per cent tax on the full face value of bets in online gaming, casinos and horse racing.

Goa Industry Minister Mauvin Godinho, who is the State’s representative on the GST Council, told reporters the imposition of tax will prove to be a “very negative factor” for the industry and affect tourism in the coastal state, a PTI report from Panaji stated.

“I have already taken up this issue with Chief Minister Pramod Sawant who said he would be writing to the Centre to reconsider the tax. The CM will take up this issue with the Centre and the Finance Minister. It will ultimately go for reconsideration before the GST council,” Godinho told reporters.

He said stakeholders in the online gaming, casino gaming and horse racing industry wanted the entire taxation to be done on the gross gambling revenue (GGR).

“There is no dispute on the imposition of 28 per cent GST but they have decided to impose it on the full face value. That is the only difference,” the minister said.

The GST Council on Tuesday decided to levy the maximum 28 per cent tax on the full face value of bets in online gaming, casinos and horse racing.

Godinho said this decision will hamper fresh investment in this industry and it will affect the sector.

“Even for Goa, footfalls are bound to decrease. Most of the flights to Goa are full because people come to play in casinos here. This decision is not going to be a very positive thing for the industry,” he added.

Early Policy Review ‘Unlikely’: Meanwhile, a Reuters report from New Delhi stated that India’s decision to impose a 28 percent tax on funds that online gaming companies collect from their customers, will not need further consultation and an early review is unlikely, the country’s Revenue Secretary told local television channels yesterday.

The government’s decision, announced late on Tuesday, was met with dismay in the $1.5 billion industry, and shares of casino operator Delta Corp and other online gaming companies plunged in Wednesday’s trade.

Revenue Secretary Sanjay Malhotra told TV channels that there was no need to consult the gaming industry and amendments to enable the tax will be brought in the monsoon session of parliament, which begins later this month.

“The GST Council was unanimous (in its decision)… I am not the one to take this decision, but I don’t think there is any chance of a review so early,” Malhotra told CNBC-TV18, according to the Reuters report.

Companies and investors plan to approach the government and the Prime Minister’s office to request a rethink, a source with knowledge of the matter told Reuters on condition of anonymity.

Although the government said the decision was not intended to hurt the sector, industry representatives have said it could sap their earnings and lead to a loss of customers, jobs and investors.

Investors in the sector include Tiger Global, Peak XV Partners (previously known as Sequoia Capital India) and TPG.

The new tax “will render the legitimate online gaming industry unviable, effectively driving consumers towards offshore and illegal platforms that pay no taxes,” Games24x7, one of India’s biggest online gaming firms backed by investors such as Tiger Global, wrote in a LinkedIn post.

This will also lead to thousands of job cuts, it said. The tax is also a threat to more than a thousand Indian gaming startups, which have been profitable, and now face increased costs and reduced users.

Govt. not considering rules for use of AI in filmmaking: Murugan

Govt. not considering rules for use of AI in filmmaking: Murugan  DTH revenue slide to ease to 3–4% this fiscal year: Report

DTH revenue slide to ease to 3–4% this fiscal year: Report  At Agenda Aaj Tak, Aamir, Jaideep Ahlawat dwell on acting, Dharam

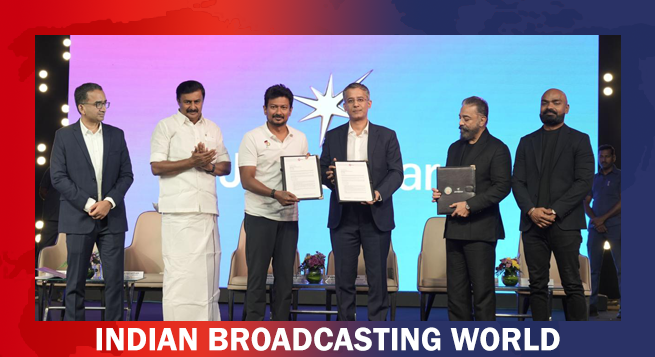

At Agenda Aaj Tak, Aamir, Jaideep Ahlawat dwell on acting, Dharam  JioHotstar to invest $444mn over 5 years in South Indian content

JioHotstar to invest $444mn over 5 years in South Indian content  Standing firm, TRAI rejects DoT views on satcom spectrum fee

Standing firm, TRAI rejects DoT views on satcom spectrum fee  Diljit Dosanjh wraps shoot for untitled Imtiaz Ali film

Diljit Dosanjh wraps shoot for untitled Imtiaz Ali film  ‘Bhabiji Ghar Par Hai 2.0’ to return with comedy, chaos, a supernatural twist

‘Bhabiji Ghar Par Hai 2.0’ to return with comedy, chaos, a supernatural twist  BBC names Bérangère Michel as new Group CFO

BBC names Bérangère Michel as new Group CFO  ‘Border 2’ teaser to be unveiled on Vijay Diwas

‘Border 2’ teaser to be unveiled on Vijay Diwas  CNN-News18 Rahul Shivshankar takes editorial charge

CNN-News18 Rahul Shivshankar takes editorial charge